Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 10/13/09

Daily Market Commentary

EUR/USD Pops Past September Highs

The EUR/USD has broken through our 3rd tier downtrend line and consequently September highs. Though the currency pair is trading off of intraday highs, today’s move will likely prove to be an important step for the beginning of a new leg up. Our 3rd tier is the final foreseeable downtrend line for the near future. Therefore, barring a large immediate reversal, the EUR/USD may have finally broken loose of its top-end constraints. Today’s positive movement comes despite weaker than expected ZEW Consumer Sentiment data. The ZEW numbers are a noticeable setback concerning the future of the economic recovery. Today’s data reflects the spotted cool down appearing in econ releases around the globe. The EUR/USD’s strength in light of today’s news contradicts rationality and reinforces the inherently negative investor sentiment surrounding the U.S. Dollar.

Despite today’s topside progress the EUR/USD still has a bit of a rough patch to deal with between present price and the highly psychological 1.50 level before immediate-term gains can truly accelerate. Meanwhile, the EUR/USD’s near-term fate likely rests upon the shoulders of 3rd quarter earnings results and important U.S. econ data over the next two days, including Retail Sales and Core CPI. If U.S. earnings and econ data both top expectations then the EUR/USD may receive the boost it needs to top 1.50. On the other hand, any significant setbacks could undermine today’s progress and cap near-term gains.

As we mentioned previously, the EUR/USD’s pop past our 3rd tier downtrend line and September highs sends a bullish signal. Although 1.50 wouldn’t be a cakewalk, recent breakouts in gold and the Aussie leave the Euro with quite a bit of room to make up. As for the downside, the EUR/USD has plenty of cushions, beginning with our fresh 1st tier uptrend line and ending with our 4th tier uptrend line and weekly lows (10/13, 10/12, 10/7, 10/5). As for the topside, the EUR/USD faces technical barriers in the form of 8/21/08 and 8/13/08 highs along with the psychological 1.50 level. The EU will release Industrial Production tomorrow, yet the EUR/USD’s upcoming movements will likely depend on the performance of the U.S.

Present Price: 1.4858

Resistances: 1.4881, 1.4905, 1.4946, 1.4981, 1.5013, 1.5052

Supports: 1.4842, 1.4823, 1.4794, 1.4769, 1.4743, 1.4719

Psychological: September Highs, 1.50

GBP/USD Bounces from Intraday Lows on Oversold Conditions

The Cable is recovering from intraday losses after experiencing a key pullback since late Friday. The GBP/USD sank below our important 1st tier uptrend line and September lows, setting itself up for another leg down over the near-term. Ironically, the EUR/USD eclipsed its September highs today, signifying the contrasting paths of the Euro and Pound. In fact, the EUR/GBP has been climbing much closer to the key parity level. However, the Pound’s present strength is not surprising, and marks the over-extension of the Aussie and gold. We notice that the S&P futures are trading soft while investors snap up oversold 30 Year T-Bond futures. The behavior of these various investment vehicles supports today’s pop in the Pound. What doesn’t support today’s pop is the weaker than expected CPI growth. Today’s disappointing CPI release couples with Friday’s discouraging PPI number, as opposed to the previous release of the two pricing data points when CPI outperformed expectations. Therefore, corporate revenue should be under added strain, leaving the door open for the BoE to add funds to its QE program. At the very least, current pricing data supports the BoE’s dovish stance and encourages the central bank to maintain its loose monetary policy for the time being. This spells bad news the Pound and gives us little reason to alter our negative outlook on the Cable trend-wise.

Britain will keep the data train rolling tomorrow by releasing important CCC numbers. The CCC has been relatively flat over the last few months. Therefore, any dramatic shift to either side would most likely have a large impact on the Pound. While the medium-term trend of the CCC has been headed south, stagnation over the past quarter could represent a trough in the pattern. Therefore, we expect the CCC may register a larger than anticipated increase tomorrow. Such an occurrence would reinforce the significance of the Cable’s decline below our key 1st tier uptrend line. Despite the weight of tomorrow’s CCC release, the GBP/USD’s present fate likely relies upon the performance of upcoming U.S. earnings and econ data flows. Outperformance of each reinforces the Cable’s negative correlation with the EUR/USD, and encourages investors to favor the Dollar over the Pound due to the BoE’s clear dovish policy stance.

