Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 10/14/09

Daily Market Commentary

EUR/USD Continues its Climb Towards 1.50

The EUR/USD has continued to climb beyond our 3rd tier downtrend line as we anticipated. As we mentioned in yesterday’s analysis, we view the movement past our 3rd tier and September highs as a key development in regards to a new leg up for the currency pair. The EUR/USD is not hovering around 8/21/08 highs and appears poised to take a crack at the highly psychological 1.50 level. There’s not much historical resistance above 1.50, meaning the EUR/USD’s near-term gains could accelerate towards 1.55 should 1.50 fail to sufficiently deflect the currency pair. Meanwhile, the EUR/USD is building up quite a few technical cushions during its ascent, including multiple uptrend lines and sets of higher lows. However, the psychological 1.50 zone could prove to be a challenging immediate-term barrier should it be tested. Additionally, the S&P futures are approaching their own highly psychological 1100 level. Therefore, the EUR/USD’s rally may hit a speed bump as the currency pair and several of its correlations test psychological barriers. Regardless, the technicals are pulling in favor of the EUR/USD’s uptrend even though this week’s ZEW data was disappointing.

Speaking of data, the EU printed an Industrial Production number in line with analyst expectations. The EU will keep the ball rolling tomorrow by releasing CPI data. EU consumer prices have registered negative growth for the past three months and analysts are expecting another subpar showing of -0.3%. The destruction of CPI prevents the EU from approaching its monetary policy with as hawkish of an attitude as the central bank may prefer. However, despite the negatively mixed EU data as of late, the U.S. released stronger than expected Retail Sales today and China reported an improvement in both export and import activity. Furthermore, earnings from bellweathers Intel and JPMorgan toppled analyst expectations. The S&P futures have responded by rising beyond 1075 and are in the midst of setting fresh 2009 highs. Overall, both Q3 earnings and U.S. econ data are coming in above analyst expectations, a positive catalyst for the EUR/USD’s uptrend due to the negative correlation between U.S. equities and the Greenback.

We have reason to believe the EUR/USD’s upward movements could accelerate over the next 24-48 hours, especially if U.S. data and earnings continue to flow in better than expected. However, the mixed EU econ data is a cause for concern and may be addressed next week if fundamental conditions don’t show signs of improvement. Additionally, the longer EU data sends mixed signals, the longer the ECB will leave its major alternative liquidity measures intact. Meanwhile, keep an eye on the S&P’s interaction with 1100 should it be reached since this may hint at how the EUR/USD would deal with 1.50.

Present Price: 1.4897

Resistances: 1.4905, 1.4946, 1.4981, 1.5013, 1.5052

Supports: 1.4875, 1.4845, 1.4830, 1.4800, 1.4758, 1.4722

Psychological: 1.50

GBP/USD’s Rally Tops Out after Eclipsing 1.60

The Cable’s rally has finally topped out after the currency pair breached the highly psychological 1.60 level. Yesterday’s pop on oversold conditions was extended today after Britain’s CCC data printed a surprising decline. The improvement in unemployment led investors back to the Pound and the Sterling also logged solid gains against the Euro. The positive CCC number combined with last week’s encouraging Services PMI data gives investors hope that the BoE may refrain from increasing its QE package. However, investors shouldn’t forget yesterday’s CPI number came in two basis points below expectations. The BoE’s ultimate goal is to meet a desired 2% level of inflation while avoiding an embarrassing decline below 1%. Hence, there’s little reason to believe that the BoE will make an effort to drain liquidity before prices show considerable signs of stabilization. In fact, previous BoE comments show the central bank is comfortable with a weaker Pound since it attracts foreign demand for British goods and services. Therefore, it is difficult for us to change our negative outlook for the Cable at this point in time. Additionally, the GBP/USD faces some challenging immediate-term technical barriers.

