After Decline, EUR Finally Advances Against the USD

UFXBank Research from UFX Bank at 02/02/10

Daily Review 2/2/2010

USD Dollar (USD) – The Dollar was mixed versus the majors after better than expected Manufacturing PMI and gains in equity markets led investors to bet on global economic recovery. ISM Manufacturing PMI came out stronger with 58.4 versus 55.5 expected. NASDAQ and Dow Jones gained by 1.11% and 1.17% respectively as a lift in energy stocks led by strong earnings from Exxon Mobil contributed to a broad incline. Crude Oil gained by 2.79% closing at 74.92$ a barrel on weaker Dollar and assaults on Nigerian oil facilities. Gold (XAU) gained by 2.22% closing at 1,107$ an ounce. Today, Pending Home Sales are expected with 0.4% versus -16% prior.

EURO (EUR) –The Euro advanced versus the Dollar after 4 consecutive days of declines as demand for risk increased on bets global economic recovery will continue. Final Manufacturing PMI came out slightly better with 52.4 versus 52 forecast. Overall, EUR/USD traded with a low of 1.3852 and a high of 1.3938. EUR/USD oversold RSI conditions and support from the 200 weekly moving averages supported the pair and sent it upwards. EUR/USD is facing many resistance levels above and if unable to cross above them will return to its downtrend. Today, German Retail Sales are expected higher with 0.9% versus -1.7% prior.

EUR/USD - Last: 1.3930

Resistance 1.3945 1.399 1.4025

Support 1.385 1.3815 1.375

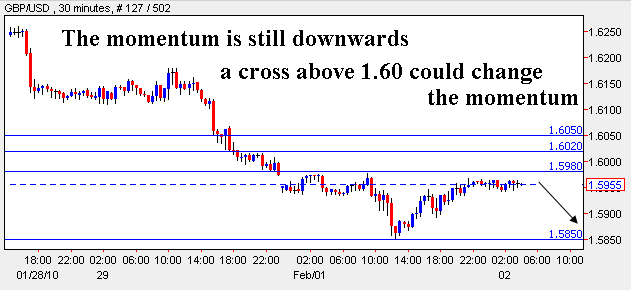

British Pound (GBP) – The Pound weakened slightly versus the Dollar after bouncing off support near 1.585. Manufacturing PMI came out stronger with 56.7 versus 54.1 forecast. Overall, GBP/USD traded with a low of 1.5850 and a high of 1.5978. GBP/USD has gained support at 1.5850 and finished the trading session almost unchanged with a Dragonfly Doji pattern. The momentum is still downwards until we could see confirmation candlestick and a cross above 1.60. Today, Construction PMI is expected with 47.7 versus 47.1 prior.

GBP/USD - Last: 1.5960

Resistance 1.5980 1.602 1.605

Support 1.585 1.578 1.57

Japanese Yen (JPY) –The Yen weakened versus the Dollar and most other majors after stronger than expected economic data led investors to favor higher yielding assets and not the Yen. Monetary Base came out 4.9% as expected but Average Cash Earnings came out weaker with -6.1% versus -2.6% expected. Overall, USD/JPY traded with a low of 89.99 and a high of 90.94. USD/JPY has crossed above 50 and 100 moving day averages and seems to be forming a bullish trend. The next major resistance is near 91. No economic data expected today.

USD/JPY-Last: 90.6

Resistance 91.2 91.55 91.9

Support 90.35 90 89.6

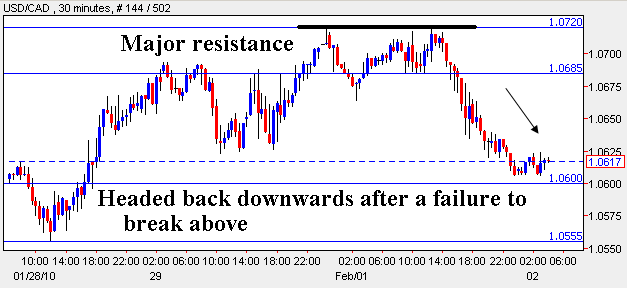

Canadian Dollar (CAD) – The Canadian Dollar gained from a 6 week low versus the Dollar as Commodities and Equities advanced. Overall, USD/CAD traded with a low of 1.0606 and a high of 1.0721. USD/CAD has turned back down after reaching close to its major resistance at 1.0745 and could continue to breakdown. No economic data expected today.

USD/CAD - Last: 1.061

Resistance 1.0685 1.072 1.078

Support 1.06 1.0555 1.0525