Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/10/09

Daily Market Commentary

EUR/USD Dips after Hitting Headwinds at 1.50

The EUR/USD is pulling back from 1.50 and our important 2nd and 3rd tier downtrend lines as we witness a consolidation of the risk trade across the marketplace. Investors are hesitating at significant levels in both the EUR/USD and the S&P futures as they approach their highly psychological 1.50 and 1100 levels, respectively. Furthermore, we are witnessing a retracement in gold towards its own psychological $1100/oz level. Such consolidation is healthy considering the relative lack of economic news along with the significance of these psychological levels in terms of future trends. Although the news wire has been somewhat quiet so far today, the EU did release its ZEW Economic Confidence data. The ZEW numbers printed roughly 10% below consensus estimates, deflating optimism generated from Germany’s positive Industrial Production release yesterday. Although the ZEW data is continuing its decline from September highs, the slope is gradual and could be part of a healthy pullback. Therefore, it may be too early to jump to any conclusions based off of this one data release. Regardless, investors didn’t get the stream of positive data they were looking for, halting the EUR/USD ascent towards October highs.

Speaking of technicals, our 2nd and 3rd downtrend lines are still intact despite yesterday’s impressive rally. These downtrends should be considered heavily-weighted since their run through October highs. Therefore, a solid movement above these two trend lines could yield a nice near-term pop. Meanwhile, the 1.50 level continues to play a lead role as far as resistance is concerned. As for the downside, the EUR/USD still has multiple uptrend lines serving as technical cushions along with 11/09 and 11/06 lows. Therefore, the EUR/USD has a solid support system in place.

Despite today’s calm thus far, activity could heat up late Tuesday EST with the release of key China econ data. China will release Industrial Production, CPI, CPI, and Fixed Asset Investments. Investors will likely be paying particularly close attention to China’s econ data since the nation’s economy has been an engine in the global recovery. An outperformance in China’s data could give the risk trades a nice boost, whereas a cool down could result in further Dollar strength.

Present Price: 1.4956

Resistances: 1.4966, 1.4981, 1.4999, 1.5019, 1.5037, 1.5049

Supports: 1.4947, 1.4923, 1.4905, 1.4887, 1.4873, 1.4856

Psychological: 1.50, October Highs

GBP/USD Declines Following Increasing Trade Deficit and Strengthening Dollar

The Cable has pulled back from yesterday’s highs after Britan’s Trade Balance came in much weaker than expected (-7.2 bill. Vs -6.1 bill forecast). The Trade Balance number is a bit disappointing since it works against the recovery we’ve witnessed since January lows. Furthermore, the rising trade deficit is concerning considering the recent improvement in Britain’s manufacturing production data. Therefore, this implies that the cause for the rising trade deficit may be more of a symptom of rising imports rather than declining exports. Either way, the combination of disappointing Trade Balance data along with broad-based strength in the Dollar has been enough to knock the Cable back below our 4th tier downtrend line. On the other hand, the Cable has avoided a retest of 1.65, and the technicals appear to be working in favor of a near-term uptrend. As a result, investors shouldn’t become too discouraged by today’s pullback.

Meanwhile, the EUR/USD is battling 1.50 while the S&P futures and gold battle their respective 1100 levels. Furthermore, the USD/JPY continues to hover around its psychological 90 area. Therefore, consolidation is the risk trade appears to be a sign of healthy hesitation in the wake of large gains and the face of important psychologicals. Although the news wire should be pretty quiet in the U.S. today, activity in the FX markets could pick-up later when China releases a wave of economic data late Tuesday EST. China will release Industrial Production, CPI, CPI, and Fixed Asset Investments. Investors will likely be paying particularly close attention to China’s econ data since the nation’s economy has been an engine in the global recovery. An outperformance in China’s data could give the risk trades a nice boost, whereas a cool down could result in further Dollar strength. Britain will also keep its news flowing with the release of CCC data tomorrow morning along with the BoE inflation report. BoE Governor King will address the general public as well and investors will be looking for hints of the BoE’s present monetary stance.

Technically speaking, the Cable faces topside technicals in the form of our 4th tier downtrend line, 11/09 highs, and the psychological 1.70 level. As for the downside, the GBP/USD still has several uptrend lines serving as technical cushions along with 11/06 lows and the psychological 1.65 level.