Technically speaking, the 1.60 area should serve as a hefty topside obstacle considering its historical prevalence. Furthermore, the Cable must face multiple downtrend lines along with previous October highs. Speaking of which, our 3rd tier downtrend line should play a key role since it runs through these October highs. A pop past our 3rd tier would likely spell the beginning of a new leg up for the currency pair. As for the downside, bulls should find comfort in the fact that the GBP/USD is trading back in September’s range and 9/28 lows. Additionally, the Cable now has a few uptrend lines to fall back on before considering a retest of previous October lows. Hence, immediate-term losses could be limited.

Britain will be quiet on the data-front for the remainder of the week, leaving the currency pair’s movements up to the performance of upcoming U.S econ data and Q3 earnings results. However, it’s a bit difficult to determine how the GBP/USD will behave correlation-wise since the recent negative correlation with U.S. equities has flipped in the past 24 hours. Therefore, investors should refrain from relying upon the behavior of correlations and pay more attention to technicals until we analyze another couple sessions for confirmation. Overall, we maintain our negative outlook on the Cable trend-wise due to discouraging pricing data the BoE’s continued dovish monetary stance.

Present Price: 1.5950

Resistances: 1.5969, 1.5990, 1.6024, 1.6044, 1.6071

Supports: 1.5930. 1.5899, 1.5862, 1.5840, 1.5812

Psychological: 1.60, 1.55, October highs

USD/JPY Stagnant Following Uneventful BoJ Meeting

The BoJ’s first monetary policy decision under the DPJ came and went with little reaction. The BoJ kept quiet concerning its QE plans, and appears to have learnt its lesson from the psychological impact of recent comments. In fact, the BoJ kept its monetary policy unchanged and didn’t mention anything about ending the corporate bond liquidity program by year end as many analysts had anticipated. The USD/JPY popped earlier in the session, yet has cooled to trade relatively unchanged. While there is plenty of speculation surrounding the DPJ and BoJ’s opinions concerning the Yen’s appreciation, it seems the ruling party and central bank feel comfortable with market forces determining the value of the major Yen crosses. Hence, there is little evidence supporting a concrete shift in the trend of the USD/JPY. Therefore, we maintain our negative outlook on the USD/JPY so long as the Dollar continues its broad-based appreciation and the BoJ refrains from intervening.

Meanwhile, the USD/JPY’s immediate-term movements will largely rely upon the upcoming performance of U.S. econ data and Q3 earnings results. Stronger than expected numbers would likely yield further equity strength and Dollar weakness, thereby placing downward pressure on the USD/JPY. However, the BoJ could provide a counteractive, psychological force with its monthly report on Thursday and Governor Shirakawa’s public address on Friday. Technically speaking, the USD/JPY is presently trading in the middle of important barriers and cushions.

As for the topside, the USD/JPY has to deal with the highly psychological 90 zone, previous October highs, and multiple downtrend lines. The USD/JPY’s rapid descent has placed quite a few challenging obstacles overhead, and it will take hefty buy-side support to overcome these barriers. As for the downside, the currency par has technical cushions in the form of 10/2 and 10/7 lows along with the important 1st tier uptrend line. A retracement beneath our 1st tier uptrend line would likely result in accelerated near-term losses and a retest of January lows.

Present Price: 89.34

Resistances: 89.45, 89.68, 89.84, 89.99, 90.21, 90.43

Supports: 89.17, 88.97, 88.78, 88.63, 88.41, 88.19

Psychological: 90, 2009 and 2008 lows

Gold Trades off 2009 Highs

Gold is trading off 2009 highs after failing to close above $1070/oz on the 4-hour. Gold’s weakness comes despite strength in both the Euro and the Pound today. Meanwhile, the AUD/USD seems to be topping off in a sign that investors are locking in some profits. Therefore, it appears gold is finally setting a top despite how temporary it may be. Gold has been on a tear this month and it is healthy for the precious metal to be experiencing some profit taking and consolidation. However, investors should take note that the EUR/USD is separating itself from our key 3rd tire downtrend line and September highs. Therefore, the currency pair may be starting a new leg up even though it must deal with the psychological 1.50 level. Gold’s positive correlation with the EUR/USD should play a key role in determining the precious metal’s near-term path. Therefore, investors should eye the currency pair’s interaction with 1.50 should it be tested.

