The GBP is the only one who decreased versus the USD in the past six weeks

Varengold Bank Research Team from Varengold Wertpapierhandelsbank AG at 10/13/09

Good morning from Hamburg and welcome to our Daily FX report. Today we are going to report about the GBP and a decision from the Bank of England about its interest rate. We wish you will have a successful trading on Tuesday.

The EUR climbed to its highest level in more than six months against the GBP to 0.9368 after the Center for Economics and Business Research said that the U.K. interest rate will stay at a record low until at least 2011. After leaving its benchmark rate unchanged for the whole next year, the Bank of England will keep it below 2% until 2014, said the London based CEBR in an e-mail yesterday. Since July 2009, the GBP has fallen 9% versus the EUR, after climbing 12% in the first six months of this year. The GBP/USD traded also at its lowest level in almost four months and slipped to 1.5805. Among the 16 most traded currency pairs, the GBP is the only one who decreased versus the USD in the past six weeks.

The USD dropped against the EUR for a second day to 1.4785. Like yesterday, the USD fell against 14 of its 16 major counterparts aiming speculation recovering corporate earnings will prompt further gains in equities. Yesterday the USD/JPY increased 0.21 % and continued the upward trend in the Tokyo session by crossing the 90.00 level. Also the EUR/JPY rose 0.41 % and is now trading at 133.08.

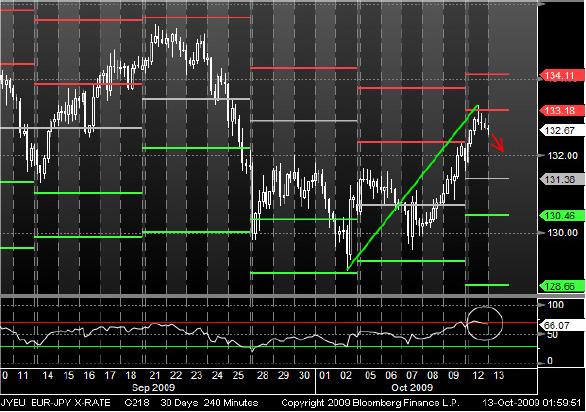

Since October, the EUR/JPY could recover from its bearish trend and has been started a bullish phase. Recently, the currency pair touched its Pivot Point at 133.18, but the resistance was strong enough so that the prices rebounded and it seems that the EUR will start a bearish trend. Furthermore the RSI may indicate a continuation of the descending trend.

Since the end of September, the EUR has been trading in a bearish trend channel against the CAD. Yesterday, it touched the bottom line from the trend channel and recovered. One time before as the EUR reached the bottom line and the currency pair rose to the upper line from the trend channel. Also a crossing MACD through the signal line from below could support a changing trend.