In the long run as the supply that is put on storage have to come back to market sometime in the future

Per-Erik Karlsson from Avantage Financial GMBH at 01/19/10

Market Comment

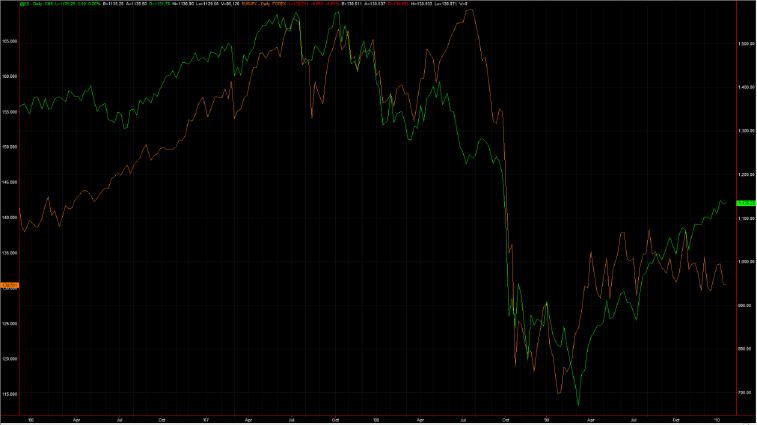

S&P 500 futures made a bearish formation on daily chart Friday, with a wide spread down bar, a bearish engulfing pattern in candlestick terms. This confirms the weakness from Monday last weak that looked like an up trust, meaning market players take prices above a resistance level to trigger stops only to drive the market lower later on. So we are still looking at possible shorts if the right signal present itself, not seen it yet. There have been quite a bit of news stories out lately focusing on the debt problems of Greece and other Euro zone member that might face downgrades. We actually think the increasing public debt will become an issue sooner or later this year and we expect this to be more reflective in the exchange rates. Countries that catch our attention are: Japan with the highest public debt in the G-10, UK and USA. The price action in EURUSD so far this year has really been driven by the Greece issue and problems of the Euro zone, meaning that EUR struggles every session this theme has been on the agenda in form of news article or Central Bank speak. JPY also struggled over a few days when there was debate over the ability to finance their debt. So with this in mind, we have put in a chart with S&P 500 futures vs. EURJPY over the last 2 years. It displays clearly that the correlation between the two contracts have fallen from start of November 2009. We used to use EURJPY as a risk appetite parameter, but not looking like the correlation to S&P it is working all that well lately. Is that a change of correlations or more indicating that either S&P or EURJPY is mispriced and a stronger move is on the way? Not sure yet, but we pay attention to EURJPY to find any clues over the next few weeks. News out overnight from Governor of the Bank of Japan Mr. Shirakawa, saying they will keep interest at the same low levels as seen over the last few years, implying that BOJ will put a main focus on getting to terms with the deflationary problem.

Crude outlook remains weak with prices below 78 USD per barrel this morning and following the inventory data last week with huge builds across the line from both API and DOE we expect the tone to continue to be weak also start of this week. The weather in the US have also turned a quite a bit warmer, which is bearish for Nat Gas. The contango continues to widen in Crude, with Brent/Crude Aug at $3.19 vs. 2.84 last Monday and the “carry trade” build momentum as investors buy spot and store in tankers and sell the futures to lock in a “risk free” return. In the long run as the supply that is put on storage have to come back to market sometime in the future, meaning the supply is still there in the background. So, several bearish factors are playing on the price for now. Gold is trading at 1134 this morning and we see interim rising support from the Dec 09 low coming at 1120 today and while above this rising support the outlook remains bullish. The test of the 1075 level was successful on 22nd of Dec., which should provide strong support in the background. AS we wrote over the last week, any strength in JPY should be viewed as another opportunity to sell JPY and indeed it tested 90.70 (former break out level) again this morning, which we see as a good short term level to trade long from. EURJPY should see decent support in the 130.00 level. GBP continues to perform well, with a rise in UK housing prices being today’s catalyst, taking EURGBP close a 4 month low. We have seen several hawkish comments on UK over the last few days, suggesting that a rate hike is being priced in more aggressively now, giving support to GBP.

