USD Gains Versus 15 Majors

UFXBank Research from UFX Bank at 12/16/09

Daily Review 16/12/2009

USD Dollar (USD) – The Dollar gained versus 15 of the 16 majors as Industrial Production rose by 0.8% versus 0.6% expected signaling U.S economy is gaining. The FOMC is still expected to keep the Interest Rate at 0.25% but more economists expect a rate increase to 0.5% until June 2010. PPI came out stronger with 1.8% versus 0.8% expected and TIC Long Term Purchases came out weaker with 20.7B versus 38.3B prior. NASDAQ and Dow Jones declined by -0.50% and -0.47% respectively as wholesale inflation raised concerns the Fed will be forced to raise interest rates. Crude gained by 0.17% closing at 70.81$ a barrel ending a 9 day declining streak. Gold (XAU) gained by 0.29% closing at 1125.70$ an ounce. Today, Building Permits are expected with 0.58M versus 0.55M prior. CPI is expected with 0.4% versus 0.3% prior and Core CPI is expected with 0.1% versus 0.2% prior. The FOMC will release its Interest Rate decision, the rate is expected to remain at 0.25%.

EURO (EUR) –The Euro fell versus the Dollar and the Pound after weaker French CPI results which triggered the Euro's decline. German Zew Economic Sentiment came out 50.4 slightly better than 50.1 expected but Zew Economic Sentiment came out weaker with 48 versus 50.9 expected. More countries in the Euro zone show signs the recession is still alive, Greece is struggling with its debt and Austria nationalized Hypo Alpe-Adria Bank. Overall, EUR/USD traded with a low of 1.4503 and a high of 1.4659. Today, German and French Manufacturing PMI are expected slightly stronger. CPI and Core CPI are expected unchanged with 0.6% and 1.2% accordingly.

EUR/USD - Last: 1.4535

Resistance 1.4575 1.4625 1.4685

Support 1.45 1.4445 1.441

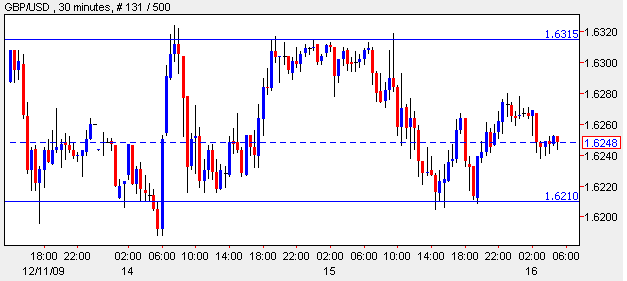

British Pound (GBP) – The Pound weakened versus the Dollar but gained versus the Euro as CPI came out 1.9% versus 1.8% expected. The CPI figures show inflation is advancing and the U.K won't be able to keep interest rates at their record lows. Overall, GBP/USD traded with a low of 1.6205 and a high of 1.6319. Today, Claimant Count Change is expected with 13.9K versus 12.9K and MPC Member Miles will speak in London.

GBP/USD - Last: 1.6275

Resistance 1.6315 1.635 1.638

Support 1.621 1.616 1.6105

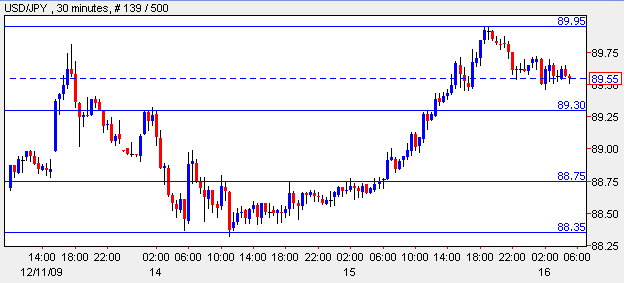

Japanese Yen (JPY) –The Yen weakened versus the Dollar and the Euro as a near U.S interest rate increase seems likely in the coming year. Tertiary Industry Activity came out 0.5% as expected. Overall, USD/JPY traded with a low of 88.61 and a high of 89.95 and EUR/JPY traded with a low of 129.54 and a high of 130.73. No economic data expected today in Japan.

USD/JPY-Last: 89.65

Resistance 89.95 90.40 90.75

Support 89.30 88.75 88.35

Canadian Dollar (CAD) – The Canadian Dollar weakened versus the U.S Dollar but gained versus most other majors as Crude prices rose slightly ending its 9 day decline. Leading Index came out better with 1.3% versus 0.6% and Labor Productivity came out weaker with -0.2% versus -0.4% expected. Overall, USD/CAD traded with a low of 1.0552 and a high of 1.0611. Today, Manufacturing Sales is expected with 1% versus 1.4% prior.

USD/CAD - Last: 1.0615

Resistance 1.067 1.07 1.075

Support 1.058 1.0550 1.0515