Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/18/09

Daily Market Commentary

EUR/USD Trades Lower as Investors Await More Data

The EUR/USD managed to bottom out at our 3rd tier uptrend line yesterday despite a pop in sell-side activity in reaction to more negative U.S. economic data. The EUR/USD continues to trade primarily off of its last important data releases, Friday’s disappointing GDP data points. However, the EUR/USD is strengthening again today in the face of a surprisingly negative EU Current Account release, indicating an increase in import demand. Additionally, the U.S. released a set of negative housing numbers combined with slightly positive CPI data. Regardless of the continuation of negatively mixed data, the Dollar continues to indicate a preference for its downtrend. We should note that both the EUR/USD and AUD/USD have been strongly correlated with gold this year, yet haven’t participated in the precious metal’s most recent rally past $1100/oz. Therefore, the EUR/USD may be gaining correlative support from gold, countering the impact from more disappointing EU economic data. Lastly, the wave of negative U.S. econ data further supports the anticipation that the Fed will maintain a loose monetary policy for the foreseeable future, thereby weighing on the value of the Dollar. The EU data wire will be relatively quiet until Friday’s German PPI release, meaning the currency pairs immediate-term performance may rest on the performance of U.S. equities and their reaction to tomorrow’s weekly Unemployment Claims release.

Technically speaking, the EUR/USD still faces multiple downtrend lines along with the highly psychological 1.50 level and previous November highs. However, and a breach beyond our 3rd tire downtrend line could result in a retest of November and October highs with the possibility of more accelerated immediate-term gains. Unfortunately for bulls, the EUR/USD was negated by our 3rd tier downtrend line and 1.50 on Monday, telling us the 1.50 zone continues to have a psychological impact on the currency pair. As for the downside, the EUR/USD has built up a solid support system considering the rally since November lows. Therefore, the EUR/USD has multiple uptrend lines serving as technical cushions along with 11/12 and 10/27 lows. Meanwhile, investors should keep an eye on the S&P’s interaction with its psychological 1100 level because a topside breakout in the S&P could bring the EUR/USD along for the ride due to their positive correlation.

Present Price: 1.4927

Resistances: 1.4942, 1.4952, 1.4967, 1.4992, 1.5018, 1.5036, 1.5049

Supports: 1.4919, 1.4905, 1.4883, 1.4856, 1.4825, 1.4813

Psychological: 1.50, November Highs and Lows

GBP/USD Consolidates with S&P Futures

The Cable is consolidating after briefly trading beyond November highs on Monday. Investors are presently digesting the BoE Meeting Minutes released earlier today. The minutes revealed that although seven members of the BoE voted for the 25 billion Pound QE injection, one member vote for non-action and the other for a larger 40 billion Pound injection. Therefore, divisions of opinion may exist in the BoE in regards to present and future monetary policy actions, thereby increasing investor uncertainty a bit. However, if pricing data points, such as Tuesday’s CPI and RPI, continue to rise while unemployment falls the BoE may choose a less dovish monetary policy stance in the future, thereby strengthening the Pound relative to the Dollar over the medium-term. U.S. data has been underperforming as of late and the Fed’s loose monetary stance could be in place for quite some time. As for the time being, the Cable has had trouble breaking 11/09 highs and our 4th tier downtrend line. Meanwhile, the EUR/USD remains locked beneath its highly psychological 1.50 level. Therefore, the Cable has yet to receive the positive boost it needs to approach its own highly psychological 1.70 level.

Technically speaking, investors should continue to monitor the Cable’s interaction with our 4th tier downtrend line since it runs through 11/09 highs. The GBP/USD faces light near-term historical resistance between present price and the psychological 1.70 level. In fact, we had to trace back to 2003 levels to find more substantial resistances. Hence, the Cable could be in for more extensive topside movements should fundamentals and U.S. equities cooperate. Speaking of which, investors received another wave of negatively mixed U.S. econ data and the S&P futures are having trouble creating some topside separation from their highly psychological 1.70 level. As a result, the economic fundamentals are not helping out the Cable’s uptrend for the time being. However, Britain will release Retail Sales tomorrow along with Public Sector Net Borrowing. A positive Retail Sales number could help the uptrend’s cause. Meanwhile, the Cable is continuing a consolidative pattern while slowly drifting back below 11/09 highs, meaning there’s a potential for downward forces to kick in. As for the downside, the Cable still has multiple uptrend lines serving as technical cushions along with 11/16 and 11/12 lows. Furthermore, the psychological 1.65 level could work in the Cable’s favor should conditions deteriorate.

Present Price: 1.6795

Resistances: 1.6808, 1.6828, 1.6849, 1.6875, 1.6896, 1.6913, 1.6935

Supports: 1.6778, 1.6753, 1.6730, 1.6694, 1.6664, 1.6615, 1.6594

Psychological: 1.70, 1.65 November and August Highs, November Lows

USD/JPY Consolidates Around Our 1st and 2nd Tier Uptrend Lines

The USD/JPY is continuing its consolidation between our 1st and 2nd tier uptrend lines as the S&P futures hover just above their psychological 1100 level. Not much has changed since yesterday despite another wave of negatively mixed U.S. econ data. The story remains the S&P’s resilience above 1100 despite econ data indicating a slowdown in the pace of America’s economic recovery. If the S&P can manage to move higher regardless of disappointing data, then another wave of broad based Dollar weakness may kick-in, thereby weakening the USD/JPY.

