Greenback Strength Returns; Yen Gains

Fan Yang from CMS Forex at 02/10/10

The USD and the JPY were the strong performers this week. The Greenback is breaking out of its recent consolidation mode. Risk aversion kept the Japanese Yen strong as the preferred safe haven currency. Commodity currencies are subdued, coming off December strength as gold made record highs. The risk aversion also pressured pairs such as the Loonie(CAD) and Aussie(AUD).

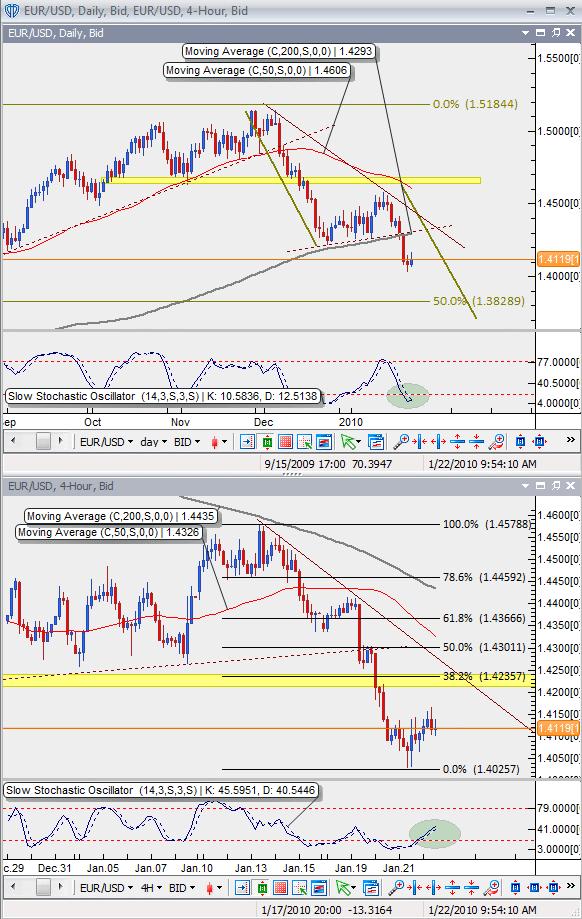

EUR/USD: Continuation After ConsolidationDaily and 4H: The EUR/USD is showing bearish strength. It looks like the 1.40 area is after all providing some short-term support as anticipated. (Refer to Daily Technical Update 1.21.2010 EUR/USD).

In the daily, you can see a swing projection to the 1.37/38 area. This is the short/intermediate term projection.

In the near/short-term. The market is rallying. This is an expected correction rally, so the strength should be inferior to that of the declining candlesticks.

Then there might be topping action around 1.4250 early next week. A hold there as resistnace would further confirm the bearish outlook to 1.37.

GBP/USD: Eyes Range Support at 1.57 – Daily Technical Udpate 1.22.2010 Throwback Provides More Bearish Confirmation

USD/JPY: Stalking Bullish Gartley4H: Great call this week on FXTimes, as the market rallied almost exactly to the 91.80 area completion a bearish Gartley. Attention was to be placed on manner of decline, and it was very aggressive. However, the market is consolidating today (Fri.) The stochastic is in oversold zone, so there may be some rally from this 90 level.

Daily: The stochastic is also oversold in the daily time-frame. The pattern however suggests continuation. Therefore, a swing can be projected to 88.50 as momentum is still aggressively bearish.

If the market does reach 88.50 and bottoms here, it is a completed bullish Gartley. Then we will truly test whether the market is ready to be bullish in the intermediate and long term.

There can be at least an expected short-term rally from 88.50 to test the 92.0 level coincident with declining trendline.

USD/CAD: Reversal Signal Eyes 1.11Weekly: This week’s price action from the USD/CAD is very bullish and indicates reversal. The weekly, price action completed a reversal combination, as the stochastic crosses up from oversold area. The 1.11 area is the 50% retracement zone and would be coincident to the 50-WK MA.

Daily: The daily time-frame shows how aggressive this week’s action was, but hints at resistance around the 1.063-1.064 area (78.6% retracement). the strength of the current rally suggests this resistance might not hold, even though it may do so in the short-term.

If the market is able to move above, the 1.07/1.0750 area is the next resistance.

If the market breaks above 1.0850/1.09, it has completed a double bottom, and suggests further rally to 1.11.

EUR/GBP Chance for PullbackDaily and 4H: The market has invalidated the bullish outlook. Adjusting the outlook by assessing weekly and monthly time-frames, we can establish bearish outlook towards 0.80 for the intermediate term (1/2 yr), but in the long-term, the market is still bullish, but may not start to be so until 2011. (Refer to EUR/GBP Revisiting the Big Picture).

Both the Daily and 4H time-frames are showing possible short-term rally from the 0.8650 level. If the market is successful at keeping the rally below the 0.8850 powerline, turning that into resistance, our bearish outlook to 0.80 strengthens.

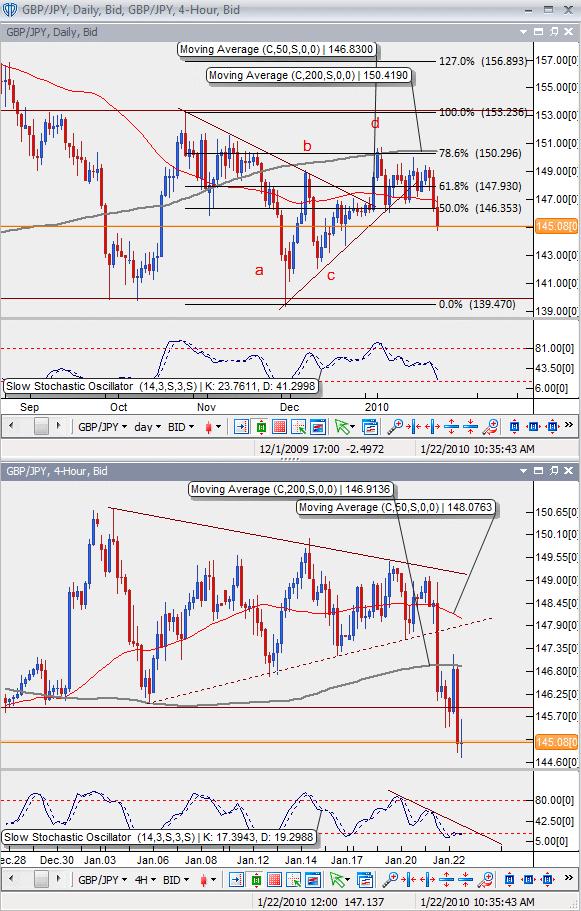

GBP/JPY: Eyeing Channel Support at 139.50Daily and 4H: The outlook for GBP/JPY had been a rally to test the 153.00. But after a couple of choppy weeks, the anticipation for the bearish scenario grew. (Refer to Daily Technical Update 1.20.2010 GBP/JPY).

This week, on Thursday, the market broke below the congestion pattern mentioned in a previous post. The decline was very aggressive, and was followed by a pullback that confirmed the bearish break.

Then the lower support at 145.80 also broke, further strengthening the bearish outlook, which is an intermediate decline to the 140.50 area.