Technically speaking, our multiple downtrend lines and the highly psychological 1.60 area serve as topside barriers. As for the downside, there’s quite a bit of distance between present price and our next uptrend line. Furthermore, a dip beneath 06/2008 lows sets the stage for a more protracted pullback towards 05/2008 levels and the psychological 1.55/1.50 trading zones. We maintain our negative outlook on the Pound due to the aforementioned analysis unless either Q3 earnings disappoint and/or the BoE alters its monetary stance.

Present Price: 1.5808

Resistances: 1.5825, 1.5847, 1.5869, 1.5907, 1.5935, 1.5981

Supports: 1.5778. 1.5760, 1.5728, 1.5708, 1.5671, 1.5635

Psychological: 1.55, 1.50

USD/JPY Edges Lower After Encountering 90 and our 2nd Tier

The USD/JPY is drifting back beneath the highly psychological 90 level after being deflected by our 2nd tier downtrend line. We cautioned investors not to become overly optimistic concerning Friday’s rally due to the strength of these two technical barriers. Friday’s bounce was based off of broad-based oversold conditions for the Dollar and weaker than expected Core Machinery Orders data. The light data gave investors a reason to unload some Yen and value the USD/JPY based on comparative economic fundamentals rather than policy uncertainties and broad Dollar trends. However, the USD/JPY’s long-term downtrend is clearly in the driver’s seat, and we will need much more convincing topside movements to alter out outlook. The USD/JPY should continue to participate with incessant deflation of the Greenback.

Meanwhile, all eyes will be on BoJ tonight EST since the central bank will be announcing its first monetary policy decision under the leadership of Minister Fujii. There has been much uncertainty and speculation swirling around Fujii’s monetary stance and the impact of the DPJ’s fiscal policy on the Yen. Although Fujii attempted to recant his indifference towards a stronger Yen, we have little reason to believe the BoJ will intervene unless the Yen were to appreciate to uncomfortable levels is a short period of time. What these levels are naturally remain to be seen, though we believe a failure of 2009 lows would raise a red flag. Even though investors are anticipating that the BoJ will announce the official expiration of its corporate bond purchase program by the end of the year, the more important element of the meeting will be any reference regarding the BoJ’s attitude towards a stronger Yen. Further indifference and uncertainty from Minister Fujii could deliver another psychological blow to a beleaguered USD/JPY.

In addition to tonight’s BoJ meeting, investors will be digesting the flood of Q3 earnings and key U.S. econ data, including Retail Sales and Core CPI. Outperformance of earnings and econ data would likely result in further equity strength combined with Dollar weakness. The USD/JPY’s trend is very much attuned to investor opinion regarding the overall health of the Dollar. Therefore, we expect current correlations and trends to remain intact until further notice. Technically speaking, our multiple downtrend lines and the highly psychological 90 zone should continue to serve as noteworthy topside barriers along with 10/12 and 9/24 highs. As for the downside, our two uptrend lines serve as key technical cushions along with previous October lows.

Present Price: 89.66

Resistances: 89.68, 89.82, 89.97, 90.21, 90.43, 90.63

Supports: 89.45, 89.16, 88.97, 88.78, 88.63, 88.41

Psychological: 90, 2009 and 2008 lows

Gold Sets New Highs on Strong EUR/USD

Gold is trading off fresh 2009 highs as the Dollar logs gains against the Euro and Aussie. However, this is after the EUR/USD popped past our key 3rd tier downtrend line and September highs. While a retracement beneath our 3rd tier downtrend line is possible, today’s movement in the EUR/USD could spell accelerated gains in the near future. The final obstacle the EUR/USD must overcome is its highly psychological 1.50 level. The reason we speak of the EUR/USD in relation to gold is because the precious metal has achieved its historic breakout without full cooperation from the Euro. The EUR/USD has been tightly correlated with gold throughout the year, implying gold’s accomplishment overcame quite a few obstacles of its own. Therefore, as we mentioned previously, a topside breakout in the EUR/USD could fuel further gains in gold. As a result, we feel a pressing need to highlight any noteworthy developments regarding the EUR/USD’s topside potential. Gold hasn’t given evidence of creating a lasting top since we have no historical reference to work with. Hence, gold’s uptrend is alive and boundless until we are able to initiate some credible downtrend lines.

