Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/16/09

Daily Market Commentary

EUR/USD’s Rally Tops Out Just Below 1.50

The EUR/USD staged an encouraging rally on Friday, bouncing off our 2nd tier uptrend line as both gold and the S&P futures headed higher despite weaker than expected EU GDP data along with a disappointing UoM Consumer Sentiment number. However, the bounce has stalled at what is now our 2nd tier downtrend line and the EUR/USD is confronting the highly psychological 1.50 area once again. Hesitation in the EUR/USD comes in reaction to mixed U.S. Retail Sales data along with a weak reading from the Empire Index. The continuation of a negatively mixed data flow from the U.S. is deterring investors from sending the EUR/USD beyond 1.50 and the S&P futures past 1100. As a result, the EUR/USD appears stuck in a trading range between previous November highs and lows. That being said, the EUR/USD has technical forces at work on both sides.

Technically speaking, the EUR/USD still faces our 2nd and 3rd downtrend lines along with the highly psychological 1.50 level and previous November highs. However, the topside barriers are wearing thin, and a breach beyond our 3rd tire downtrend line could result in a retest of November and October highs with the possibility of more accelerated immediate-term gains. As for the downside, the EUR/USD has built up a solid support system considering the rally since November lows. Therefore, the EUR/USD has multiple uptrend lines serving as technical cushions along with 11/12 and 10/27 lows. Meanwhile, investors should keep an eye on the S&P’s interaction with its psychological 1100 level because a topside breakout in the S&P could bring the EUR/USD along for the ride due to their positive correlation.

The EU will be relatively quiet on the data side, leaving tomorrow’s action up to British and American pricing data. The EU released CPI data in line with expectations today, yet investors have shown a muted reaction to the data release thus far.

Present Price: 1.4962

Resistances: 1.4967, 1.4992, 1.5011, 1.5019, 1.5046, 1.5060

Supports: 1.4952, 1.4937, 1.4924, 1.4904, 1.4883, 1.4856

Psychological: 1.50, November Highs and Lows

GBP/USD Aims for Previous November Highs

The Cable is perking up this morning as the S&P futures fight to break loose of their psychological 1100 level. The GBP/USD has benefitted from a relatively quiet data wire from Britain since the CCC number beat expectations. However, the news flow will pick up tomorrow with the release of both CPI and RPI data points. Furthermore, the BoE will release its anticipated Inflation Letter. Since the BoE’s target inflation rate is 2%, any disappointing numbers concerning inflation could spark investor speculation that the BoE will inject more liquidity into its QE fund. After all, Governor King recently left the door open to future alternative liquidity measures if deemed necessary. Meanwhile, an inflation reading topping analyst expectations could boost the Cable beyond previous November highs and would support why the BoE opted to inject 25 billion Pounds at its last meeting instead of the anticipated 50 billion.

The U.S. will release pricing data of its own tomorrow along with TIC Long-Term Purchases, Capacity Utilization Rate, and Industrial Production. As we saw today, the U.S. data flow continues to print negatively mixed. Regardless, investors are snapping up equities and looking to send the S&P futures to fresh 2009 highs. If the S&P futures should experience a topside breakout, the Cable may follow suit since the two investment vehicles are normally positively correlated.

Technically speaking, the Cable faces thin topside obstacles in the form of our 3rd and 4th tier downtrend lines along with previous November highs. Since our 4th tier downtrend line runs through these November highs, a pop past our 4th tier on sufficient volume could indicate a more extensive near-term breakout towards August highs and the highly psychological 1.70 level due to a relative lack of historical resistance. As for the downside, the GBP/USD has our 1st and 2nd tier uptrend lines serving as technical cushions along with 11/12 and 11/05 lows. Furthermore, the psychological 1.65 level could work in the Cable’s favor should it be tested.

Present Price: 1.6741

Resistances: 1.6761, 1.6790, 1.6808, 1.6828, 1.6849, 1.6875

Supports: 1.6730, 1.6694, 1.6666, 1.6643, 1.6615, 1.6598

Psychological: 1.65, 1.70, November and August Highs, November Lows

USD/JPY Drifts Lower After GDP Tops Expectations

The USD/JPY is drifting lower today following stronger than expected Prelim GDP data from Japan. Furthermore, although the headline U.S. Retail Sales data topped expected, the Core number underperformed. Altogether, this could be a negative catalyst for the USD/JPY. The outperformance of Japan’s GDP could lead investors to favor the Yen over the Dollar considering America’s data continues to roll in negatively mixed. Furthermore, the positive headline Retail Sales figure could bode well for Japanese automakers, thereby benefiting Japan’s economy and consequently the Yen. However, the S&P futures are currently climbing past previous 2009 highs as investors take the mixed U.S. data in stride. Therefore, it will be interesting to see how the USD/JPY reacts to both positive Japanese data along with a bullish technical move in U.S. equities. There’s a possibility the two developments could counterbalance one another and leave the USD/JPY around its highly psychological 90 level for the time being. However, we’ll just have to wait and see how the session pans out.

