Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 11/23/09

Daily Market Commentary

EUR/USD Rallies Strongly on Positive Flash PMI Data

The EUR/USD has taken advantage of its relative strength on Friday stemming from ECB President Trichet’s hawkish comments. The currency pair has since jumped back up to its highly psychological 1.50 level after of a wave of Flash PMI data that was altogether positive. Therefore, it seems the recovery in the EU’s services and manufacturing industries is continuing at a steady pace. In addition to good news from the EU, U.S. Existing Home Sales just printed 400k hotter than expected(6.10m vs. 5.71m). The S&P futures are reacting positively by pushing previous 2009 highs while crude heads north for a retest of $80/bbl. Meanwhile, the Dollar is experiencing a broad-based weakness and gold has shot up to $1170/oz in reaction to continual dovish statements from Fed board members. The concept of loose monetary policy at the Fed well into 2010 is countering any strength built up over last week’s stream of disappointing economic data. As a result, correlative pressures and psychological forces are working in the EUR/USD’s favor, allowing the currency pair to climb back towards previous November and October highs.

Technically speaking, the EUR/USD is trading in a favorable position right now since it is within arm’s length of previous November highs and our 3rd tier downtrend line. Our 3rd tier downtrend line runs through these November highs, meaning there appears to be only a few topside barriers separating the EUR/USD from the possibility of a new near-term uptrend. However, downward forces are still intact, and we’ve seen how powerful the psychological 1.50 area can be. Therefore, investors may want to taper their enthusiasm and watch the EUR/USD’s interaction with topside barriers closely. As for the downside, the EUR/USD has multiple uptrend lines serving as technical cushions along with 11/23, 11/17, and 11/12 lows. Therefore, there seems to be a solid support system in place for the time being.

The data roll will continue tomorrow with the release of German Ifo Business climate data along with Britain’s Inflation Report Hearings. However, the focus of the day will likely be America’s Prelim GDP and CB Confidence numbers. A second set of positive data points from the U.S. and EU could help send the EUR/USD beyond previous November highs should psychological forces cooperate.

Present Price: 1.4991

Resistances: 1.4998, 1.5021, 1.5036, 1.5051, 1.5070, 1.5088

Supports: 1.4983, 1.4963, 1.4952, 1.4936, 1.4918, 1.4902, 1.4882, 1.4859

Psychological: 1.50, November Highs and Lows

GBP/USD Bounces on Broad-Based Dollar Weakness

The Cable has stabilized nicely after Friday’s sizable selloff. The GBP/USD has popped back above its psychological 1.65 level and 11/12 lows as the currency pair benefits from a positive wave of EU and U.S. econ data. The set of Flash EU PMI data and U.S. Existing Home Sales came in altogether positive, and the S&P futures have responded by knocking on the door of previous 2009 highs. Meanwhile, gold has surged beyond its psychological $1150 level and is trading around $1170/oz at the moment. Hence, the Cable’s correlative forces are helping buoy the currency pair after testing our 2nd tier uptrend line. Our 2nd tier uptrend line carries some weight since it runs through previous November lows. Therefore, a failure of our 2nd tier could imply a more extensive retracement towards 1.63. However, today’s strength in the Cable has created some breathing room and now has multiple uptrend lines serving as technical cushions along with the psychological 1.65 level once again. As for the topside, the GBP/USD still faces multiple downtrend lines 10/23 and 11/18 highs. Hence, the Cable seems to have its work cut out for it to the topside.

Britain will re-enter the data wire tomorrow with the release of BBA Mortgage Approvals and Prelim Business Investment. Last week’s discouraging outlook from Nationwide and Bloomberg in regards to the outlook for Britain’s housing market in 2010 could place a little more weight on tomorrow’s Mortgage Approvals number. However, investors will likely be paying more attention to Britain’s Inflation Report Hearings. The last BoE monetary policy vote revealed a bit of disagreement, thereby stirring up some investor uncertainty. On the other hand, if tomorrow’s inflation report signals encouraging developments in Britian’s inflationary outlook, then the BoE may be more inclined to apply a bit more of a hawkish monetary stance. Regardless of the outcome, tomorrow’s fate of the U.S. Dollar may rest on the shoulders of the U.S. Prelim GDP release. A positive Prelim GDP number could entice investors to put some more money to work in riskier asset classes, thereby devaluing the Dollar and benefitting the Cable, and vice versa. Therefore, investors should keep a close eye on America’s GDP number since it could prove to be a market mover.

Present Price: 1.6624

Resistances: 1.6636, 1.6664, 1.6694, 1.6730, 1.6761, 1.6794, 1.6851

Supports: 1.6605, 1.6571, 1.6527, 1.6489, 1.6457, 1.6427, 1.6398

Psychological: 1.65, November Highs and Lows, 1.70

USD/JPY Continues Consolidation Amid FX Fluctuations

The Cable has been relatively stable despite recent volatility in most Dollar crosses along with gold flying towards $1175/oz. Investors were sending the Yen lower earlier today after a set of positive EU PMI data points along with the Dollar weakening in reaction to recent dovish statements from Fed members. However, the USD/JPY has recovered earlier losses and is pushing higher towards 89 after U.S. Existing Home Sales topped analyst expectations. Therefore, it seems the USD/JPY’s correlative pattern is a combination of investor appetite for the risk trade countering comparatively loose monetary policy from the Fed. Since the Fed and the BOJ both have their benchmark rates sitting just above zero, the aforementioned forces see to be cancelling each other out and creating comparatively subdued activity in the USD/JPY. However, it will be interesting to see how the USD/JPY reacts to tomorrow’s wave of data and news.