Meanwhile, investors should eye near-term performances of both the AUD/USD and EUR/USD since gold should be positively correlated with these two major Dollar crosses. Furthermore, upcoming Q3 earnings and U.S. econ data should impact the FX markets, meaning gold will be influenced as well. Outperformance of earnings and data implies gains in U.S. equities and consequently serve as positive catalysts for gold’s uptrend, and vice versa. Technically speaking, it’s difficult to place topside technicals on gold other than the psychological $1075/oz and $1100/oz levels. As for the downside, the precious metal has developed a few technical cushions, including our multiple uptrend lines along with 10/13, 10/10, and 10/7 lows. Additionally, the psychological $1050/oz level should serve as a technical support.

Present Price: $1057.40/oz

Resistances: $1058.54/oz, $1061.40/oz, $1068.30/oz

Supports: $1054.82/oz, $1052.80/oz, $1050.67/oz, $1048.60/oz, $1045.23/oz, $1042.96/oz

Psychological: $1050/oz, $1075/oz, $1100/oz

The S&P Futures Wobble Around 2009 Highs

The S&P futures are hovering around previous 2009 highs and the psychological 1075 level after pulling back slightly earlier in the session. The S&P weakened initially following a Whitney downgrade of Goldman couple with disappointing revenue from J&J. Furthermore, we got weak econ data from both the EU and Britain. The EU printed disappointing ZEW numbers while Britain’s weak CPI tacked onto Friday’s disappointing PPI. Therefore, global econ data continues to come in negatively mixed, signaling a cool down in the economic recovery. However, it remains to be seen whether what we are witnessing is a hiccup or the beginning of a more protracted slowdown. Investors are uncertain whether the global economic recovery can stay on track once stimulus fades and central banks tighten. Fortunately for the bulls, it’s likely these concerns won’t be addressed until the end of ’09 and beginning of ’10. For the time being there is little reason to believe Q3 earnings will disappoint since global stimulus measures were in full effect. Furthermore, it will take a few more waves of econ data before we can more accurately determine the extent of the cool down.

Meanwhile, the EUR/USD and crude appear on the verge of topside breakouts and the USD/JPY remains mired in its long-term downtrend. Additionally, gold’s incredible run has yet to show signs of fading since we have not historical reference to guide us in terms of initiating downtrend technical forces. Therefore, the S&P’s correlations are strengthening and continue to create a positive environment in which equities can climb higher. Fundamentally speaking, the S&P’s near-term trajectory will be guided by Q3 earnings and outlooks along with the performance of upcoming econ data. Tomorrow’s Retail Sales data will be a key release since other consumption data has printed negative lately. Additionally, Thursday’s Core CPI will give us a better idea of inflation and how the Fed may approach its upcoming monetary policy meeting. Weaker than expected CPI data would likely drive the Dollar lower since the Fed would be less inclined to tighten liquidity any time in the near future. As we have seen throughout the year, the more the Dollar weakens, the higher equities climb. Therefore, investors will be paying particularly close attention to these two data releases.

Technically speaking, the S&P’s topside barriers are wearing thin and the futures are knocking on the door of 2009 highs. However, immediate-term topside movements could be hampered by the psychological 1075 and 1100 levels. As for the downside, crude has several potential uptrend lines along with 10/9 and 10/7 lows. Furthermore, the psychological 1050 level should act in the S&P’s defense should the futures reach this area. We maintain our positive outlook trend-wise until further notice.

