Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/09/09

Daily Market Commentary

EUR/USD Tests 1.50 Amid Broad-Based Dollar Weakness

The Dollar’s odd, negative reaction to Friday’s surge in the U.S. Unemployment Rate has carried through strongly into Monday’s session. We’re seeing broad-based Dollar weakness as well as a gold breaking through its psychological $1100/oz level. Additionally, the S&P futures are trading up by nearly 1% pre-market, likely a reaction to the weakening Greenback. Friday’s discouraging U.S. unemployment data supported the belief that the Fed will not be able to tighten liquidity for quite some time. In fact, this weekend’s G20 meeting concluded with the group of nations stating they will keep the liquidity flowing until further confirmation of an economic recovery. Such unity hasn’t been seen since all of the central banks acted together when reducing rates and implementing their respective stimulus packages. This statement of solidarity is renewing investor confidence which has been struck by recent speculation that more central banks will follow Australia’s lead. As a result, investors are feeling more comfortable about getting back into riskier vehicles, and the EUR/USD is clearly reaping some of the benefits.

The EUR/USD is also being driven higher by impressive Industrial Production data from Germany (2.7% vs 1.2% expected). Investors will receive ZEW Economic Sentiment tomorrow. Should the ZEW data print better than expected, the EUR/USD might have enough momentum to carry though 1.50 and October highs. Technically speaking, the psychological 1.50 area proved to be a worth psychological barrier back in October. Therefore, it will be interesting to see how the currency pair interacts with 1.50 this time around. Meanwhile, the EUR/USD could be on the cusp of a more extensive topside breakout considering how close the currency pair is trading to our new 2nd and 3rd tier downtrend lines. These downtrend lines run through October highs. Hence, investors should keep a close eye on these trend lines since a movement beyond these barriers could indicate heightened upward momentum for the immediate-term. As for the downside, we’ve shifted our downtrend lines to compensate for today’s topside activity. The EUR/USD still has multiple uptrend lines serving as technical cushions to go along with intraday and 11/6 lows.

Present Price: 1.5001

Resistances: 1.5013, 1.5036, 1.5049, 1.5062, 1.5085, 1.5127, 1.5146

Supports: 1.4994, 1.4983, 1.4966, 1.4947, 1.4927, 1.4909, 1.4895

Psychological: 1.50, October Highs

GBP/USD Surges Through Our Downtrend Lines as Dollar Weakens

Both the Cable and the EUR/USD are making a commitment to their respective uptrends today after finishing the week on an indecisive tone. Investors are showing a clear preference for riskier investment assets despite U.S. unemployment data printing worse than expected on Friday. Investors are being encouraged by the G20 statement from this weekend’s meeting in favor of continued loose monetary policies until the global economy is on a better footing. Such solidarity is boosting investor confidence since the latest central bank meetings were ripe with speculation. Speaking of which, the BoE’s decision to inject 25 billion into QE as opposed to the expected 50 billion is helping fuel the Cable’s topside breakout. Furthermore, investors should keep in mind that both Britain’s Services and Manufacturing PMIs are outperforming, showing that the economy is recovering nicely despite the poor Prelim GDP.

Technically speaking, the Cable has responded by charging well beyond our previous downtrend line running through August highs. Therefore, the Cable is indicating that a continued topside breakout towards the August highs and the psychological 1.70 level may be around the corner. As for the downside, we’ve readjusted our uptrend lines to compensate for today’s positive movements. That being said, the GBP/USD still has multiple uptrend lines serving as technical cushions along with 11/6 and 11/5 lows, not to mention the psychological 1.65 level is no working in the currency pair’s favor.

Meanwhile, gold has broken past its psychological $1100/oz level, another positive catalyst for the Cable considering the precious metal’s negative correlation with the Dollar. Additionally, the S&P futures are trading higher by nearly 1% pre-market while the EUR/USD tests our key 3rd tier downtrend line and its psychological 1.50 level. Hence, the Cable’s correlations are creating an environment supportive of further broad-based Dollar weakness. Britain will release its Trade Balance data tomorrow, and analysts are expecting a slight improvement from the previous number considering the encouraging PMI data as of late.

Present Price: 1.6791

Resistances: 1.6797, 1.6812, 1.6830, 1.6847, 1.6876

Supports: 1.6761, 1.6730, 1.6714, 1.6688, 1.6662, 1.6621

Psychological: 1.65, August Highs

USD/JPY Heads South with Broad-Based Dollar Weakness

The USD/JPY is trading lower today in what appears to be a broad-based sell-off of the Dollar. The combination of weak unemployment data and the G20 stating that central banks will maintain their respective loose monetary policies (see EUR/USD commentary) has led investors away from the Dollar and towards riskier assets. Today’s trend is a negative catalyst for the USD/JPY since the currency pair has been negatively correlated with the risk trade. Furthermore, the DPJ’s more conservative fiscal policy is leading investors to believe that the BoJ will not intervene at present levels. Data-wise, Japan will release Core Machinery Orders late Tuesday night EST along with a wave of Chinese econ data. Therefore, volatility could pick up in the next 24-48 hours, especially if the Asian data points outperform expectations. While analysts are expected continual growth in Japan’s CMO data, China’s numbers could have a larger impact considering it is Japan’s largest trading partner. Further strength in China’s economy implies greater demand for Japanese goods, thereby strengthening the Yen. On the other hand, weak Chinese econ data could rattle markets and send the USD/JPY back above 90.

