Bank Holiday Pushes USD Down

UFXBank Research from UFX Bank at 01/20/10

Daily Review 19/01/2010

USD Dollar (USD) – The Dollar weakened versus most majors after a low volume session and gains in world equity markets worldwide pushed the Dollar lower versus the other majors. U.S stock markets have been closed due to Martin Luther King Day. Crude was almost flat with 0.22% closing at 78.25$ a barrel and Gold (XAU) almost unchanged closing at 1131.10$ an ounce. Today, TIC Long Term Purchases are expected stronger with 30.3B versus 20.7B prior.

EURO (EUR) –The Euro gained slightly versus the Dollar and weakened versus the Pound as Greece's debt problems continue to worry investors. Overall, EUR/USD traded with a low of 1.4335 and a high of 1.4408. EUR/USD has been trading near the 200 moving day average that acts as support and an upside move is possible. Today, German ZEW Economic Sentiment is expected weaker with 49.8 versus 50.4 prior.

EUR/USD - Last: 1.44

Resistance 1.4425 1.445 1.4485

Support 1.4365 1.4335 1.43

British Pound (GBP) – The Pound gained versus the Dollar and the Euro as House Prices in the U.K rose, signaling the economy is getting better in the U.K. Overall, GBP/USD traded with a low of 1.6249 and a high of 1.6378. GBP/USD has hit resistance level at 1.6350 along with 200 day moving average. Remaining above 1.6350 will likely set a move toward the 1.67 resistance. Today, CPI is expected higher with 2.6% versus 1.9% prior. BOE's Governor King will speak in Exeter today.

GBP/USD - Last: 1.64

Resistance 1.642 1.6475

Support 1.63 1.627 1.621

Japanese Yen (JPY) –The Yen gained versus the Dollar and the Euro as comments about U.S recovery slowing down helped the appeal of the Yen as safety. Overall, USD/JPY traded with a low of 90.57 and a high of 91.06. USD/JPY has moved down and reached the 50% Fibonacci retracement from the upside movement it made in December. Along with the Fibonacci support level daily moving averages 50 and 100 are near and all these are expected to support the pair near 90.50. Today, Tertiary Industry Activity is expected weaker with -0.1% versus 0.5% prior.

USD/JPY-Last: 90.68

Resistance 91.05 91.3 91.55

Support 90.60 90.4 90

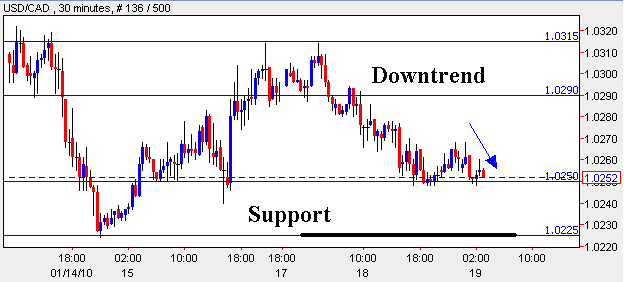

Canadian Dollar (CAD) – The Canadian Dollar gained versus the Dollar as commodities and equities gained, leading the high yielding currency higher. Foreign Securities Purchases came out stronger than expected helping the Canadian Dollar to gain. Overall, USD/CAD traded with a low of 1.0248 and a high of 1.0314. USD/CAD trend is downwards trading near its 2009 lows at 1.0205. A rebound back up is possible but it will be against the main trend. Today, BOC will release its Rate Statement. The Rate is expected to remain unchanged at 0.25%.

USD/CAD - Last: 1.0255

Resistance 1.029 1.0315 1.0355

Support 1.025 1.0225 1.0205