Daily Currencies Report

UFXBank Research from UFX Bank at 02/10/10

Daily Review 10/2/2010

USD Dollar (USD) – The Dollar has weakened versus most majors after European Union officials signaled they will aid Greece in reducing its budget deficit. As the Euro's uncertainty lowered the demand for the Dollar as a safe haven waned. Dollar Index dropped by 0.7% as a result. NASDAQ and Dow Jones gained by 1.17% and 1.52% respectively as the Dollar weakened and uncertainty lowered. Crude Oil gained by 2.59% closing at 73.75$ a barrel. Gold (XAU) gained by 1.03% closing at 1,076.7$ an ounce. Today, Trade Balance is expected with -35.8B versus -36.4B prior. Crude Inventories are expected with 1.4M, volatility in Crude prices is likely. Federal Budget Balance is expected with -66.2B versus -91.9B prior.

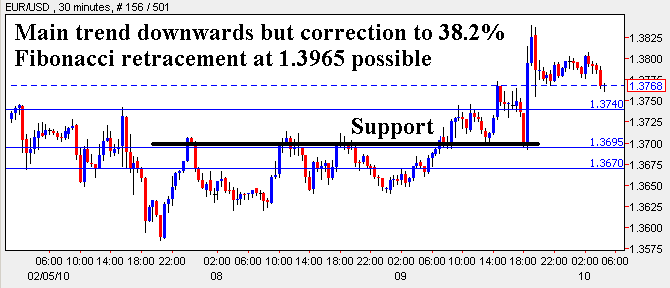

EURO (EUR) –The Euro gained versus the Dollar after signals from EU officials about supporting Greece. EU nations were pressured by world markets to rescue Greece from its deficit in order to prevent it from dragging down the Euro and stock markets. Overall, EUR/USD traded with a low of 1.3649 and a high of 1.3839. EUR/USD has started correcting upwards after being oversold according to the RSI indicator. Continuance of the correction back up to 38.2% Fibonacci retracement at 1.3965 is possible. Today, French Industrial Production is expected with 0.6% versus 1.1% prior.

EUR/USD - Last: 1.3790

Resistance 1.3855 1.391 1.3945

Support 1.374 1.3695 1.367

British Pound (GBP) – The Pound gained versus the Dollar as equity markets rose following EU clues about bailing out Greece out of its debt crisis. Trade Balance came out weaker with -7.3B versus -6.6B expected. Overall, GBP/USD traded with a low of 1.5562 and a high of 1.5747. GBP/USD has started correcting upwards after being oversold according to the RSI indicator. The correction upwards could continue to 1.59 (the first Fibonacci retracement level), but the main trend is still downwards. Today, Manufacturing Production is expected with 0.4% versus 0% prior. BOE will release the Inflation Report and BOE governor King will speak afterwards.

GBP/USD - Last: 1.5705

Resistance 1.575 1.5805 1.585

Support 1.565 1.5565 1.5525

Japanese Yen (JPY) –The Yen weakened versus the Dollar, Euro and the Pound as Risk Aversion lowered following EU comments about supporting Greece. Core Machinery Orders came out stronger with 20.1% versus 8.1% expected. Overall, USD/JPY traded with a low of 89.2 and a high of 89.97. USD/JPY has broken above resistance at 89.75 but is facing major resistance near 90.50. Japanese Banks will be closed today due to National Foundation Day. Low liquidity and irregular volatility are expected.

USD/JPY-Last: 89.95

Resistance 90.1 90.5

Support 89.3 89 88.55

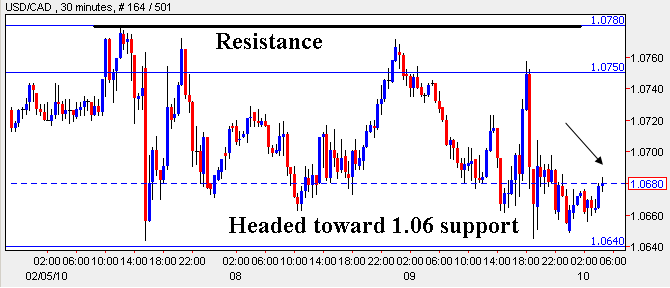

Canadian Dollar (CAD) – The Canadian Dollar gained versus the American Dollar as equities and commodity prices rose due to Greece's upcoming bailout. Overall, USD/CAD traded with a low of 1.0645 and a high of 1.0757. USD/CAD failed to break above resistance near 1.078 and seems to be heading toward support at 1.06. Today, Trade Balance is expected with -0.1B versus -0.3B prior. Crude Inventories could affect the commodity linked currency's direction.

USD/CAD - Last: 1.0670

Resistance 1.064 1.0605 1.0555

Support 1.075 1.078 1.085