Meanwhile, investors shouldn’t forget that Japan’s Prelim GDP topped expectations by 5 basis points to kick off the week. Therefore, one may expect investors to send the USD/JPY lower due to a more favorable outlook for the Yen as compared to the Dollar. However, the USD/JPY is continuing to hold strong above our 1st tier uptrend line since the currency pair is drifting closer to a key retracement towards October lows. Regardless of the USD/JPY’s present resilience, there is still a long-term downtrend at play and our technical cushions are wearing thin.

Technically speaking, the USD/JPY is presently fighting to stay above our 1st and 2nd tier uptrend lines. Should our 1st tier give way, the currency pair still has 10/2 lows along with October lows serving as technical cushions. As for the topside, the USD/JPY faces multiple downtrend lines along with the highly psychological 90 level. Therefore, quite a few topside challenges are in place. Meanwhile, investors should continue to monitor the S&P’s interaction with 1100 as well as the reaction of equities to tomorrow’s weekly Unemployment Claims release.

Present Price: 89.18

Resistances: 89.31, 89.41, 89.54, 89.68, 89.83, 89.89, 90.07

Supports: 89.15, 88.99, 88.85, 88.73, 88.58, 88.44

Psychological: 90, November and October Lows

Gold Hits Psychological $1150/oz Level

Gold is continuing its incessant rise higher despite very limited participation from the Dollar. The EUR/USD and AUD/USD are both fluctuating between their respective uptrend and downtrend lines while the S&P futures hover around their highly psychological 1100 level. Gold has ignored its usual positive correlations since breaking through its psychological $1100/oz level and seems to have a mind of its own. Gold’s aggressive bull movements without a sizable depreciation of the Dollar is a bit puzzling. Therefore, investors should question if/and when gold’s correlations will lock back into place.

Meanwhile, U.S. equities have held up well considering the continual wave of negatively mixed econ data. Despite today’s slightly positive CPI numbers, both Building Permits and Housing Starts registered disconcerting declines. Therefore, America’s recent fundamentals are indicating a cool down in the nation’s economic recovery. Hence, the S&P’s resilience above its highly psychological 1100 level has been impressive. However, it feels like something’s got to give and investors will eventually need to favor one direction or another in U.S. equities and the Dollar. Investors should closely monitor the EUR/USD, GBP/USD, and AUD/USD for a directional statement since gold has been more closely correlated to the Dollar than equities so far this year.

Technically speaking, we’re still unable to install a downtrend line on our chart due to a lack of historical perspective. Therefore, it’s difficult to find any topside technical barriers besides gold’s potentially psychological $1150/oz level. As for the downside, gold has multiple uptrend lines serving as technical cushions along with 11/17 and 11/16 lows along with the psychological $1100/oz level.

Present Price: $1147.70/oz

Resistances: $1150.09oz, $1152.65/oz

Supports: $1143.05/oz, $1137.60/oz, $1134.71/oz, $1130.54/oz, $1127.24/oz, $1124.27/oz

Psychological: $1150/oz, $1100/oz

The S&P Futures Hold Strong Above 1100 Despite Housing Data

The S&P futures continue to hold strong above their highly psychological 1100 level despite a disappointing set of housing data. Housing Starts and Building Permits both missed analyst expectations, implying the U.S. housing recovery may be facing headwinds. That being said, the core and headline CPI numbers topped expectations by a basis point, showing consumer prices are rising despite yesterday’s decline in producer prices. Such a development could benefit corporate gross margins and benefit the 4th quarter earnings season. Regardless, this week’s data has thus far indicated a slowdown in America’s economic recovery. However, it remains to be seen whether this is just a bump in the road to stronger fundamental growth rates.

Meanwhile, the negatively mixed data points continue to support a loose monetary policy from the Fed. Although CPI did edge up this time around, the basis point increase likely won’t have too large of an influence on the Fed’s next policy decision. Focus will now shift to tomorrow’s weekly Unemployment Claims release along with Philly Manufacturing Index. Since high unemployment has been a sore thumb in the recovery from yearly lows in the S&P, a sub-500 reading in the weekly Unemployment Claims data point could result in a slight return to the risk trade, thereby benefitting the S&P futures. However, an unexpected rise in Unemployment Claims could send the S&P futures back towards mid-November levels. Correlation-wise, the EUR/USD and AUD/USD seem to be following the S&P’s consolidative pattern while the Cable heads back below our 4th tier downtrend line. Therefore, topside resistances remain in the S&P’s positive correlations, highlighting investor hesitation in regards to the near-term direction of U.S. equities.

