Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/05/09

Daily Market Commentary

EUR/USD Jumps Higher after ECB Policy Decision

Both the EUR/USD and GBP/USD registered an initial positive reaction to their respective monetary policy decisions. The ECB and BoE kept their interest rates at their present levels, yet the BoE only increased its QE packaged by 25 billion Pounds vs 50 expected. Meanwhile, the ECB isn’t budging on their language that their will practice a gradual removal of alternative liquidity measures from the monetary system. Therefore, it seems the ECB will make us wait until next month to get a better idea of if/when/how the central bank will reign in liquidity. The ECB is likely waiting to see how the Euro interacts with the Dollar and Yuan over for a little longer before moving forward. This neutral language isn’t quite what the bulls were hoping for, yet the EUR/USD is trading in a relatively strong technical position despite today’s inaction.

Speaking of technicals, the EUR/USD still faces technical barriers in the form of our 2nd and 3rd tier downtrend lines along with October highs and the highly psychological 1.50 level. Therefore, a few tough topside challenges are separating the EUR/USD from more accelerated upward movements. As for the downside, the currency pair has multiple uptrend lines serving as technical cushions along with 11/4 and 10/27 lows. Meanwhile, tomorrow’s U.S. unemployment data has taken on a larger role since the ECB decided to sit tight for the month of November. Furthermore, the EU won’t be releasing any noteworthy data for the remainder of the week, meaning all eyes will be on the U.S.

The U.S. will release its headline Unemployment Rate along with Services Employment Change data. The U.S. Unemployment Rate is expected to print at 9.9%, just a hair below the 10%. ‘If the number prints at 10% or above, this could have a negative psychological impact on investors and rattle U.S. equities, thereby appreciating the Dollar. On the other hand, any stronger than expected unemployment data could boost U.S. equities and lead investors towards higher risk vehicles such as the EUR/USD. Therefore, investors should keep a close watch on tomorrow’s unemployment data while monitoring the Dollar’s broad-based reaction.

Present Price: 1.4909

Resistances: 1.4909, 1.4926, 1.4947, 1.4966, 1.4983, 1.4994, 1.5022

Supports: 1.4872, 1.4856, 1.4840, 1.4822, 1.4804, 1.4781, 1.4769

Psychological: 1.50, 1.45

GBP/USD Heads Higher Following BoE Decision

The Cable is knocking on the door of our 4th tier downtrend line after the BoE opted to increase its QE package by 25 billion Pound, less than the 50 expected. The lighter than anticipated injection of liquidity has given a boost of confidence to the markets, and investors are opting to retreat from the Dollar in reaction. Additionally, Britain received another positive data reading today with Manufacturing Production printing at 1.7%, 6 basis points higher than expectations. Today’s Manufacturing Production number confirms the encouraging Manufacturing PMI data we have received recently. Therefore, Britain’s services and manufacturing industries are both recovering quicker than anticipated, giving the BoE ample reasons to injection 25 billion instead of 50. However, cautionary fundamental signs do remain considering the latest unemployment and GDP data left something to be desired. Hence, investors shouldn’t get overly optimistic, especially considering we’re cheering the use of quantitative easing in the first place. Regardless, today’s monetary policy decision may provide investors with enough incentive to send the Cable higher towards October and September highs, especially if tomorrow’s U.S. unemployment data prints positive.

Technically speaking, the Cable is facing what could be the final downtrend line separating the currency pair from more accelerated near-term gains. Our 4th tier downtrend line runs through October highs, meaning these highs could be tested relatively soon if the Cable doesn’t buckle under the pressure of our 4th tier. That being said, there still is a possibility that the Cable can reverse into its downtrend. However, the Cable is sitting in a fairly advantageous position considering September highs are drawing near. There isn’t much resistance between September highs and August highs, meaning the Cable could potentially have a clear shot at 1.70 should the fundamentals cooperate. As for the downside, the Cable has multiple uptrend lines serving as technical cushions along with 11/5 and 11/3 lows. Additionally, the psychological 1.65 level may now work in the Cable’s favor.

