Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/04/09

Daily Market Commentary

EUR/USD Experiences Solid Recovery from Tuesday Lows

The EUR/USD logged sizable losses yesterday as we witnessed a broad-based preference for the Greenback despite a breakout in gold and U.S. equities ending slightly positive. Therefore, it seems downward momentum was more in control than correlations and fundamentals. Speaking of gold, yesterday’s breakout was impressive, and the precious metal is looking to test its psychological $1100/oz level. Though much of gold’s strength may be attributed to India’s large bullion purchase from the IMF, the breakout could also signal another pullback in the Dollar due to their negative correlation. In fact, the EUR/USD and GBP/USD have posted encouraging gains since yesterday’s bottom as investors await the FOMC’s monetary policy decision this afternoon. Since the Fed is expected to keep a loose monetary policy for the foreseeable future, any unexpected wording would likely have a large impact on the Dollar. If the Fed does stand pat as anticipated, then tomorrow’s ECB and BoE meetings should carry some more weight in the FX markets.

It will be interesting to see how the ECB behaves tomorrow since the central bank has recently voiced its displeasure of such a weak Dollar. Since the Chinese RMB is pegged to the Dollar, the Euro has also lost a lot of value against the Yuan, causing further damage to the EU’s recovering manufacturing sector. However, the EUR/USD has pulled back from October highs following the ECB’s public objection, so it is uncertain whether the central bank will continue to be more Hawkish or omit more of a neutral tone. Considering these observations, the ECB’s rate meeting tomorrow has an air of uncertainty to it, meaning volatility may pick up over the next 24-48 hours.

Meanwhile, the S&P futures have climbed back to their psychological 1050 mark while crude trades around its own psychological $80/bbl level. Therefore, the bulls have placed the riskier investment vehicles back into a more reasonable position following last week’s large pullback. As a result, the EUR/USD finds itself at a crossroads as well. The currency pair has multiple uptrend and downtrend lines we can create while the psychological 1.50 level bears overhead and the psychological 1.45 level rests underneath. Therefore, investors should keep a close eye on the Dollar’s reaction to upcoming monetary policy decisions until the Greenback commits to a new near-term trend.

Present Price: 1.4780

Resistances: 1.4796, 1.4814, 1.4828, 1.4847, 1.4859, 1.4876, 1.4890

Supports: 1.4773, 1.4759, 1.4740, 1.4711, 1.4684, 1.4648

Psychological: 1.50, 1.45

GBP/USD Climbs Back Above 1.65 Ahead of FOMC Decision

The Cabled has recovered nicely from Tuesday lows after bottoming along our 2nd tier uptrend line and just above 10/26 lows. Buyers come to the rescue following positive economic data flows from Britain coupled with another large topside breakout in gold. Yesterday’s Halifax HPI number tagged onto the positive Manufacturing PMI performance on Monday by printing 4 basis points above analyst expectations. Today’s Services PMI data completed the trifecta, printing at 56.9 vs. 55.4E. We mentioned previously how the Services PMI number should carry a little more weight since the services industry comprises roughly 70% of GDP. The Services data didn’t disappoint, and the 56.9 reading falls in line with pre-crisis levels. The Pound has reacted positively, flexing its relative strength while sending the EUR/GBP lower.

The Cable also got a boost from yesterday’s impressive breakout in gold. The precious metal is presently looking to test its highly psychological $1100/oz level. As we mentioned in today’s EUR/USD commentary, gold’s large topside movement could signal a coinciding decline in the Dollar due to their negative correlation. On the other hand, yesterday’s action in gold may been largely due to India’s sizable purchase of bullion from the IMF. Either way, gold’s breakout sends some positive signals, helping the Cable’s uptrend. However, despite today’s strength in the Cable, the currency pair still faces our 3rd and 4th tier downtrend lines along with 10/29, 10/23, and 9/11 highs. Therefore, a few worthy topside technicals remain between present price and more significant topside movements. As for the downside, the Cable has multiple uptrend lines serving as technical cushions along with 11/03 and 10/23 lows. Furthermore, the psychological 1.65 level may now work in the Cable’s favor.