The BoJ will kick off Tuesday’s session with the release of the BoJ’s Monthly Report. While the BoJ has maintained its neutral monetary policy stance, the DPJ is beginning to place a bit of pressure on the BoJ to add some liquidity measures to counter deflation and aid the economy. Despite the chatter, these are just psychological forces right now, although it will be interesting to see what the monthly report reveals and how investors react. In addition to the BoJ’s report, the U.S. will release its Prelim GDP number along with a host of news and data from the EU and Britain. Therefore, tomorrow’s data has the potential to stir up volatility should it surprise in either direction.

Technically speaking, the USD/JPY has held strong above November lows and what is now our 2nd tier uptrend line. We’ve added a 1st tier uptrend line that runs through October lows should conditions deteriorate. Therefore, despite recent weakness, the USD/JPY still has what appear to be sturdy technical cushions in place. As for the topside, the currency pair faces multiple downtrend lines along with 11/18 highs and of course the highly psychological 90 level. Therefore, quite a few topside obstacles remain, especially considering the USD/JPY still has long-term downtrend forces in play.

Present Price: 88.95

Resistances: 89.02, 89.17, 89.35, 89.51, 89.64, 89.82, 90.03

Supports: 88.81, 88.72, 88.57, 88.45, 88.30, 88.18, 88.01

Psychological: 90 and October Lows

Gold Rockets Towards $1175/oz

Gold is defying gravity and continues its incredible run despite fluctuations in the EUR/USD and AUD/USD. Gold continues to have a mind of its own and is rising rapidly regardless of comparatively limited participation from the precious metal’s usual correlative forces. Hence, there are clearly alternative forces driving gold higher. Ultimately, it seems that the Fed’s dovish monetary policy combined with mounting U.S. debt is causing investors and central banks to diversify from the Dollar and pile into gold as the safest alternative. As a result, gold continues to charge higher despite some analyst warnings of a bubble. Overall, it will be interesting to see whether gold can continue its ascent towards the psychological $1200/oz level, and whether the precious metal’s usual positive correlation with the Dollar eventually kicks into place. If so, this would likely imply a large selloff in the Dollar. Meanwhile, volatility in the FX markets could pick up tomorrow with the release of U.S. Prelim GDP along with a host econ data and news from Britain and the EU. Investors should keep an eye on the EUR/USD. If the EUR/USD should find the strength to break through 1.50 and previous November highs, this could help fuel gold’s run towards $1200/oz.

Technically speaking, we’re unable to place any notable topside barriers or downtrend lines on our chart due to the lack of historical perspective. Therefore, the psychological $1175/oz and $1200/oz levels appear to be the only topside technicals at work for the time being. As for the downside, we continue to move our multiple uptrend lines higher while 11/20 lows and the psychological $1150/oz level serve as technical cushions.

Present Price: $1169.80/oz

Resistances: $1170.16/oz, $1173.02/oz

Supports: $1163.85/oz, $1160.69/oz, $1152.65/oz, $1150.09/oz, $1139.50/oz, $1132.01/oz

Psychological: $1175/oz, $1200/oz, $1050/oz

The S&P Futures Knock on the Door of 2009 Highs

Another positive U.S. Existing Home Sales release is appeasing investors after Friday’s retracement below 1100. In addition to the positive Existing Home Sales number, investors are reacting favorable to another wave of encouraging EU Flash PMI data points. Furthermore, Fed members continue to support the anticipation that the central bank is not likely to raise rate until well into 2010. Such a loose monetary policy is favorable for corporate performance due to the abundance of cheap cash. As a result, investors are shrugging off last week’s wave of sluggish econ data, and are opting to focus on a weakening Dollar along with another surge in gold.

The Dollar is experiencing broad-based weakness today as gold charges higher towards $1075/oz. The Fed’s incessant dovish monetary policy is encouraging investors to disfavor the Dollar and divest their money into various safe havens, such as gold. A weaker Dollar also benefits U.S. corporate performance since it makes U.S. goods more attractive to foreign demand, thereby boosting exports and decreasing America’s trade deficit. That being said, investors are highly anticipating tomorrow’s Prelim GDP release. Analysts are expecting GDP growth of 2.9%. A reading above or below this figure could prove to be a market mover. In addition to Prelim GDP, investors will receive CB Consumer Confidence data along with the S&P/CS HPI number. Furthermore, the EU and Britain will release their own host of econ data. As a result, we could be in for an active trading session tomorrow considering the combination of events.