Technically speaking, we’re presently unable to place any near-term topside technicals on the S&P futures due to a lack of perspective. However, the psychological 1100 area continues to play a key role considering it has been a strong technical barrier for the past month. On a positive note, the S&P futures have avoided a sizable retracement below 1100 following Monday’s breakthrough. Meanwhile, the S&P futures have multiple uptrend lines serving as technical cushions along with the psychological 1100 level and 11/13, 11/09, and 11/05 lows.

Price: 1103

Resistances: 1107, 1112

Supports: 1098.75, 1090.75, 1082.5, 1071.25, 1061.75

Psychological: 1100, Previous 2009 Highs, 1075

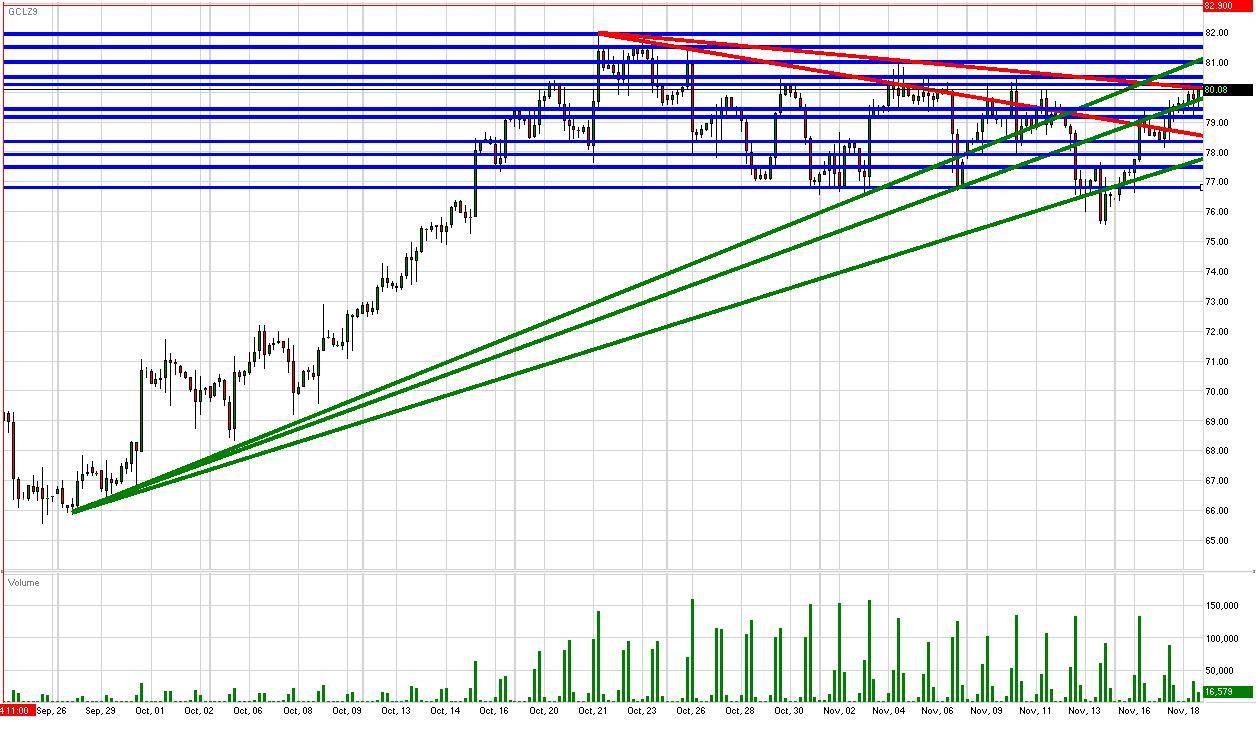

Crude Hits $80/bbl on Lower Inventories

Crude futures have just breached their psychological $80/bbl level in reaction to weekly inventories coming in -1.7 million bbl below analyst expectations. Since the Dollar and U.S. equities are consolidating right now, today’s positive performance from crude appears to stem directly from the -0.9 million bbl decrease in inventories this week. However, the $80/bbl area has proven to be a tough trading zone over the past month. Therefore, crude futures could have trouble getting beyond October highs should neither U.S. equities nor the Dollar work in crude’s favor. As a result, investors should continue to monitor the EUR/USD’s interaction with 1.50 and the S&P’s behavior towards 1100. A topside breakout in either could help crude add on to present gains due to their positive correlations.

Technically speaking, crude still faces topside barriers in the form of 2nd tier downtrend line along with the psychological $80/bbl level and previous November/October highs. As for the downside, crude has our 1st and 2nd tier uptrend lines serving as technical cushions along with 11/17 and 11/13 lows. Furthermore, the psychological $75/bbl level could work in crude’s favor should it be tested.

Price: $80.10/bbl

Resistances: $78.62/bbl, $79.15/bbl, $79.55/bbl, $80.02/bbl, $80.45/bbl, $81.01/bbl

Supports: $77.85/bbl, $77.34/bbl, $77.03/bbl, $76.54/bbl, $75.54/bbl

Psychological: 2009 highs, $75/bbl, $80/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.