The next 24-48 hours will be all about the central bank meetings. The Fed will announce its monetary policy this afternoon with the BoE and ECB following early Thursday PST. While the Fed is expected to keep its loose liquidity policy intact for the ‘foreseeable future’, the BoE and ECB meetings carry more uncertainty. Although analysts are expecting the BoE to increase its QE package by 50 billion, the BoE has expressed a more hawkish tone as of late. Prelim GDP aside, recent British econ data has been more positive than negative. Therefore, although the BoE is expected to inject more liquidity tomorrow, there remains a possibility that the central bank may just stand pat. Considering the slight uncertainty surrounding upcoming monetary policy decisions, we could be in for a volatile couple trading sessions in the FX markets. Therefore, investors should keep a sharp eye on the Cable’s interaction with its technical levels as well as the behavior of its correlations.

Present Price: 1.6526

Resistances: 1.6544, 1.6566, 1.6604, 1.6630, 1.6662, 1.6688

Supports: 1.6505, 1.6473, 1.6428, 1.6397, 1.6362, 1.6329

Psychological: 1.65

USD/JPY Edges above 90 on Flow to Risk Trade

The USD/JPY has popped back above its psychological 90 level in reaction to solid gains in both the EUR/USD and GBP/USD. Hence, the USD/JPY’s recent behavior stems from a slight return to risk, supported by the S&P’s rally to 1050 and Crude’s climb back to $80/bbl. However, despite today’s recovery in the risk trade, upcoming central bank meetings could move the markets either way. The Fed, BoE, and ECB will all announce their monetary policy decisions in the next 24 hours, meaning the FX market could experience heightened volatility due to uncertainty surrounding the events. Although investors are expecting the Fed to stay pat, the BoE and ECB decisions could be wildcards should the central banks decide to diverge from their respective stances. Since Japan doesn’t have any events on the board besides tonight’s release of the BoJ meeting minutes, the USD/JPY’s movements will likely be linked to broad based activity in the Dollar and U.S. equities. Because the USD/JPY is moving in correlation with the risk trade today, the currency pair may exert a positive correlation with the EUR/USD, GBP/USD, and U.S. equities for the time being. Considering the Dollar is at a crossroads, investors should keep a sharp eye on upcoming activity in reaction to monetary policy decisions.

Technically speaking, the USD/JPY has created a little breathing room by getting back above 90 along with our 1st and 2nd tier uptrend lines. Furthermore, should another downturn take hold, the currency pair has November and October lows to fall back on. However, the last pop in volume came on Friday’s large pullback, meaning near-term momentum may be in favor of the downside. As for the topside, the USD/JPY potentially faces multiple uptrend lines along with 10/30 and 10/27 highs. Investors should keep in mind that there is still a debilitating, long-term downtrend at work, meaning the road to the topside may be filled with speed bumps.

Present Price: 90.76

Resistances: 90.78, 90.93, 91.08, 91.26, 91.44, 91.61

Supports: 90.60, 90.41, 90.29, 90.16, 89.91, 89.77

Psychological: 90

Gold Tops Out Just Below $1100/oz

Gold surged past our 2nd tier downtrend yesterday after the IMF announced that India made a large bullion purchase from the monetary fund’s stockpile. Gold’s technicals were already working in the topside’s favor, making yesterday’s breakout explosive. Furthermore, gold managed to make yesterday’s key topside movement without the full cooperation of the Euro and Aussie. In fact, gold’s impressive breakout could signal another round of weakness in the Dollar. Regardless, gold’s momentum continues to work in favor of the topside as investors and governments try to diversify their assets and decrease their dependency on the Dollar. Meanwhile, central bank meetings will be in focus for the next 24-48 hours, meaning volatility in the FX markets should increase. Therefore, investors should expect further volatility in gold, especially considering the precious metal made such a bullish movement.