Meanwhile, the USD/JPY still has our 1st and 2nd tier uptrend lines serving as technical supports along with 11/11, 11/02, and 10/14 lows. Therefore, the USD/JPY has quite a few technical cushions in place should conditions deteriorate. As for the topside, the USD/JPY is still mired in its long-term downtrend and faces multiple downtrend lines along with 11/12 and 11/06 highs. Furthermore, the psychological 90 level serves as both a technical cushion and barrier. Therefore, the USD/JPY may need a sizable jolt to proceed in a more definite direction.

Present Price: 89.47

Resistances: 89.54, 89.68, 89.83, 89.98, 90.07, 90.20, 90.39

Supports: 89.41, 89.26, 89.15, 88.99, 88.85, 88.73, 88.58

Psychological: 90, November and October Lows

Gold Shines as it Sets Fresh 2009 Highs

Gold is shooting higher again after rallying from $1100/oz on Friday. Today’s positive performance stems from a strong EUR/USD and GBP/USD. However, the real gold movers are the AUD/USD and S&P futures, which are both headed for new 2009 highs. Therefore, it seems the risk trade is finally taking a cue from gold’s incredible rally as of late. Now it seems gold’s positive correlations are leading the way, sending the precious metal beyond $1130/oz. The S&P’s charge past its highly psychological 1100 level could prove to be a key move for the risk trade since the S&P futures have buckled under the pressure of 1100 for the past month. Such a movement would likely serve as a positive catalyst for gold since stronger equities have been resulting in a weaker Dollar. Since gold is also negatively correlated to the Dollar, the precious metal may be in for further near-term gains. Hence, investors should keep an eye on the EUR/USD and its interaction with 1.50 and previous November/October highs (refer to EUR/USD commentary). Any key topside breakout in the EUR/USD could serve as another positive indicator for gold. Meanwhile, the U.S. will release some important pricing data tomorrow. Therefore, the markets could remain in a volatile state for the next 24-48 hours.

Technically speaking, we’re still unable to install a downtrend line on our chart due to a lack of historical perspective. Therefore, it’s difficult to find any topside technical barriers besides gold’s potentially psychological $1150/oz level. As for the downside, gold has multiple uptrend lines serving as technical cushions along with intraday lows and the psychological $1100/oz level.

Present Price: $1130.45/oz

Resistances: $1131.19/oz $1133.16/oz

Supports: $1127.24/oz, $1124.42/oz, $11122.54/oz, $1117.87/oz, $1114.39/oz, $1110.59/oz

Psychological: $1100/oz., $1150/oz.

The S&P Futures Break Free of 1100, Set New 2009 Highs

The S&P futures appear to have finally broken free of 1100 after a month long struggle with the key psychological barrier. The S&P futures are climbing to fresh 2009 highs despite a wave of negatively mixed U.S. econ data once again. Although the headline Retail Sales number beat analyst expectations by 4 basis points, the Core figure disappointed expectations. As a result, it appears auto sales picked up while the remainder of retail sales struggled under of pressure of a historically high unemployment rate. In addition to the mixed retail sales data, both the Empire Index and Business Inventories printed well short of analyst expectations. These negative data releases tag onto Friday’s discouraging UoM reading. The positive reaction of the S&P futures to negatively mixed data flows over the past two sessions is a bit puzzling, and could stem from an improvement in weekly Unemployment Claims along with a weakening Dollar. The U.S. will release another set of key data points tomorrow, including PPI, TIC Long-Term Purchases, Industrial Production, and the Capacity Utilization Rate. We will be paying particularly close attention to the TIC data to see whether foreign purchases of U.S. Treasuries stayed positive.

Meanwhile, the combination of rising gold and a falling Dollar seem to be propelling U.S. equities higher due to correlative forces. Gold continues to set new all-time highs while topside barriers in both the EUR/USD and GBP/USD wear thin. Additionally, the AUD/USD is looking to break out to fresh 2009 highs of its own. The devaluation of the Dollar is making U.S. goods and services cheaper abroad, thereby increasing revenue for U.S. corporations and lifting the S&P futures in the process. That being said, investors should keep an eye on the EUR/USD and GBP/USD as both major Dollar crosses face their previous monthly highs. A topside breakout in these currency pairs could indicate further upward movements in the S&P futures due to their positive correlation.

Technically speaking, we’re presently unable to place any near-term topside technicals on the S&P futures due to a lack of perspective. However, a retracement towards 1100 wouldn’t be out of the ordinary considering the psychological influence the level has had over the past month. As for the downside, the S&P futures have several uptrend lines serving as technical cushions along with 11/13, 11/09, and 11/05 lows. Additionally, the 1100 level could begin to work in the S&P’s favor should it be tested.