Meanwhile, investors should keep in mind neither the Cable nor the EUR/USD fully participated in the Cable’s topside breakout earlier this week. Therefore, considering the BoE made a more hawkish than anticipated move today, gold may be hinting that a sizable pullback in the Dollar is in order. However, the Cable may need a little help from upcoming U.S. econ data. Britain will release some more data of its own tomorrow, Input PPI. Investors are expecting an increase from -0.5% to 1.6%.

Present Price: 1.6607

Resistances: 1.6630, 1.6662, 1.6688, 1.6714, 1.6736, 1.6783

Supports: 1.6591, 1.6566, 1.6566, 1.6538, 1.6510, 1.6475, 1.6430

Psychological: 1.65, October and September highs

USD/JPY Fights to Stay Above 90 Despite Present Weakness

The USD/JPY has backed away from yesterday’s highs after the currency pair was deflected by our 2nd tier downtrend line. Today’s strength in the Yen came despite the fact that the BoJ’s meeting minutes showed that just because the central bank decided to halt its corporate bond purchase program, this doesn’t necessarily imply that the BoJ will reign in liquidity any time soon. In fact, analysts predicted that the BoJ would end the program since it hasn’t received much interest from corporations.

Fortunately for bulls, the USD/JPY has found support at its psychological 90 level and our 2nd tier uptrend line. Furthermore, both the EUR/USD and GBP/USD are heading higher following their respective monetary policy decisions. The question becomes whether the EUR/USD and GBP/USD can make a commitment to their near-term uptrends. Such a movement could be positive for the USD/JPY as long as U.S. equities follow suit. We’ve recently seen the USD/JPY head higher with broad-based risk rallies, implying investors view the Dollar as a riskier asset than the Yen. Therefore, investors should keep an eye on today’s activity in the USD/JPY’s correlations, particularly the GBP/USD since its technical resistances are wearing thin.

Technically speaking, the USD/JPY has our 1st and 2nd tier uptrend serving as technical cushions along with 11/03 and 10/13 lows. Furthermore, the psychological 90 level should continue to play an important role for the time being. As for the topside, the USD/JPY faces multiple downtrend lines along with 11/04 and 10/29 highs. There is still a long-term downtrend at work in the USD/JPY. As a result, near-term topside movement will likely be hard-fought.

Present Price: 90.31

Resistances: 90.44, 90.57, 90.68, 90.79, 90.93, 91.12, 91.27

Supports: 90.28, 90.18, 90.04, 89.91, 89.77, 89.61, 89.37

Psychological: 90

Gold Consolidates After Huge Gains

Gold is consolidating around the $1090/oz level after its impressive topside breakout earlier this week. Investors are monitoring the Dollar as the markets digest today’s monetary policy decisions from the ECB and BoE while contemplating a test of the psychological $1100/oz level. Regardless, this week’s breakout was a sign of strong support for gold’s uptrend since the precious metal moved without full participation from the Dollar. However, the sustainability of gold’s new near-term uptrend will likely depend upon a broad-based devaluation in the Dollar since the two are negatively correlated. Hence, investors should keep a sharp on the interaction of gold’s correlations with tier respective topside technicals, most notably the EUR/USD and AUD/USD.

Technically speaking, we’re at a loss of downtrend lines and historical perspective again. Therefore, the psychological $1100/oz level serves as our only trustworthy topside technical for the time being. Speaking of which, gold stopped just short of $1100/oz, hinting that the level could have a near-term psychological impact on investors. As for the downside, we’ve readjusted our uptrend lines, giving us an idea of support. Gold has 11/05 and 11/04 lows serving as technical cushions along with our new 3rd tier uptrend line and the psychological $1075/oz level.