Technically speaking, we’re at a loss of downtrend lines and historical perspective again. Therefore, the psychological $1100/oz level serves as our only trustworthy topside technical for the time being. Speaking of which, gold stopped just short of $1100/oz, hinting that the level could have a near-term psychological impact on investors. As for the downside, we’ve readjusted our uptrend lines, giving us an idea of support to go along with the psychological $1075/oz level. Meanwhile, gold’s near-term activity could take its cue from the Dollar. Hence, investors should monitor any technical breakouts or setbacks in either the EUR/USD or AUD/USD.

Present Price: $1091.30/oz

Resistances: $1091.49/oz, $1092.77/oz, $1095.77/oz, $1100.04/oz

Supports: $1087.85/oz, $1085.28/oz, $1083.14/oz, $1079.93/oz, $1075.01/oz, $1069.89

Psychological: $1100/oz, $1075/oz.

The S&P Futures Climb Past 1050 Despite Weak Data

The S&P futures are climbing past our 1st tier uptrend and downtrend lines along with the psychological 1050 level despite weaker than expected economic data. Both the ADP Non-Farm Unemployment Change and ISM Non-Manufacturing PMI disappointed expectations, signaling unemployment continues to drag despite the pickup in manufacturing and improvements in corporate earnings. Today’s data supports the belief that the unemployment market is still too weak for the Fed to begin considering a tightening of liquidity. Therefore, investors seem to be pricing in a neutral monetary policy stance from the Fed later today. The Dollar is weakening across the board, buoying equities and sending crude above its psychological $80/bbl level.

However, even if the Fed’s monetary policy decision is fairly certain, the BoE and ECB policies are a bit more vague(refer to our EUR/USD and GBP/USD commentaries). Therefore, the potential does exist for a monetary shock in the next 24 hours, meaning investors should monitor the wires and stay on their toes since volatility should increase in the FX markets. The S&P’s impressive recovery from crisis lows has been driven in most part by a weakening Dollar. Therefore, the S&P’s negative correlation with the Dollar is still in play. Hence, any surprisingly hawkish move by either the ECB or BoE could stunt the S&P’s present stability.

Technically speaking, the S&P’s climb back above 1050 and our 1st tier uptrend line is an encouraging development for the bulls. However, a downward momentum remains in the market, signified by our 2nd tier downtrend line and the pop in sell-side volume equities received on Friday. Therefore, the S&P futures are currently at a crossroads, placing added significance on the upcoming central bank monetary policy decisions. On a positive note, gold’s breakout yesterday could imply a forthcoming downturn in the U.S. Dollar, which would be a positive catalyst for the S&P futures. However, we will have to see how the central bank meetings pan out as well as the Dollar’s reaction.

