Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 12/01/09

Daily Market Commentary

EUR/USD Clears Monday Highs on Back of Risk Trade

The EUR/USD is trading in the green again today as the risk trade regains some of its positive momentum. The combination of in line Chinese Manufacturing PMI data and the RBA raising its benchmark rate by another 25 basis points is giving investors confidence that economic performances remain on the path to recovery. Although the RBA signaled that its latest rate increase places the central bank’s monetary policy in coordination with expected inflation, the RBA’s vote of confidence is enough to refuel the risk trade. Naturally, the EUR/USD is benefitting from today’s events since the Euro was already flexing a relative strength despite the debt issue in Dubai, which now appears not as severe as previously speculated. The EU released a bit of data of its own, including a positive Germany Unemployment Change figure along with an expected 9.8% EU Unemployment Rate. German Retail Sales did print a basis point shy of expectations, although this doesn’t seem to be having too large of an impact on the currency pair at the moment. Meanwhile, investors should note that gold is knocking at $1200/oz while the S&P consolidates above 1100. Hence, the EUR/USD’s positive correlations are strengthening and could be preparing for another leg higher should fundamentals and psychologicals work in favor of the risk trade.

Technically speaking, the EUR/USD is creating some space between present price and the psychological 1.50 level. The currency pair has cleared October highs once again and could take a shot at November highs. That being said, investors should monitor the EUR/USD’s interaction with our 3rd tier downtrend line and 11/25 highs should they be tested. A breakout beyond these two technical barriers could yield a more accelerated upward movement. As for the downside, the EUR/USD has multiple uptrend lines serving as technical cushions along with intraday lows and the psychological 1.50 level.

The EU news wire should be relatively quiet until Thursday’s ECB meeting. At the ECB’s previous press conference, Trichet seemed to have a more aggressive tone in terms of the central banks intentions to unwind alternative liquidity measures. Exactly which liquidity tools and when they would be dismantled remains to be seen. Either way, Thursday’s monetary policy meeting could carry a bit of uncertainty. For the time being, investors should eye the EUR/USD’s topside technicals along with any developments in the currency pair’s positive correlations.

Present Price: 1.5076

Resistances: 1.5082, 1.5097, 1.5117, 1.5133, 1.5154, 1.5168, 1.5117, 1.5133

Supports: 1.5068, 1.5060, 1.5045, 1.5027, 1.5015, 1.4988, 1.4977

Psychological: 1.50, November Highs

GBP/USD Rallies as Gold Tests $1200/oz

The Cable has cleared our 4th tier uptrend line and its psychological 1.65 level as the currency pair runs higher with the risk trade. Investors are heading back to riskier investment classes after China’s Manufacturing PMI results showed Dubai’s debt issue does not necessarily imply a slowdown in the overall growth of emerging markets. In addition to China’s positive data release, the RBA raised its benchmark rate by another 25 basis points as widely expected. The RBA’s vote of confidence in Australia’s economic recovery is encouraging investors to reconsider the risk trade after the occurrence in Dubai shook FX markets. The Cable is a direct beneficiary of this boost in confidence despite a lighter than expected UK Manufacturing PMI number. However, UK’s economy is more service-based, reducing the weight of manufacturing. Furthermore, Nationwide’s HPI figure printed in line with expectations, implying a stable UK housing market. As a result, the Cable is showing little hesitation to participate in today’s broad-based weakness of the Dollar.

Meanwhile, gold is knocking on the door of its psychological $1200/oz level as the S&P futures rally beyond their psychological 1100 level pre-market. Hence, the Cable’s positive correlations are currently creating an environment supportive of further downward movements in the Dollar sound economic fundamentals comply. That being said, investors should also keep an eye on the EUR/USD and its interaction with our 3rd tier downtrend line as well as November highs should they be tested. A topside breakout in the EUR/USD could signal a more extensive rally in the FX risk trade, thereby benefitting the Cable.