Technically speaking, the psychological 90 area is proving to be a tough psychological area once again. The USD/JPY continues to gravitate towards 90 despite recent hints of a topside breakout. The currency pair is currently trading back below 90, yet is holding above our 1st and 2nd tier uptrend lines. Hence, there are a few more technical cushions separating the USD/JPY from a retest of October lows. As for the topside, the USD/JPY faces multiple downtrend lines along with 11/6 and 11/4 highs.

Present Price: 89.74

Resistances: 89.88, 90.03, 90.27, 90.38, 90.50, 90.64

Supports: 89.61, 89.44, 89.30, 89.15, 88.97, 88.82, 88.73

Psychological: 90, November and October Lows

Gold Breaks Past $1100/oz

Gold has finally broken past its psychological $1100/oz level after a week-long debate. The precious metal is finding strength from a broad-based weakness in the Dollar as the Aussie, Euro, and Pound all log solid gains against the Greenback. Furthermore, India’s large purchase of IMF bullion is probably increasing speculation that global central banks are beginning to diversify their reserves and decrease their reliance on the Dollar. Gold is a direct beneficiary of such a trend since it is a notorious safe haven asset. Meanwhile, we also notice sizable topside movements in both crude and the S&P futures, indicating today’s activity in Gold’s correlations are all creating an environment supportive of the precious metal’s psychological breakout.

Meanwhile, gold’s near-term reaction should remain reliant on the Dollar’s reaction to upcoming econ data. In focus will be tomorrow’s EU ZEW Economic Sentiment number followed by a wave of Chinese data late Tuesday EST. If tomorrow’s econ releases should impress and the Dollar reacts negatively, gold would likely be a beneficiary, and vice versa. Technically speaking, gold’s movement beyond $1100/oz is another key uptrend statement from the precious metal. Although there’s the possibility gold may retrace towards the upper end of the $1100/oz psychological zone, the precious metal’s technicals are still supportive of its medium-term uptrend. It’s difficult to place too many topside resistances until gold cools down, while the precious metal has multiple uptrend lines along with 11/6 lows serving as technical cushions.

Meanwhile, investors should keep an eye on the EUR/USD’s interaction with its highly psychological 1.50 level along with our 2nd and 3rd tier downtrend lines. Gold has been strongly correlated with the EUR/USD lately, meaning a topside breakout in the Euro could push gold highs, adding more weight to tomorrow’s ZEW data.

Present Price: $1106.80/oz

Resistances: $1108.20/oz, $1110.59/oz

Supports: $1103.64/oz, $1100.97/oz, $1098.11/oz, $1094.78/oz, $1090.71/oz, $1088.55/oz

Psychological: $1100/oz, $1075/oz.

The S&P Futures Head Higher Amid Broad-Based Dollar Weakness

Investors are ignoring Friday’s disappointing unemployment data and have sent the S&P futures well beyond our downtrend line. Hence, investors appear to be opting for the topside following Friday’s erratic session. Today’s topside breakout in equities further signifies the S&P’s increasing reliance on the path of the Dollar. The Dollar is experiencing a broad-based selloff today after the G20 released a statement saying global central banks will maintain stimulus measures and historically loose monetary policies. The Dollar’s downward trajectory is boosting the S&P futures higher sans noteworthy U.S. eocn data. Speaking of the Dollar, the GBP/USD has popped past all of our previous downtrend lines while the EUR/USD tests its highly psychological 1.50 level. Hence, investors should keep an eye on the EUR/USD since a breakout beyond 1.50 and October highs could help the S&P futures head towards their previous 2009 highs. In addition to the Greenback’s weakness, we also notice that gold has broken through its psychological $1100/oz level. This is yet another key topside movement for gold, supportive of further weakness in the Dollar and consequently stronger U.S. equities.

Meanwhile, the U.S. will be relatively quiet on the data front following a busy week. Investors won’t receive much from the U.S. until Thursday’s weekly Unemployment Claims data. Hence, the S&P’s immediate-term performance may become increasingly reliant upon movements in the Dollar. Since the U.S. will be taking a timeout from data, focus will shift to the Far East. China will be printing a wave of data late Tuesday EST, including Industrial Production, CPI, PPI, and Fixed Asset Investment. Any outperformance in China’s econ data could help fuel a S&P retest of 1100.

Technically speaking, although the S&P futures have darted beyond our downtrend line, they still have to deal with previous 2009 highs and the psychological 1100 level. Therefore, a couple key topside technicals do remain before the S&P has the opportunity to experience a more protracted breakout. As for the downside, the S&P futures have multiple uptrend lines service as technical cushions now along with 11/06, 11/05, and 11/03 lows. Furthermore, the psychological 1050 level should service as a reliable support should it be tested.