Speaking of psychological levels, gold and the S&P future are quickly approaching their respective 1100 levels. Additionally, the Cable is trading around 1.60 and the USD/JPY is fluctuating near 90. Therefore, the markets are reaching an important point concerning the continuation of the bull trend. Regardless, we have no reason to alter our positive outlook on gold trend-wise unless the FX markets experience a rapid appreciation of the Dollar. Meanwhile, gold’s movements for the rest of the week will rely upon the Dollar and its reaction to further Q3 earnings and U.S econ data. If these two fundamental elements continue to outperform, then gold has the ability to test $1100/oz fairly soon. As for the downside, gold has technical cushions in the form of multiple uptrend lines, 10/13 and 10/9 lows, and the psychological $1050/oz level.

Present Price: $1061.45/oz

Resistances: $1061.40/oz, $1065.45/oz, $1068.30/oz

Supports: $1058.54/oz, $1054.82/oz, $1052.80/oz, $1050.67/oz, $1048.60/oz, $1045.23/oz

Psychological: $1050/oz, $1075/oz, $1100/oz

The S&P Futures Rally Past 1075 and are Looking Towards 1100

The S&P futures are setting fresh 2009 highs after earnings from Intel and JPMorgan topped analyst expectations. In addition to positive Q3 earnings, U.S. Retail Sales printed stronger than anticipated while China’s Trade Balance revealed a sizable improvement in both exports and imports. The vast improvement in China’s imports is the most important figure of the Trade Balance since it indicates consumption as picking up as investors had hoped. Q3 results reveal that corporations are outperforming as we anticipated and they continue to benefit from global stimulus packages coupled with a weakening Dollar. Speaking of the weak Dollar, we are witnessing a breakout in the EUR/USD while the Cable makes an impressive run at 1.60. Activity in the EUR/USD is most important since it is separating from our key 3rd tier downtrend line. Meanwhile, crude futures have popped above their own important 3rd tier downtrend line and are trading at the psychological $75/bbl. Therefore, the S&P’s correlations continue to create an environment which is supportive of an uptrend in U.S. equities.

Technically speaking, although U.S. equities have surpassed 1075, the 1100 level could prove to be a more challenging psychological obstacle. Furthermore, we recognize 1.50 in the EUR/USD, 1.60 in the Cable, and the $75/bbl and $80/bbl levels in crude. Hence, the S&P and its correlations are approaching some potentially challenging topside technicals. As for the downside, the S&P futures have several uptrend lines along with consecutive higher lows (10/13, 10/9, 10/7). Additionally, the psychological 1075 should begin acting in the S&P’s favor. In terms of fundamentals, investors will continue to digest Q3 earnings throughout the week along with tomorrows CPI and weekly Unemployment Claims data. Better than expected results all around would likely fuel a test of the psychological 1100 level.