Technically speaking, the Cable still faces multiple downtrend lines along with 11/25 and 11/17 highs. Our 4th tier downtrend line appears to carry the most weight since it runs through 11/17 highs. A movement beyond our 4th tier could imply more extensive near-term gains in the Cable. As for the downside, the Cable could find supports in the psychological 1.65 area along with 11/20, 11/30, and 11/27 lows. Additionally, the GBP/USD has multiple uptrend lines serving as technical cushions.

Present Price: 1.6596

Resistances: 1.6616, 1.6634, 1.6673, 1.6707, 1.6730, 1.6748, 1.6790

Supports: 1.6571, 1.6543, 1.6498, 1.6461, 1.6409, 1.6372

Psychological: 1.65, November Highs and Lows

USD/JPY Pops and Fades with Emergency BoJ Meeting

The USD/JPY experienced a solid rally during the Asia trading sessions after the BoJ called an emergency meeting to confront a strengthening Yen and deflationary pressures. The prospect of governmental intervention in the currency markets resulted in a selloff in the Yen with investors expecting either a large purchase Yen or QE measures. However, the USD/JPY has since relinquished most of its intraday gains after the BoJ decided to make 10 trillion Yen available for loans to Japanese banks at the BoJ’s 0.1% benchmark rate, or essentially free loans. Investors don’t seem too impressed by the results of the emergency meeting considering the post-meeting reaction of the USD/JPY. However, we will have to see how the day pans out as investors digest today’s events. Meanwhile, China’s Manufacturing PMI data printed in line with analyst expectations and the RBA decided to increase its benchmark rate by another 25 basis points. The positive signals from these other major Pacific economies increases the outlook in demand for Japanese exports and services despite the Yen’s recent wave of appreciation. Such developments seem to be benefitting the Yen as the USD/JPY drops back towards Monday’s levels.

Technically speaking, 85 seems to be the new psychological benchmark with 90 hanging far overhead. Should conditions deteriorate below 85, we notice that the 82.50-85 area proved to be a strong support area during the Spring/Summer of 1995. Therefore, the USD/JPY could experience similar support should the currency pair’s downturn continue. As for the topside, there are multiple downtrend lines serving as technical barriers along with intraday highs as the long-term downtrend bears down on price. Hence, the USD/JPY has its work cut out for it to the topside should the currency pair want to re-challenge the highly psychological 90 level.

Present Price: 86.85

Resistances: 87.04, 87.22, 87.51, 87.72, 87.82, 87.94, 88.13

Supports: 86.80, 86.64, 86.49, 86.30, 86.14, 85.99, 85.74, 85.51

Psychological: 85, 90, 80

Gold Challenges $1200/oz

Gold is knocking at its psychological $1200/oz level as the precious metal benefits from a return to the risk trade. The combination of in line Chinese manufacturing data combined with another 25 basis rate increase from the RBA has boosted investor confidence recently dented by the Dubai debt issue. The Dollar has responded with broad-based weakness while the S&P futures fight for some topside separation beyond their highly psychological 1100 level. Weakness in the Dollar and strength in U.S. equities are developments supportive of gold’s uptrend, allowing investors to set new all-time highs with a bit of confidence. Meanwhile, investors should monitor the reaction of U.S. equities to today’s ISM Manufacturing PMI and Pending Home Sales releases. A breakout in the S&P futures could help gold climb above its psychological $1200/oz level. Additionally, investors should keep an eye on the EUR/USD’s interaction with November highs and our 3rd tier downtrend line since gold is positively correlated to the currency pair.

Technically speaking, gold has multiple uptrend lines serving as technical cushions in addition to 11/30 and 11/24 lows. Furthermore, the psychological $1175/oz and $1150/oz levels could serve as supports should they be tested. As for the topside, we’re still unable to initiate a reliable downtrend line due to the lack of historical data. Therefore, the psychological $1200/oz level serves as the only technical barrier for the time being.