Price: 1108

Resistances: 1109.25

Supports: 1098.75, 1091.75, 1082.5, 1075.75, 1064

Psychological: 1100, Previous 2009 Highs, 1075

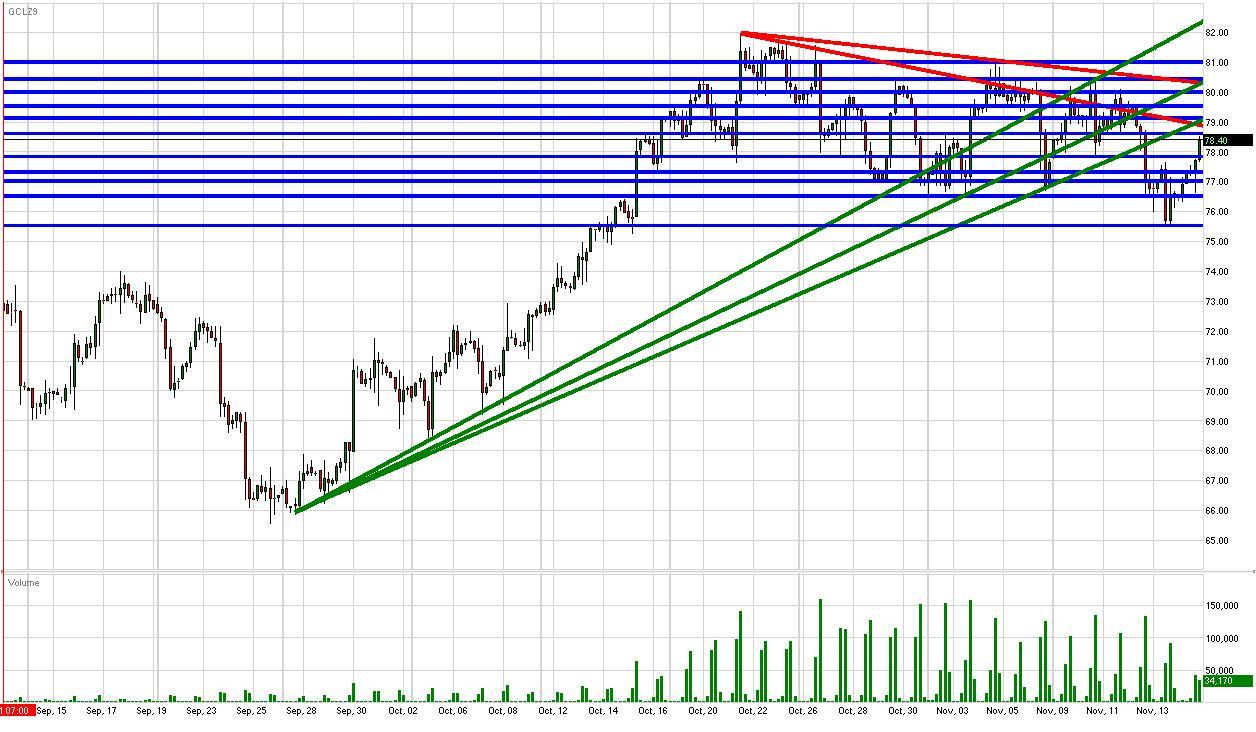

Crude Climbs with Stronger Equities and Weaker Dollar

Crude futures are logging solid gains thus far today as the S&P futures pop above 1100 and previous 2009 highs while the FX markets experience another session of broad-based Dollar weakness. U.S. equities are trading higher today despite negatively mixed data and the S&P futures are looking to finally break free of their month long battle with 1100. Although the Empire Index, Business Inventories, and Core Retail Sales all disappointed analyst expectations, the headline Retail Sales number outperformed by 4 basis points. The outperformance of the headline figure implies a boost in automobile purchases. The concept of more cars on the road also implies a larger aggregate demand for gasoline over the medium-term, thereby benefiting the price of crude today.

Meanwhile, gold continues to set new all-time highs while the Dollar experiences broad-based weakness. The negative performance of the Dollar makes crude a more attractive purchase for foreign countries since it is a Dollar-denominated commodity. Hence, crude’s negative correlation with the Dollar is still in play. That being said, investors should keep an eye on the EUR/USD’s interaction with its highly psychological 1.50 level. Any topside breakout in the EUR/USD beyond 1.50 and previous November/October highs could prove to be a positive catalyst for crude due to their positive correlation. Additionally, investors will receive any wave of key econ data from the U.S. tomorrow. Should U.S. equities reactive positively, crude futures may receive another topside boost.

Technically speaking, crude still faces multiple topside barriers in the form of our 1st and 2nd tier downtrend lines along with the psychological $80/bbl level. Furthermore, a movement back above our key 1st tier uptrend line could prove to be a positive development for crude. As for the downside, there are a couple potential uptrend lines we can form while intraday and Friday lows serve as technical cushions.

Price: $78.40/bbl

Resistances: $78.62/bbl, $79.15/bbl, $79.55/bbl, $80.02/bbl, $80.45/bbl, $81.01/bbl

Supports: $77.85/bbl, $77.34/bbl, $77.03/bbl, $76.54/bbl, $75.54/bbl

Psychological: 2009 highs, $75/bbl, $80/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.