Price: 1070

Resistances: 1071, 1075

Supports: 1067.75, 1063.5, 1058.25, 1051.75, 1045.5, 1041, 1036.25

Psychological: 2009 highs, 1050, 1075, 1100

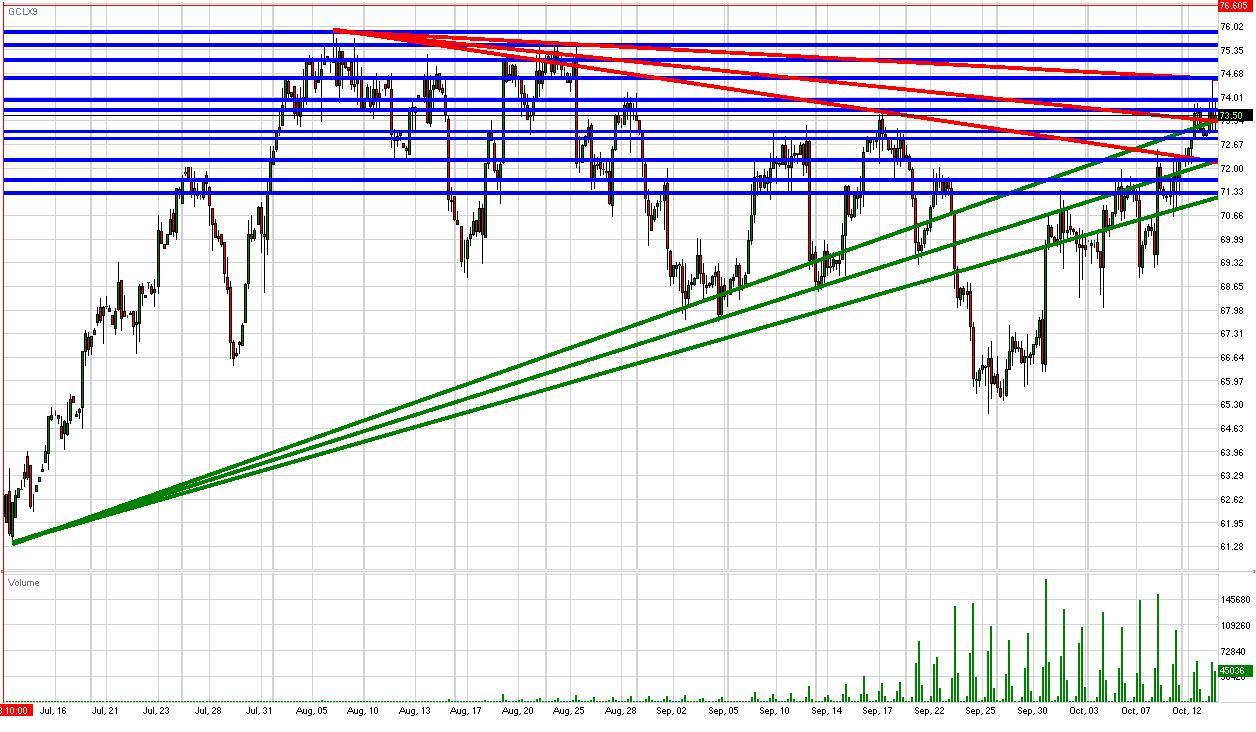

Crude Tops Out Below $75/bbl

Crude futures have made an encouraging movement by stepping over and consolidating above our previous 3rd tire downtrend line. However, crude is currently topping out just beneath the psychological $75/bbl and previous 2009 highs. Meanwhile, crude continues to climb higher while setting continual higher lows on the back of a broad-based Dollar weakness. Crude’s ascent has ignored negatively mixed global econ data, and is clearly being driven by the prospect of increased export demand derived from a weak Greenback. In the process crude is testing our final 3rd tier downtrend line which runs through August highs. A pop past our fresh 3rd tier downtrend line could yield accelerated near-term gains in crude. The positive development in crude reflects the EUR/USD’s climb beyond its own 3rd tier downtrend line. Therefore, crude’s topside technical barriers are wearing thin and the probability of a breakout has increased considerably. As for the downside, crude has multiple uptrend lines serving as technical cushions along with 10/12 and 10/9 lows. Additionally, the psychological $70/bbl is now working in favor of crude’s uptrend.

As with the rest of the markets, crude’s near-term movements will likely depend upon the outcome of upcoming Q3 earnings and U.S. econ data, most notably tomorrows Retail Sales numbers. Retail Sales data helps gauge the overall health of U.S. consumption. Since crude has risen recently despite weak consumption data points, better than expected Retail Sales numbers could help boost crude to new 2009 highs. Meanwhile, investors should continue to keep a close eye on behavior of the Greenback, especially the EUR/USD. A topside breakout in the EUR/USD could fuel fresh gains in gold, thereby bringing crude futures along for the ride. In all, the behavior of crude’s correlations and the thinning topside technical barriers give us ample reasons to be positive as far as crude’s outlook is concerned.

Price: $73.50/bbl

Resistances: $723.64/bbl, $73.93/bbl, $74.56/bbl, $75.06/bbl, $75.49/bbl, $75.86/bbl

Supports: $73.04/bbl, $72.84/bbl, $72.23/bbl, $71.67/bbl, $71.29/bbl

Psychological: $75/bbl, $70//bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.