EUR Continues Falling

UFXBank Research from UFX Bank at 12/14/09

Daily Review 14/12/2009

USD Dollar (USD) – The Dollar continued rallying versus most majors on Friday after Retail Sales and Michigan's Consumer Sentiment came out stronger than expected signaling economy is recovering improving Fed Rate Outlook. NASDAQ ended almost flat with -0.03% change and Dow Jones gained by 0.63%. Crude weakened by -1.39% dropping below 70$ for the first time since October closing at 69.87$ a barrel and Gold (XAU) dropped by -0.91% closing at 1114.55$ an ounce on a stronger Dollar. No economic data expected today.

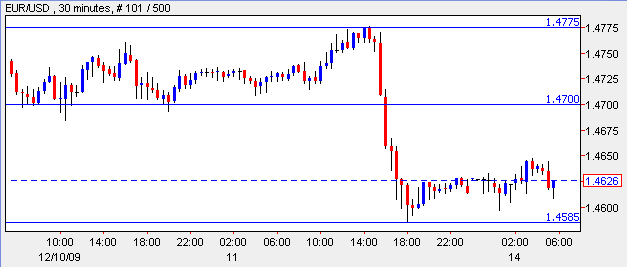

EURO (EUR) –The Euro continued falling versus the Dollar reaching a 2 month low below the 1.46 support level as better economic data in the U.S led investors to expect a near rate increase. Ireland and Greece are facing major debt concerns that may lead to their exit from the Euro-Zone. Overall, EUR/USD traded with a low of 1.4586 and with a high of 1.4776. Today, Industrial Production is expected with -0.6% versus 0.3% prior.

EUR/USD - Last: 1.4620

Resistance 1.47 1.4775 1.4825

Support 1.4585 1.4535 1.447

British Pound (GBP) – The Pound dropped slightly versus the Dollar after PPI Input and Output came out weaker than the forecast. The U.K budget deficit keeps growing as the government keeps spending money to spur the economy preventing the Pound from gaining back. Overall, GBP/USD traded with a low of 1.6196 and a high of 1.6338. Today, RICS House Price Balance is expected with 39% versus 34% prior.

GBP/USD - Last: 1.6200

Resistance 1.6275 1.634 1.638

Support 1.616 1.612

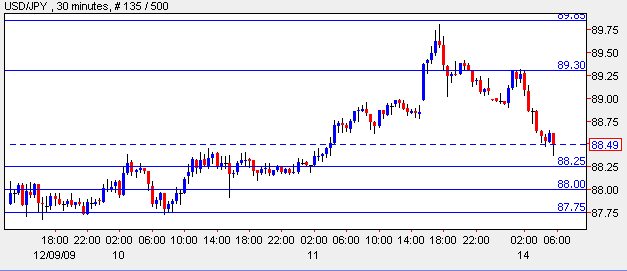

Japanese Yen (JPY) –The Yen weakened versus the Dollar and the Euro as economic conditions improve and a future rate increase in the U.S seems more likely. Overall, USD/JPY traded with a low of 88.26 and a high of 89.81 and EUR/JPY traded with a low of 129.97 and a high of 131.59. No economic data expected today.

USD/JPY-Last: 88.40

Resistance 89.30 89.85 90.1

Support 88.25 88.00 87.75

Canadian Dollar (CAD) – The Canadian Dollar weakened versus the Dollar as Crude dropped beneath 70$ a barrel on stronger Dollar sending the high yield commodity related Australian and Canadian Dollar lower. Overall, USD/CAD traded with a low of 1.0484 and a high of 1.0623. No major economic data expected today.

USD/CAD - Last: 1.0610

Resistance 1.063 1.065 1.069

Support 1.054 1.05 1.048