Present Price: $1191.85/oz

Resistances: $1195.55/oz, $1198.87/oz

Supports: $1189.65/oz, $1184.85/oz, $1180.42/oz, $1176.73/oz, $1174.15/oz, $1168.25/oz

Psychological: $1200/oz, $1175/oz, $1150/oz

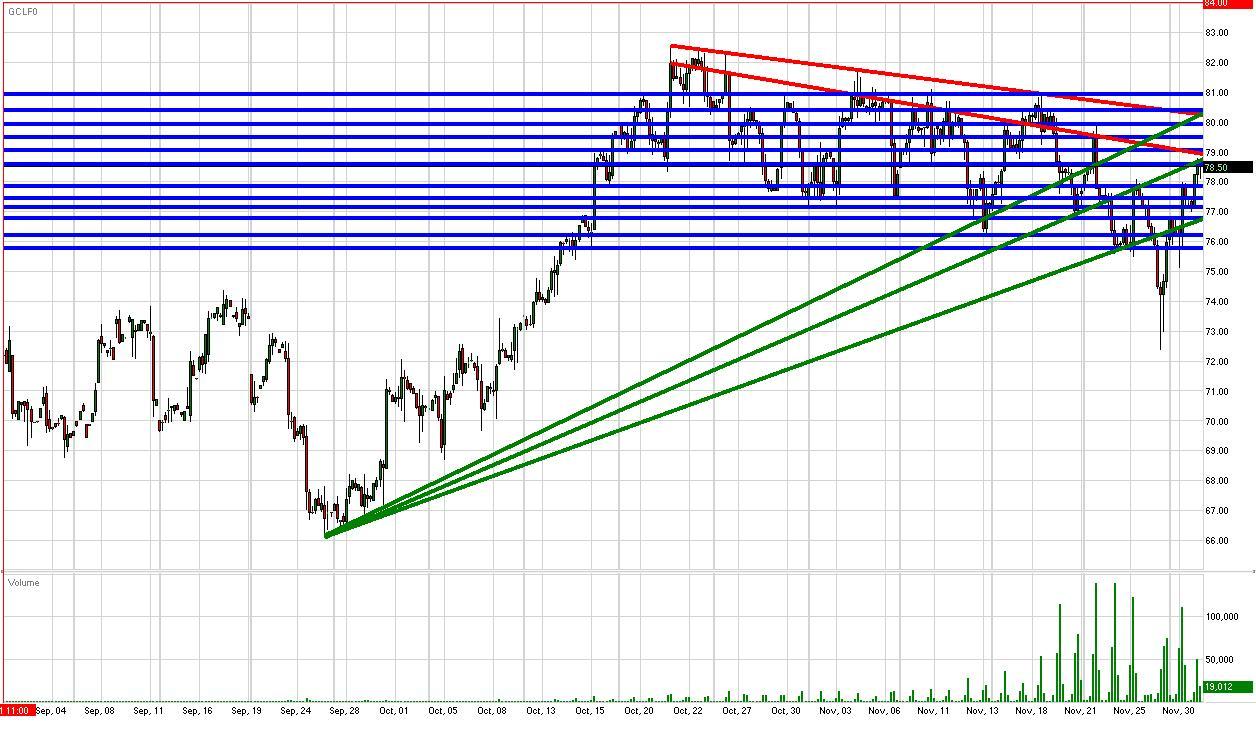

Crude Climbs Towards $80/bbl with Weakening Dollar

Crude futures are benefitting from a return to the risk trade as investors react to positive Chinese manufacturing data along with an RBA rate increase of 25 basis points. China’s reassuring Manufacturing PMI numbers are improving the outlook for crude’s aggregate demand, resulting in a positive impact on price. Additionally, the RBA’s rate increase is a vote of confidence to the current global economic recovery. On the other hand, both UK and U.S. Manufacturing PMIs printed shy of analyst expectations, taking a bit of wind out of the rally’s sails. However, any negative forces are being countered effectively by the Dollar’s negative reaction to today’s set of economic events while gold knocks at its highly psychological $1200/oz level. A weaker Greenback makes Dollar-based commodities, such as crude, cheaper and a more attractive U.S. export, resulting in positive price movements in crude. Meanwhile, the S&P futures have topped the 1100 mark once again, and it will be interesting to see if the S&P can extend intraday gains and take down previous 2009 highs. If so, the Dollar may be encouraged to pullback further and consequently push crude futures higher. Therefore, investors should monitor the S&P’s interaction with current technical levels in addition to the EUR/USD’s potential retest of its November highs.