There are some notable earnings releases out this week: Bank of America, Morgan Stanley out Wednesday and Goldman Sachs due Thursday. Others are IBM and Google.

| ATM | 1w | 1m | 3m | |||

| put | call | put | call | put | call | |

| EURUSD | 9,40% | 9,40% | 10,16% | 10,16% | 10,90% | 10,90 % |

| GBPUSD | 9,60% | 9,60% | 10,42% | 10,42% | 11,46% | 11,46 % |

| USDJPY | 11,35% | 11,35% | 12,03% | 12,03% | 12,96% | 12,96 % |

| USDCHF | 9,51% | 9,51% | 10,10% | 10,10% | 10,76% | 10,76 % |

| AUDUSD | 10,49% | 10,49% | 12,01% | 12,01% | 13,43% | 13,43 % |

| USDCAD | 9,90% | 9,90% | 10,57% | 10,57% | 11,85% | 11,85 % |

| EURJPY | 10,84% | 10,84% | 11,83% | 11,83% | 13,01% | 13,01 % |

| GBPJPY | 12,60% | 12,60% | 13,63% | 13,63% | 15,16% | 15,16 % |

| AUDJPY | 13,77% | 13,77% | 15,18% | 15,18% | 16,61% | 16,61 % |

| NZDJPY | 14,40% | 14,40% | 15,61% | 15,61% | 17,09% | 17,09 % |

| EURNOK | 5,76% | 5,76% | 6,68% | 6,68% | 7,36% | 7,36 % |

Technical’s

Euro: Was never able to reach the resistance at 1.4630 and broke lower overnight, bearish tone below 1.4450 now with Friday’s low of 1.4262 should is now support.

Cable: Held at 1.5895 last week, which gives a higher low than previous week. That is bullish in itself and the interim falling resistance was taken out yesterday, possible for a test of 1.6410.

USDJPY: We see longer term falling trend line coming in at 94.24, which is still the key level to break to open for a stronger run higher. We expect sellers to use this level to look for a correction on the strong run from the 85 at 27th of Nov 09. Longer term we still expect JPY to underperform due to high public debt, weak demographics and tougher export markets due to slower growth going forward.

Swissy: Trading inside a triangle on daily chart with rising support coming in at 1.0157 today and falling resistance at 1.0314, which are the levels to watch for now. Any break in either direction could open for a more directional move.

AUDUSD: Broke the interim rising support line overnight and recent uptrend is broken. Expect to see a test of 0.9120 or so next. Key resistance remains up at the Nov 09 high of 0.9405.

USDCAD: Still expect the 1.04 to continue to be a main pivot level in the near future. So while below the 1.04 level it remains bearish. Key support is down at 1.0205 (low from October 09) and this support level has been tested a few times over the last week, but held so far, maybe another approach would deal the final blow out punch?

EURJPY: Have minor support in the 130.50 region today, with stronger support down at 129. Key resistance level is last reaction high at 134.56 (Dec 2009 high).

GBPJPY : All over the place lately, but bullish above 146, with strong resistance up at 151.

AUDJPY: Still trading inside the Rising trend channel from 13th of July with support down at 78.54 and overhead resistance at up at 88.58. Right in the middle of this channel at the moment and no real levels to trade off at the moment.

| Levels | Euro | Cable | USDJPY | Swissy | AUDUSD | USDCAD | EURJPY | GBPJPY | AUDJPY |

| Res2 | 1.4625 | 1.6719 | 94.37 | 1.0507 | 0.9405 | 1.07 | 134.54 | 150.66 | 88.58 |

| Res1 | 1.4556 | 1.641 | 93.7 | 1.0314 | 0.932 | 1.04 | 133.7 | 149.45 | 85.3 |

| Sup1 | 1.4216 | 1.6135 | 90.6 | 1.0157 | 0.912 | 1.0205 | 130.5 | 146.77 | 78.54 |

| Sup2 | 1.4044 | 1.5895 | 90.34 | 0.9959 | 0.863 | 1 | 129 | 145.99 | 76.54 |

| Pair | Our strategy Today | Our medium term forecast |

| EURO | Bearish below 1.4450, next sup is 1.4262 | Test of 1.4200 over the next week |

| Cable | Bullish for a test of 1.6410 this week | Negative outlook for GBP longer term |

| USDJPY | Profit taking as 94.35 level held, 90.60 should provide support and looking enter long down there if possible | Test of 94.42 |

| USDCAD | 1.04 is pivot level, bearish below, sell rallies, key support is 1.02 | Test of 1.02 next 4 weeks |

| EURJPY | Should bounce from 130.50 | Our 133.70 target reached |

| AUDJPY | Expect more JPY weakness and AUDJPY should head higher, but need lower levels to be attractive for longs | 85 target hit |

| GBPJPY | Bullish above 146, looking for 151 test again | 153 target hit, stand aside |

| AUDUSD | Uptrend broken, looking for a test of 0.9120 | Test of 0.9405 |