Present Price: $1091.30/oz

Resistances: $1091.49/oz, $1092.77/oz, $1095.77/oz, $1100.04/oz

Supports: $1087.85/oz, $1085.28/oz, $1083.14/oz, $1079.93/oz, $1075.01/oz, $1069.89

Psychological: $1100/oz, $1075/oz.

The S&P Futures Creep Higher in Reaction to Positive Unemployment Claims

The S&P futures are creeping higher after Weekly Unemployment Claims registered an encouraging drop to 512K. However, the claims data comes with mixed signals since productivity surged and labor costs plummeted. Therefore, employers are getting much more out of their workers for a reduced cost. This could drag on the employment market since companies will likely higher at a slower, more cautious rate. Regardless, the decline in claims is encouraging, and sets the stage for tomorrow’s headline Unemployment Rate and Services Employment Change data releases. Analysts are expected the Unemployment Rate to print at 9.9%, just shy of the psychological 10% level. Any reading at or above 10% could deal a negative psychological blow to equities, and vice versa. Therefore, tomorrow’s wave of unemployment data could be a market mover.

Meanwhile, the Fed kept its monetary policy unchanged as anticipated since unemployment hasn’t improved enough for the central bank to feel comfortable with tightening liquidity. On a positive note, the BoE increased its liquidity package by 25 billion Pounds vs. 50 billion expected. The GBP/USD is receiving a nice boost in reaction to the tighter than expected monetary policy from the BoE. On the other hand, the ECB kept its policy unchanged, and will likely make investors wait another month before outlining their plan for reducing their alternative liquidity measures. The ECB’s decision deals a slight blow to confidence since analysts were hoping the ECB would take a step forward today rather than standing pat. Today’s early morning rally in the EUR/USD has halted in reaction to the decision, and could limit immediate term gains in the S&P until we receive tomorrow’s wave of data.

Meanwhile, the S&P futures have popped back above their psychological 1050 level and our 1st tier uptrend line, and it appears they may try to make a run towards our 2nd tier downtrend line. Furthermore, investors should keep in mind that gold experienced a large topside breakout earlier this week. The precious metal is usually negatively correlated with the Dollar and positively correlated with the S&P futures. Therefore, gold’s breakout could be hinting at a similar movement in U.S. equities. However, a downward momentum remains in the market, signified by our 2nd tier downtrend line and the pop in sell-side volume equities received on Friday. Therefore, the S&P futures are currently at a crossroads and investors should actively monitor the markets for any significant technical shift in either the S&P futures or their correlations.