Technically speaking, the S&P futures presently have limited near-term topside technical barriers in the form of previous 2009 highs. As for the downside, there are potentially multiple uptrend lines we can form to serve as technical cushions along with 11/20, 11/13, and 11/6 lows. Meanwhile, the highly psychological 1100 level could continue to play a factor unless tomorrow’s wave of econ data dislodges the S&P futures from 1100’s gravitational pull.

Price: 1108

Resistances: 1107, 1112

Supports: 1098, 1090.25, 1082.5, 1072.5, 1066, 1061.75

Psychological: 1100, Previous 2009 Highs, 1075

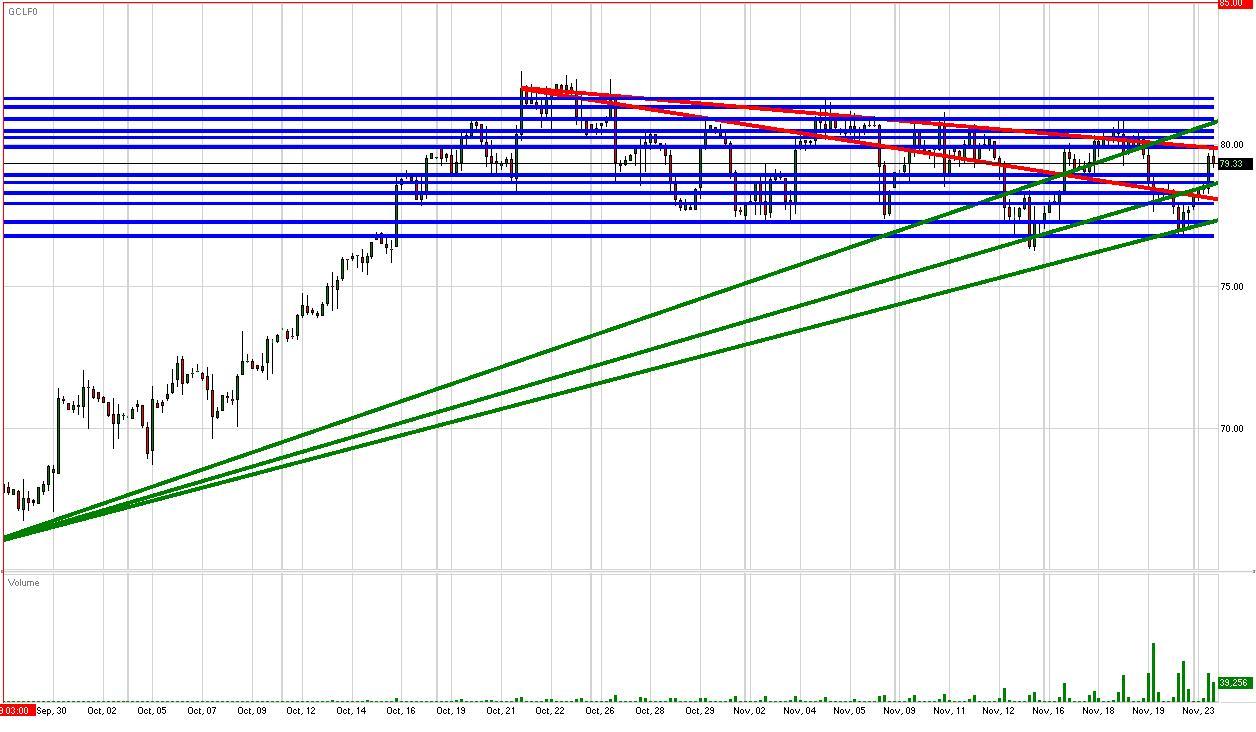

Crude Continues Fluctuations Towards $80/bbl

Crude futures are continuing their consolidative behavior around the highly psychological $80/bbl area. Crude is popping from Friday lows in reaction to broad based weakness in the Dollar, and the S&P futures strengthening above their psychological 1100 level again. Meanwhile, gold is skyrocketing towards $1175/oz as investors divest from the Dollar and flock towards the precious metal instead. All of today’s developments are positive catalysts for crude and keep its uptrend alive and well. However, crude still faces headwinds in the form of our 2nd tier downtrend line, $80/bbl, and previous November highs. Therefore, it seems crude may opt to wait and see how tomorrow’s U.S. Prelim GDP number fares. That being said, investors should monitor the reaction of the Dollar and U.S. equities upon the release of tomorrow’s GDP number along with a host other U.S., EU, and British econ data. A breakout in the S&P and/or EUR/USD could help push crude beyond its aforementioned technical barriers. As for the downside, Crude managed to avoid a retest of 11/13 lows and $75/bbl on Friday, a positive development. Our 1st and 2nd tier uptrend lines serve as technical cushions along with 11/20 and 11/13 lows. If conditions should deteriorate, $75/bbl could prove to be a reliable psychological support.

Price: $79.33/bbl

Resistances: $79.91/bbl, $80.25/bbl, $80.49/bbl, $80.90/bbl, $81.32/bbl, $81.62/bbl

Supports: $78.94/bbl, $78.66/bbl, $78.29/bbl, $77.92/bbl, $77.26/bbl, $76.78/bbl

Psychological: $80/bbl, 2009 Highs, $75/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.