Price: 1050.75

Resistances: 1054.75, 1062.5, 1069.75, 1077, 1083.25

Resistances: 1044.75, 1036, 1029.25, 1022.5, 1014.25

Psychological: 1050, 1075, 1000

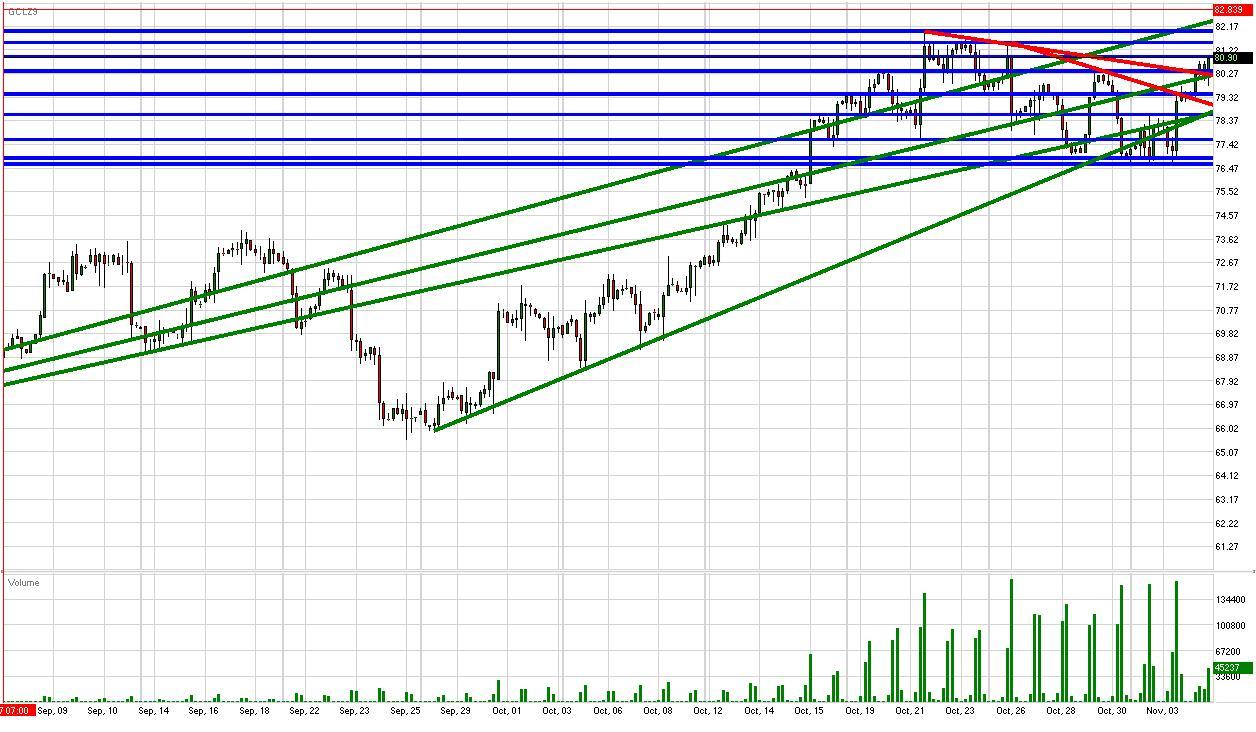

Crude Futures Spring Above our 3rd Tier Uptrend Line

Crude futures have climbed back above their $80/bbl psychological level again and are currently staring down previous 2009 highs. Weekly inventories just printed nearly 6 mill barrels below analyst expectations, indicating a pickup in demand for and consumption of crude. The pullback in supply is providing a positive catalyst for crude, creating an environment supportive of another breakout should correlative activity follow through. Crude’s correlations are behaving thus far, with a broad based depreciation in the Dollar to go along with gold’s monster topside breakout towards $1100/oz. Furthermore, the S&P futures are climbing past their psychological 1050 level despite both the Non-Farm Employment Change and Non-Manufacturing PMI data points coming in below analyst expectations. Speaking of which, these negative econ data points from the U.S. could be what’s holding back crude from setting fresh 2009 highs right now.

However, despite today’s disappointing stream of U.S. data, both U.S. and British Manufacturing PMI numbers topped expectations earlier this week. The pick-up in manufacturing is likely an element bolstering demand for and consumption of crude. Meanwhile, all eyes will be on the central banks over the next 24 hours. The Fed, ECB, and BoE will all make monetary policy decisions, meaning volatility in FX markets could increase over the next couple trading sessions. Since the price of crude is being driven by the value of the Dollar, the Greenback’s reaction to upcoming monetary policy could have a sizable impact on near-term movements in crude. Hence, investors should monitor any technical breakouts or pullbacks in the EUR/USD and GBP/USD. Fortunately for bulls, gold’s aggressive topside movements yesterday could imply a corresponding depreciation in the Dollar. If this is the case, then crude may find its catalyst to set new yearly highs.

Technically speaking, crude’s topside barriers are wearing thin. The futures are trying to take a step above our 2nd tier downtrend line right now, and the only foreseeable topside obstacles beyond our 2nd tier are previous 2009 highs and the psychological $85/bbl level. As for the downside, crude has multiple uptrend lines serving as technical cushions along with 10/27 and 11/3 lows. Meanwhile, the $80/bbl level could turn into a psychological support should crude create more topside separation.

Price: $80.90/bbl

Resistances: $80.96/bbl, $81.52/bbl, $81.98/bbl

Supports: $79.45/bbl, $78.63/bbl, $77.62/bbl, $76.89/bbl, $76.63/bbl

Psychological: $80/bbl, $85/bbl, $75/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.