Present Price: 1.6704

Resistances: 1.6714, 1.6730, 1.6761, 1.6797, 1.6812, 1.6838

Supports: 1.6688, 1.6662, 1.6615, 1.6598, 1.6574, 1.6530

Psychological: 1.70, 1.65, August Highs

USD/JPY Consolidates around 90

The USD/JPY is consolidating around its highly psychological 90 level as we witness a broad-based preference for the Dollar. However, focus could shift to the Yen soon since Japan will release Core Machinery Orders late Tuesday night EST along with a wave of Chinese econ data. Therefore, volatility could pick up in the next 24-48 hours, especially if the Asian data points outperform expectations. While analysts are expected continual growth in Japan’s CMO data, China’s numbers could have a larger impact considering it is Japan’s largest trading partner. Further strength in China’s economy implies greater demand for Japanese goods, thereby strengthening the Yen. On the other hand, weak Chinese econ data could rattle markets and send the USD/JPY back above 90.

Technically speaking, the psychological 90 area is proving to be a tough psychological area once again. The USD/JPY continues to gravitate towards 90 despite recent hints of a topside breakout. The currency pair is currently trading back below 90, yet is holding above our 1st and 2nd tier uptrend lines. Hence, there are a few more technical cushions separating the USD/JPY from a retest of October lows. As for the topside, the USD/JPY faces multiple downtrend lines along with 11/6 and 11/4 highs.

Present Price: 89.85

Resistances: 89.92, 90.06, 90.19, 90.31, 90.43, 90.58, 90.72

Supports: 89.71, 89.61, 89.43, 89.26, 89.15, 88.99, 88.83

Psychological: 90, November and October Lows

Gold Retraces to $1100/oz

Gold has retraced to $1100/oz following yesterday’s break above as investors snap up the Dollar in reaction to overbought conditions and disappointing econ data points from both Britain and the EU. Meanwhile, the S&P futures are staring at their own psychological 1100 level along with previous 2009 highs. Therefore, today’s consolidation appears healthy thus far as investors take a breather in anticipation of tonight’s wave of econ data from China. China will release Industrial Production, CPI, CPI, and Fixed Asset Investments. Investors will likely be paying particularly close attention to China’s econ data since the nation’s economy has been an engine in the global recovery. An outperformance in China’s data could give the risk trades a nice boost, whereas a cool down could result in further Dollar strength. Therefore, strong econ data out of China could help gold separate itself from $1100/oz despite today’s retracement. On the other hand, disappointing China data could lead investors to close out some risk trades as well as take profits in gold.

Technically speaking, we’re still unable to place any sort of reliable downtrend line on gold due to a lack of historical perspective. Therefore, gold’s key barrier to further topside gains appears to rest in the hands of the psychological $1100/oz level. As for the downside, gold several uptrend lines serving as technical cushions along with 11/06 lows. Meanwhile, investors should keep an eye on the EUR/USD’s battle with 1.50. Gold has been strongly correlated with the EUR/USD. Therefore, any significant breakout in the currency pair could help drive gold higher.

Present Price: $1101.85/oz

Resistances: $1105.32/oz, $1108.20/oz, $1110.59/oz

Supports: $1100.97/oz, $1097.65/oz, $1094.78/oz, $1091.43/oz, $1087.59/oz

Psychological: $1100/oz, $1075/oz.

The S&P Futures Knock on the Door of 2009 Highs and 1100

The S&P futures added onto yesterday’s gains as investors dove back into the risk trades. The futures are holding up well today and are presently knocking on the door of previous 2009 highs and the psychological 1100 level. Investor sentiment remains upbeat thus far today since we are not receiving noteworthy data from the U.S. today. Optimism is surrounding the anticipation that global central banks will maintain their respective stimulus and liquidity measures until the economy is back on stable ground. Hence, the Fed’s loose monetary policy appears intact for the foreseeable feature, meaning corporate performance should continue to benefit from access to cheap.

Meanwhile, investors won’t receive much from the U.S. until Thursday’s weekly Unemployment Claims data. Hence, the S&P’s immediate-term performance may become increasingly reliant upon movements in the Dollar. Since the U.S. will be taking a timeout from data, focus will shift to the Far East. China will be printing a wave of data late Tuesday EST, including Industrial Production, CPI, PPI, and Fixed Asset Investment. Any outperformance in China’s econ data could help fuel a S&P retest of 1100.

Technically speaking, although the S&P futures have darted beyond our downtrend line, they still have to deal with previous 2009 highs and the psychological 1100 level. Therefore, a couple key topside technicals do remain before the S&P has the opportunity to experience a more protracted breakout. As for the downside, the S&P futures have multiple uptrend lines service as technical cushions now along with 11/06, 11/05, and 11/03 lows. Furthermore, the psychological 1050 level should service as a reliable support should it be tested.