Price: 1079.50

Resistances: 1079.5, 1083.5, 1089, 1094.5, 1098.75

Supports: 1073.25, 1063, 1056.5, 1047.5, 1043.25

Psychological: 1100, 2009 Highs, 1050

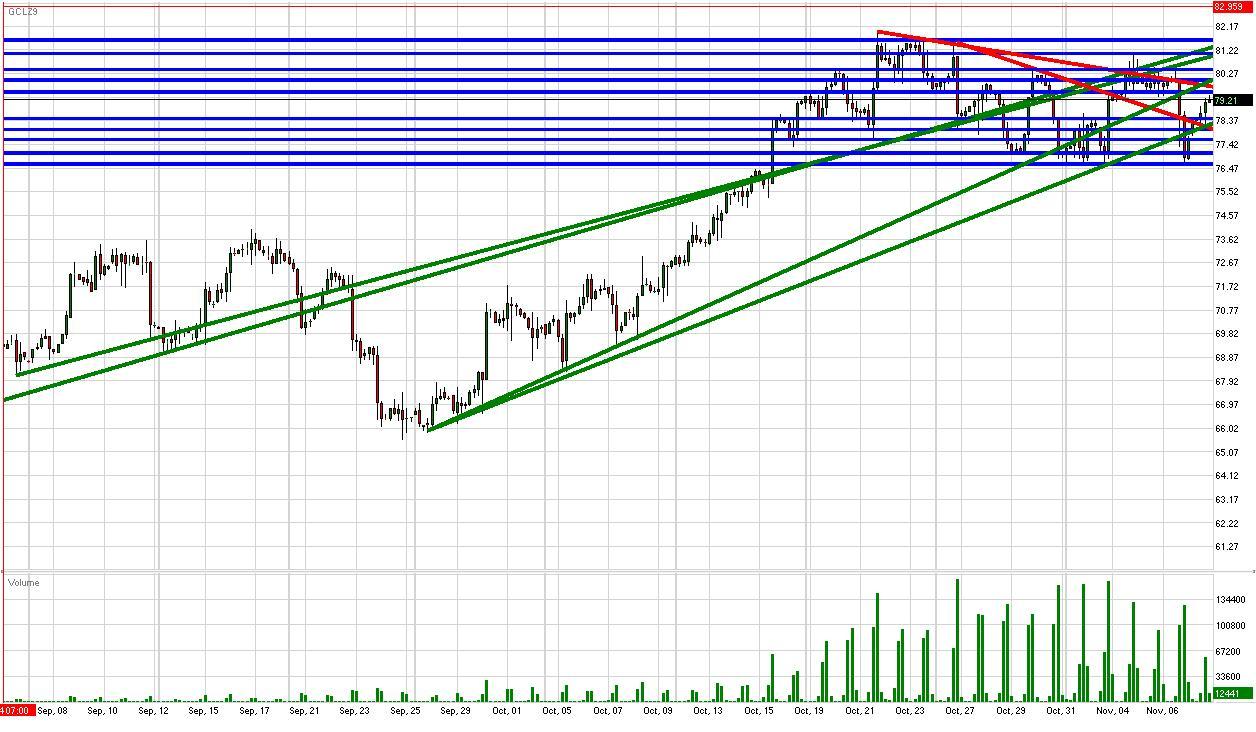

Crude Rises Towards $80/bbl With Weak Dollar & Strong Equities

As one would expect, crude futures reacted negatively to Friday’s disappointing U.S. unemployment data. Higher unemployment implies less demand for and consumption of crude. Therefore, crude proceeded to dip below our 1st tier uptrend line on a pop in sell-side activity. However, the futures managed to stabilize along previous November lows, and have since rallied back above our 1st tier uptrend line. Crude is presently trading just beneath our 2nd tier downtrend line and the psychological $80/bbl level. Today’s strength in crude comes from a selloff in the Greenback in reaction to the G20 stating that they will keep their respective stimulus packages in place until the global economic recovery solidifies. Both the EUR/USD and GBP/USD have responded positively, making crude a more attractive import since it is a dollar-denominated commodity. The S&P futures have also responded favorably since the G20 statement all but confirms that the Fed will need to keep its benchmark rate at its low for quite some time. The positive reaction of the S&P futures is further buoying crude, allowing the commodity to avert a retracement towards its psychological $75/bbl level. However, despite today’s positive developments in crude’s correlations, gains are being capped by news that China will raise gasoline prices again to boost the revenue of state refiners. This decision implies a decline in China’s consumption of crude, thereby weighing down on the price.

Technically speaking, crude has our 1st tier uptrend line serving as a technical cushion once again along with 11/06 lows and the psychological $75/bbl level. As for the topside, crude still faces our 2nd tier downtrend line along with the psychological $80/bbl level and previous 2009 highs. Meanwhile, crude’s movement should follow the path of the Dollar for the most part until the wave of Chinese econ data late Tuesday EST.

Price: $79.21/bbl

Resistances: $79.53/bbl, $80.02/bbl, $80.43/bbl, $81.08/bbl, $81.61/bbl

Supports: $78.47/bbl,$78.02/bbl, $77.62/bbl, $77.07/bbl, $76.63/bbl

Psychological: $75/bbl, $80/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.