Crude Remains Unchanged

UFXBank Research from UFX Bank at 01/04/10

Daily Review 04/01/2010

USD Dollar (USD) – The Dollar was mixed versus the majors gaining versus the Euro and the Yen and weakening versus the Pound. Weekly unemployment claims came out better than expected with 432K, showing the U.S employment slump is ending. Light end of the year trading caused abnormal movements in the markets led by speculations. NASDAQ and Dow Jones declined by -0.97% and -1.14% respectively. Crude remained unchanged closing at 79.49$ a barrel and Gold (XAU) gained by 0.28% closing at 1096.35$ an ounce. Today, ISM Manufacturing PMI is expected stronger with 54.1 versus 53.6 prior.

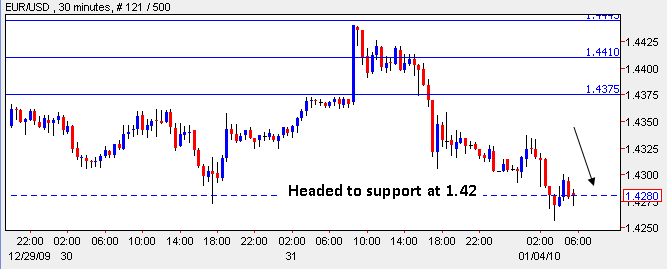

EURO (EUR) –The Euro weakened versus the Dollar after better than expected unemployment claims in the U.S increased speculations a rate hike will happen in the Dollar soon. Overall, EUR/USD traded with a low of 1.4303 and a high of 1.4440. EUR/USD has been unable to cross above 1.4450 due to sellers' pressure and light volume and it is heading lower to the 1.42 support level. Today, Final Manufacturing PMI is expected unchanged with 51.6 and Italian Prelim CPI is expected unchanged with 0.1%.

EUR/USD - Last: 1.4325

Resistance 1.4375 1.441 1.4445

Support 1.4235 1.4220

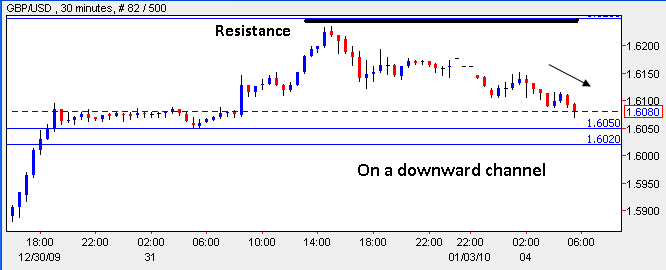

British Pound (GBP) – The Pound gained versus the Dollar after Nationwide HPI came out 0.4% as expected. Better than expected Unemployment Claims in the U.S erased most of the Pound early gains. Overall, GBP/USD traded with a low of 1.6049 and a high of 1.6235. GBP/USD is still trading on a downward channel on the daily chart and faces many resistance levels above the 1.62 level. Today, Manufacturing PMI is expected stronger with 52.1 versus 51.8 prior. Net Lending to Individuals is expected with 0.6B versus 0.3B prior.

GBP/USD - Last: 1.6145

Resistance 1.625 1.63 1.6345

Support 1.605 1.602

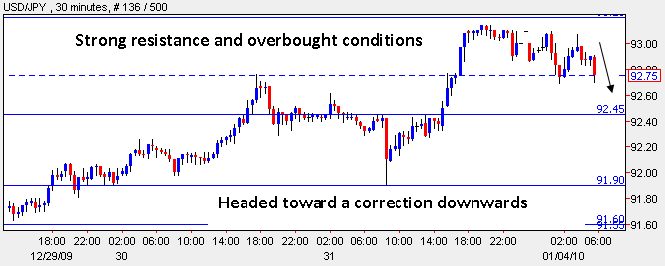

Japanese Yen (JPY) –The Yen has continued to weaken versus the Dollar as Unemployment Claims in the U.S came out better than expected weakening the appeal for the Yen. Overall, USD/JPY traded with a low of 91.91 and a high of 93.14. USD/JPY is on a daily uptrend and faces resistance at 93.3. USD/JPY is near overbought conditions on the RSI and might face a downward correction. Today, Monetary Base is expected with 3.5% versus 3.8% prior.

USD/JPY-Last: 92.70

Resistance 93.2 93.5 93.85

Support 92.45 91.9 91.6

Canadian Dollar (CAD) – The Canadian Dollar gained slightly versus the Dollar as commodities advanced modestly. Overall, USD/CAD traded with a low of 1.0455 and a high of 1.0549. USD/CAD is holding above the 1.04 support level and the RSI is in a bullish trend line. Unless the 1.04 level is breached downwards the pair is destined to continue toward the 1.07 resistance. No economic data expected today.

USD/CAD - Last: 1.0470

Resistance 1.054 1.058 1.063

Support 1.0455 1.04 1.0365