Central Banks Move Reserve Currencies from USD to EUR and JPY

UFXBank Research from UFX Bank at 10/13/09

Daily Review 13/10/2009

USD Dollar (USD) – The Dollar weakened versus most majors as more central banks moved bigger parts of their reserve currencies from Dollars to Euros and Yen. NASDAQ closed almost flat with -0.01% and Dow Jones gained by 0.21%, Crude rose by 0.75% closing at 73.10$ a barrel, Gold (XAU) gained by 0.55% closing at 1055.4$ an ounce on weaker Dollar. Today, the Federal Budget Balance will be released and is expected better with -77.3B versus -111.4B prior. Fed's Member Kohn will speak about the economic outlook.

EURO (EUR) –The Euro gained versus the Dollar as a result of central bank's shifting from Dollar holdings to Euros. EUR/USD traded with a low of 1.4676 and with a high of 1.4812. Today, German Zew Economic Sentiment will be released and is expected at record highs at 58.6 versus 57.7 prior.

EUR/USD - Last: 1.4775

Resistance 1.4782 1.4845 1.488

Support 1.4745 1.471 1.467

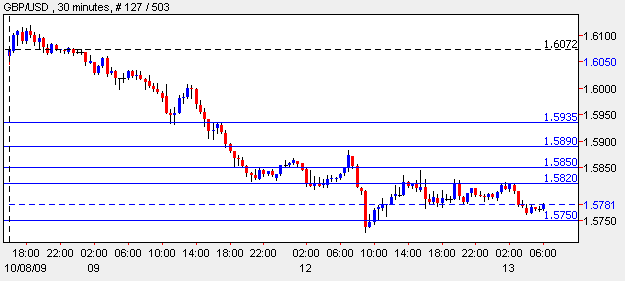

British Pound (GBP) – The Pound weakened slightly versus the Dollar and fell versus the Euro after a research from the Center for Economics was released and predict UK's Interest Rates will remain at their record lows at least until 2011. RICS House Price Balance came out at 22% higher than 15.1% forecast and 10.7% prior. Overall, GBP/USD traded with a low of 1.5727 and with a high of 1.5882. Today, CPI will be released and is expected to gain by 1.3% lower than 1.6% prior.

GBP/USD - Last: 1.5780

Resistance 1.585 1.589 1.5935

Support 1.575 1.57 1.566

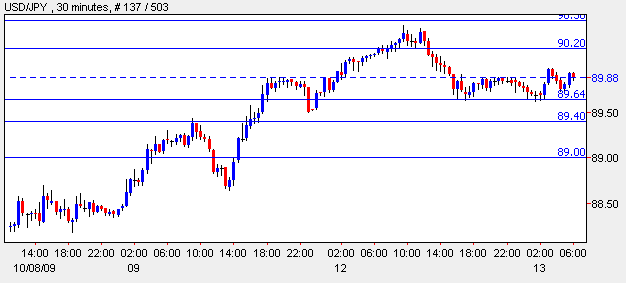

Japanese Yen (JPY) –The Yen weakened versus the Dollar and fell to a 2 week low versus the Euro as Risk Appetite grew on speculations good earnings reports will be released and lead to a rally in stocks. The Yearly M2 Money Stock came out 3% better than 2.9% forecast and 2.8% prior. Overall, USD/JPY traded with a low of 89.27 and with a high of 90.46. The Japanese Rate decision will be announced tonight and is expected to be held at 0.1%.

USD/JPY-Last: 89.9

Resistance 90.2 90.5 90.7

Support 89.64 89.4 89

Canadian dollar (CAD) – The Canadian Dollar continued rallying versus the Dollar reaching September 2008 price levels on big Risk Appetite and demand for higher yielding assets. Overall, USD/CAD traded with a low of 1.0317 and with a high of 1.0451. Today, New Homes Price Index is expected with 0.2% change versus 0.3% prior.

CAD/USD - Last: 1.0340

Resistance 1.04 1.0455 1.0515

Support 1.03 1.025 1.02