Price: 1052.50

Resistances: 1054.75, 1062.5, 1069.75, 1077, 1083.25

Resistances: 1044.75, 1036, 1029.25, 1022.5, 1014.25

Psychological: 1050, 1075, 1000

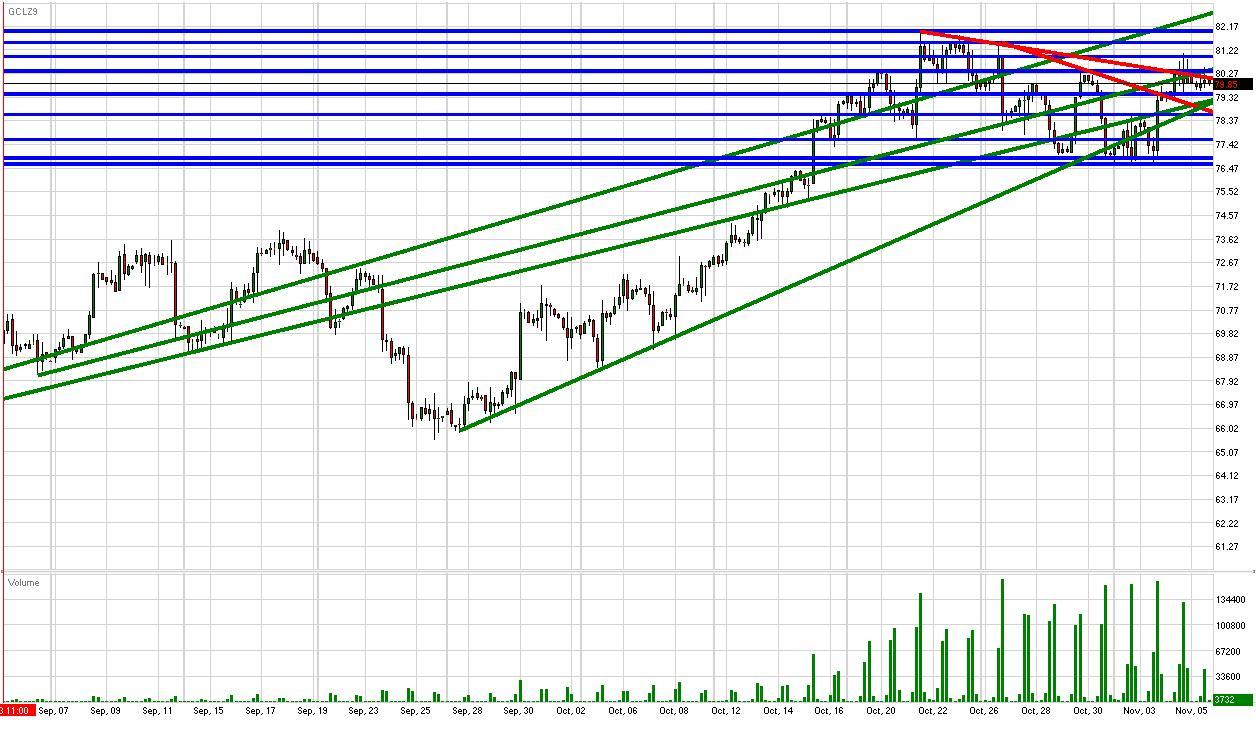

Crude Futures Consolidate Around $80/bbl

Crude futures find themselves stuck around their psychological $80/bbl level following mixed U.S. labor data and relatively quiet central bank meetings. Both the Fed and ECB kept their monetary policies unchanged, while the BoE increased its QE packaged by 25 billion Pounds vs. 50 expected. Hence, the Dollar is getting a slight boost, yet the ECB’s inaction leaves investors a bit disappointed. Therefore, although the technical environment for the EUR/USD and GBP/USD are improving, downside pressures remain. Due to all of the mixed signals around the marketplace, crude is opting to consolidate around $80/bbl as investors await tomorrow’s key unemployment data from the U.S. The U.S. will print its headline Unemployment Rate along with Services Employment Change data. Since the central bank meetings left something to be desired, tomorrow’s wave of data could prove to be a market mover. Because crude is reliant on personal consumption of gasoline, employment figures directly impact the outlook for aggregate demand, and consequently effect the price of crude. As a result, positive unemployment data could help send crude towards previous 2009 highs, while disappointing figures could drive the futures towards previous November lows.

Meanwhile, our trendlines are beginning to reach their respective inflection points, meaning a period of increased volatility could be approaching. Crude futures are well within reach of previous 2009 highs, and are a burst away from a potential near-term topside breakout. On the other hand, topside barriers remain in the form of our 2nd tier downtrend line while $80/bbl could continue to have a gravitational pull on price for the time being. As for the downside, crude has our 1st tier uptrend line serving as a technical cushion along with 11/3 lows. However, there aren’t too many strong immediate-term supports below these cushions besides the psychological $75/bbl level. Therefore, crude futures could easily reverse course should their present cushions give way.

Overall, the relatively strong position of the Dollar and the S&P’s present resilience above 1050 creates a positive environment for crude’s near-term performance. However, any significant technical reversal in either of these investment vehicles could change the picture.

Price: $79.85/bbl

Resistances: $80.96/bbl, $81.52/bbl, $81.98/bbl

Supports: $79.45/bbl, $78.63/bbl, $77.62/bbl, $76.89/bbl, $76.63/bbl

Psychological: $80/bbl, $85/bbl, $75/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.