Price: 1083.50

Resistances: 1085, 1100

Supports: 1076.25, 1067.75, 1063.5, 1058.25, 1051.75, 1045.5

Psychological: 1100, 1075, 1050

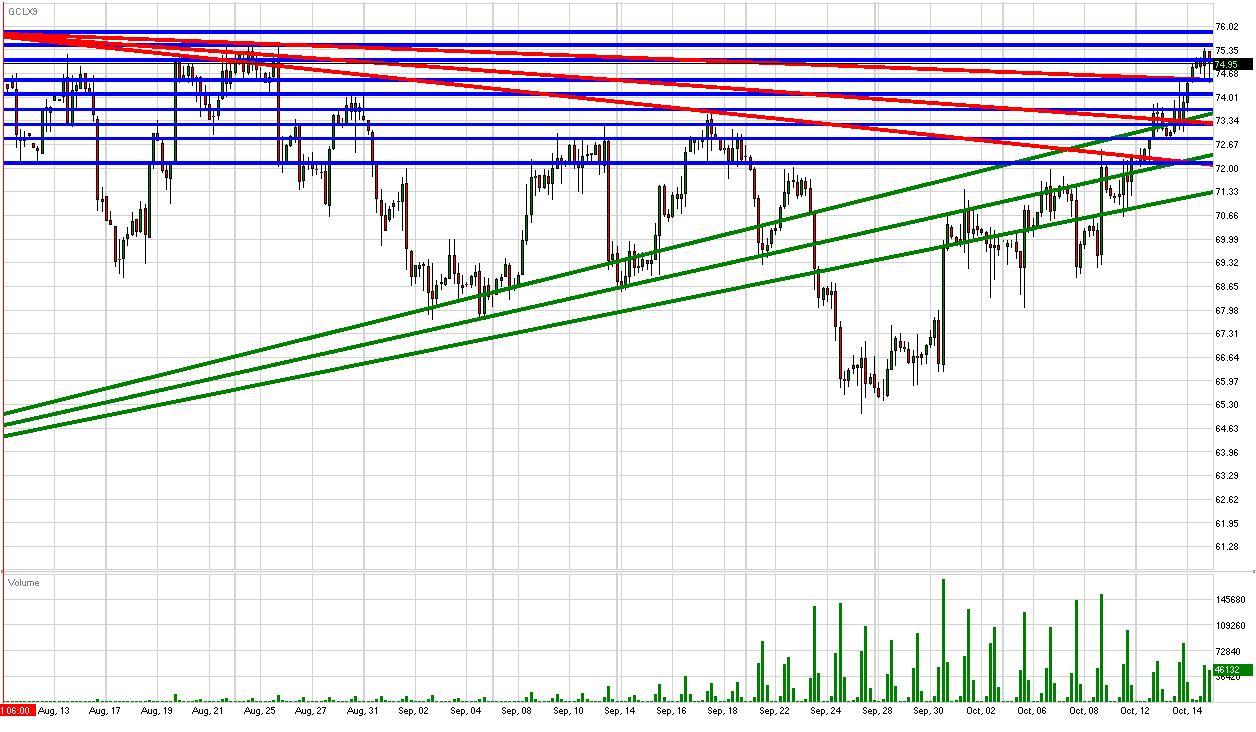

Crude Consolidates above our Key 3rd tire Downtrend Line

Crude futures have managed to pop above our important 3rd tier downtrend line and are currently toying with the psychological $75/bbl level. We highlighted the significance of our 3rd tier downtrend line in yesterday’s analysis because it runs through previous 2009 highs. As a result, crude becomes the latest investment vehicle to send a strong buy signal. The EUR/USD has also separated itself from its key 3rd tier downtrend line and is flirting with the idea of testing 1.50. Meanwhile, gold is trading just below 2009 highs and the S&P futures are setting fresh ones. Therefore, crude’s key correlations all continue to create an environment supportive of a new leg up.

Meanwhile, U.S. econ data and Q3 earnings have done their part thus far. Intel and JPMorgan both topped expectations today while U.S. retail sales came in strong than anticipated. Both are positive catalysts for crude and the S&P futures, particularly since an improvement in retail sales is supportive of a recovery in U.S. consumption. In addition to U.S. news, China reported stronger than expected export and import activity. China continues to import incredible amounts of iron ore, leading us to believe that the nation is adding onto its stockpiles of crude and gold as well. Hence, crude’s fundamentals support its positive technical developments.

Technically speaking, crude faces topside barriers in the form of 8/24 and 8/6 highs along with the psychological $75/bbl level. Crude’s technical barriers are clearly wearing thin and the next foreseeable obstacle would be the psychological $80/bbl. As for the downside, crude has technical cushions in the form of multiple uptrend lines along with consecutive higher lows (10/13, 10/9, 10/8). Additionally, the psychological $70/bbl level should work in crude’s favor if it is tested.

Price: $74.95/bbl

Resistances: $75.06/bbl, $75.49/bbl, $75.86/bbl

Supports: $74.50/bbl, $74.10/bbl, $73.66/bbl, $73.24/bbl, $72.84/bbl, $72.15/bbl

Psychological: $75/bbl, $70//bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.