Price: 1093.25

Resistances: 1094.5, 1098.75, 1100

Supports: 1086, 1076.75, 1071.25, 1062.5, 1056.5, 1053

Psychological: 1100, 2009 Highs, 1050

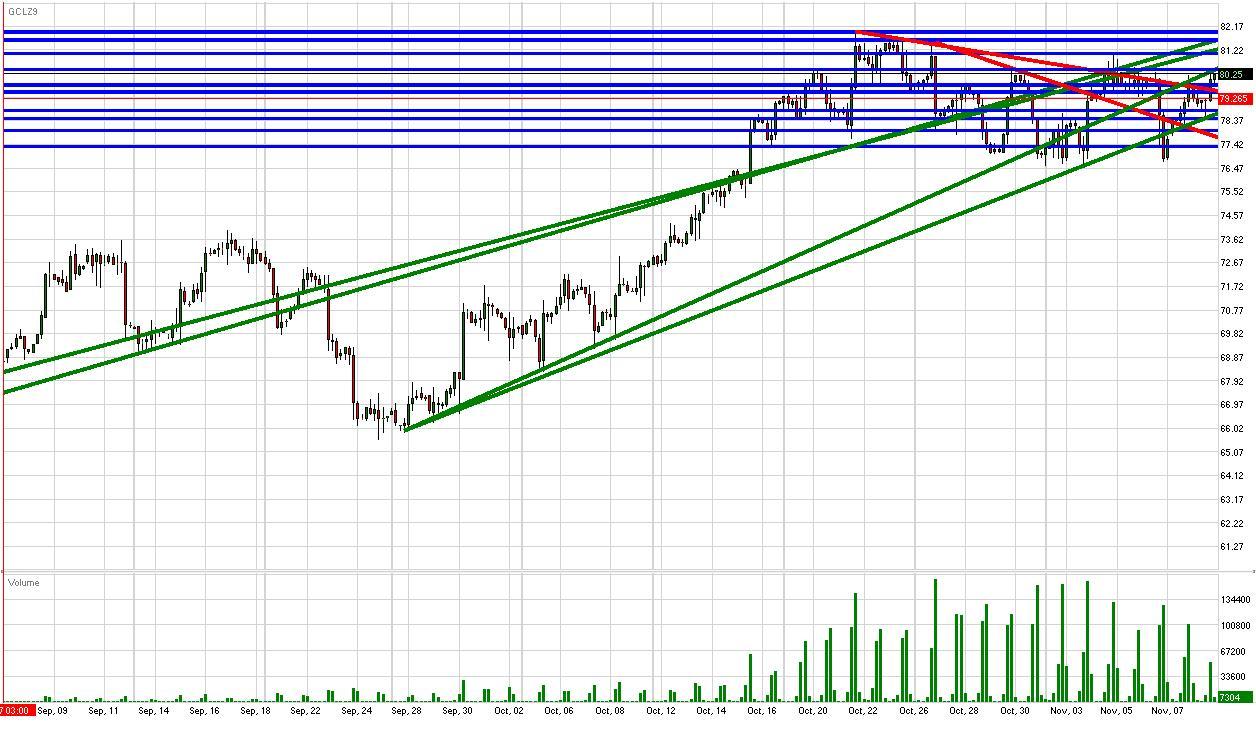

Crude Climbs Back Above $80/bbl

Crude futures are trading back above their psychological $80/bbl level and are rising above our 2nd tier downtrend line. The Dollar is beginning to retreat following earlier gains, helping crude consolidate with an upward momentum. Speaking of momentum, yesterday’s upward momentum appears to be intact since we have received relatively light economic data today. Meanwhile, the S&P futures are staring down their highly psychological 1100 level and previous 2009 highs. Therefore, it appears we are approaching a critical juncture as far as the continuation of crude’s uptrend is concerned. Considering Dollar technicals remain weak across the board while gold holds strong above $1100/oz, it seems crude’s correlations continue to create an environment support of extended gains should the fundamentals warrant such a movement.

Attention will shift to the Far East with the release of some key China econ data. China will be printing a wave of data late Tuesday EST, including Industrial Production, CPI, PPI, and Fixed Asset Investment. Any outperformance in China’s econ data could help fuel an S&P retest of 1100. Such a development would likely bode well for crude since the futures are staring down their own previous 2009 highs.

Technically speaking, crude has our 1st tier uptrend line serving as a technical cushion once again along with 11/06 lows and the psychological $75/bbl level. As for the topside, crude faces previous 2009 highs. Meanwhile, crude’s movement should follow the path of the Dollar for the most part until the wave of Chinese econ data late Tuesday EST.

Price: $80.25/bbl

Resistances: $80.43/bbl, $81.08/bbl, $81.61/bbl, $81.94/bbl

Supports: $79.82/bbl, $79.53/bbl, $78.79/bbl, $78.47/bbl,$77.98/bbl, $77.34/bbl

Psychological: 2009 highs, $80/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.