Technically speaking, crude futures have our 1sst tier uptrend line serving as a technical cushion along with Monday lows and the psychological $75/bbl level. As for the topside, crude faces our 1st and 2nd tier downtrend lines along with 11/18, 11/4, and 10/21 highs. Furthermore, the psychological $80/bbl level proved to be a tough barrier to overcome in the past, meaning crude faces a few challenging near-term topside obstacles. Meanwhile, the U.S. will release its ADP Non-Farm Employment Change data along with weekly crude inventories. Should the ADP figure signal further improvement in America’s employment market, this could yield another positive movement in crude due to an increase in expected aggregate demand.

Price: $78.50/bbl

Resistances: $78.61/bbl, $79.07/bbl, $79.51/bbl, $79.93/bbl, $80.41/bbl, $80.93/bbl

Supports: $77.87/bbl, $77.74/bbl, $77.15/bbl, $76.80/bbl, $76.23/bbl, $75.80/bbl

Psychological: $75/bbl, $80/bbl, $70/bbl

S&P Futures Climb Past 1100

The S&P futures have moved back above their highly psychological 1100 level as investors make a return to the risk trade. The Dollar is experiencing broad-based weakness while gold looks to test its own psychological $1200/oz level. Meanwhile, crude futures are edging higher while aiming for their highly psychological $80/bbl level. In other words, the S&P futures are benefitting from the strength of its positive correlations. Today’s preference for the risk trade stems from encouraging manufacturing data from China combined with the RBA’s decision to increase its benchmark rate by 25 basis points. China’s PMI numbers relieve some of the uncertainty surrounding the performance of emerging markets following Dubai’s debt problems. Furthermore, the RBA’s 25 basis point increase, though expected, gives the central bank’s vote of confidence concerning the state of the global economic recovery.

In addition to news from Australia and China, the BoJ held an emergency monetary policy meeting to alleviate concerns of an appreciating Yen. However, the BoJ’s decision to supply 10 trillion Yen worth of loans at the benchmark rate to Japanese commercial banks hasn’t had its desired impact on the currency as the USD/JPY trades back around Monday’s levels. Hence, there remains a disconcerting downward pressure on the currency pair. Moving across the Pacific, the U.S. released a soft Manufacturing Production PMI and this number may be taking a bit of momentum out of today’s pre-market rally in the S&P futures. In addition to the PMI figure, the U.S. released yet another encouraging Pending Home Sales number, indicating the U.S. housing market is holding up rather well in comparison to crisis levels. In all, the mixed data from the U.S. seems to be overshadowed by the positive developments in China and Australia. Therefore, it seems a declining Dollar is driving equities higher. That being said, investors should eye the EUR/USD’s interaction with our 3rd tier downtrend line and November highs should they be tested, for a topside breakout could send the S&P futures higher. Additionally, investors should monitor gold’s behavior around $1200/oz since the precious metal is normally negatively correlated with the Greenback.

Technically speaking, the S&P futures face topside barriers in the form of the psychological 1100 level and 11/25 highs. The futures have moved back above our 1st tier uptrend line, a positive technical development. As for the downside, the S&P has 11/30 and 11/27 lows serving as technical cushions along with the psychological 1100 and 1075 levels.

The U.S. will release more key data points tomorrow, including its ADP Non-Farm Employment Change coupled with the publishing of the Fed’s Beige Book. Should tomorrow’s ADP number echo last week’s movement below 500k in Unemployment Claims in addition to a more positive Beige Book, the S&P futures could experience a nice immediate-term pop.

Price: 1104.75

Resistances: 1109.75, 1113.25

Supports: 1100.75, 1096, 1089, 1083.75, 1075.75, 1071.5, 1067

Psychological: 1100, 1075,November Highs and Lows

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.