Comprehensive FX and Futures Daily Commentary

FastBrokers Research Team from FastBrokersFX at 01/20/10

Daily Market Commentary

EUR/USD Crashes Following Negative Comments Concerning Greece

The EUR/USD is getting pummeled after the IMF’s Director joined the party in issuing a negative comment concerning the state of Greece’s economy. Greece’s poor economic state is hammering the Euro, exemplified by a huge downturn in the EUR/GBP. Furthermore, the setback in this week’s Economic Sentiment data wasn’t much help. Meanwhile, China’s tighter monetary policy stance is worrying investors that this may have a discernable impact on global growth should the central bank continue its course. During today’s U.S. trading session Building Permits registered an encouraging increase while inflation remained in a sedated state. The bump up in Building Permits has yielded strength in the Dollar so far and gold has taken a step down. Strength in the U.S. economy amid instability in the EU and tightening from China leads investors to favor the Dollar over its major crosses. However, earnings have been negatively mixed thus far. Should this earnings season disappoint this could stabilize the Dollar since investors would expect the Fed to maintain a loose monetary policy. That being said, it seems currencies may continue to behave on their own fundamentals, particularly the Euro until the full ramifications of Greece’s debt problem is realized. Attention will now turn to China’s GPD and Industrial Production data tomorrow. China’s recent efforts to tighten liquidity imply strong economic data coming. While one would expect this to have a positive impact on the risk trade, should China’s economic data far exceed expectations then investors may anticipate China’s tightening to pick up pace, a negative development for the risk trade. Regardless, volatility could remain at a heightened state for the next 24 hours. The EU will release its Flash PMI data set tomorrow. Strong PMI data could help stem the bleeding in the Euro, whereas more weak economic data would likely place even more downward pressure on the currency.

Technically speaking, we’ve left our downtrend lines on the chart to give investors a clear picture in regards to the extent of the EUR/USD’s collapse. The EUR/USD is also dragging below our current 1st tier uptrend line, which runs through August lows, or the 1.38 area. Hence, there could be even more room to the downside over the near-term should the currency pair not hop back above this trend line soon. In the meantime, the psychological 1.40 area could serve as a technical cushion should it be tested. As for the topside, there are multiple downtrend lines we can form considering the pace of the EUR/USD’s pullback. Hence, the road to recovery looks like an uphill battle.

Present Price: 1.4135

Resistances: 1.4146, 1.4165, 1.4191, 1.4224, 1.4247, 1.4274

Supports: 1.4112, 1.4084, 1.4065, 1.4046, 1.4023, 1.3999

Psychological: 1.40

GBP/USD Drops with Strong Dollar

The Cable has pulled back to our 1st tier uptrend line despite the continuation of strong economic data from the UK. CPI came in much hotter than anticipated yesterday, indicating the BoE could have a tough time keeping such a dovish monetary policy stance considering how much weight the central bank places on inflation. However, King tried to downplay the pop in CPI last night and this helped contain the Cable. In addition to yesterday’s strong CPI, today’s CCC number came in much lower than analyst expectations, indicating the UK’s employment picture continues to improve. The recent positive economic data from the UK has yielded an extensive relative strength in the Pound, highlighted by a collapse in the EUR/GBP. Such optimism concerning the Pound could continue until we see Friday’s Retail Sales number. However, the Euro’s rapid decline and concern regarding China’s tighter monetary policy stance has dragged down the risk trade, bringing the Cable along for the ride. That being said, the Cable has held up relatively well and is still trading above all of our previous trend lines. Meanwhile, attention will shift to the East with China’s GDP and Industrial Production data on deck. It will be very interesting to see how investors react to this data set. China’s recent hawkish monetary policy stance hints that the data will outperform. Although, should China’s economic data come in much stronger than analyst expectations then investors may actually be turned off by the risk trade in the anticipation of even more hawkish liquidity measures from the central bank. Investors will also digest UK CBI Industrial Order Expectations along with U.S. Unemployment Claims and the Philly Manufacturing Index. Hence, volatility could remain at a heightened state for the next 24 hours.

Technically speaking, as we mentioned the Cable has held up very well considering the plight of the EUR/USD. The Cable has held strong above our 4th tier uptrend line and still has multiple uptrend lines serving as technical cushions along with 1/15 and 1/13 lows. As for the topside, the Cable faces multiple downtrend lines along with 1/15 and 1/19 highs. Furthermore, the psychological 1.645 area could prove to be a technical barrier should it be tested.

Present Price: 1.6275

Supports: 1.6262, 1.6238, 1.6214, 1.6184, 1.6161, 1.6137

Resistances: 1.6303, 1.6318, 1.6340, 1.6360, 1.6379, 1.6407

Psychological: 1.60, 1.65, January highs and lows

USD/JPY Strengthens after Strong U.S. Building Permits

The USD/JPY has strengthened towards our 1st tier downtrend line after U.S. Building Permits data showed an encouraging improvement. Investors proceeded to snap up the Dollar across the board and sent gold tumbling. Improvements in the U.S. economy have led investors to prefer the Dollar over the Yen considering recent Japanese economic data has left something to be desired. Furthermore, investors should keep in mind that both the BoJ and Finance Ministry have reiterated their preference for a weaker Yen, implying the BoJ’s monetary policy should remain loose for quite some time. Hence, more positive economic data streams from the U.S. could yield additional gains in the USD/JPY over the near-term. That being said, the U.S. will release weekly Unemployment Claims and the Philly Manufacturing Index tomorrow. Meanwhile, attention will turn to China’s economic data set being released during tomorrow’s Asia trading session. China’s economic data could increase volatility across the board considering the weight being placed on recent monetary policy action from the central bank. Therefore, volatility could remain at a heightened state over the next 24 hours.

Technically speaking, the USD/JPY has multiple uptrend lines serving as technical cushions along with intraday and 1/19 lows and the highly psychological 90 level should it be tested. As for the topside, the USD/JPY faces multiple downtrend lines along with 1/14 and 1/12 highs.

Present Price: 91.32

Resistances: 91.46, 91.63, 91.84, 92.04, 92.25, 92.46

Supports: 91.12, 90.91, 90.75, 90.54, 90.37, 90.24

Psychological: 90, January highs and lows

Gold Tumbles Amid Broad-Based Dollar Strength

Gold is undergoing a heavy selloff right now in reaction to a combination of a huge pullback in the Euro combined with broad-based Dollar strength after an encouraging improvement in U.S. Building Permits. Today’s rally in the Dollar has had its expected impact on gold considering their negative correlation. Losses accelerated in the precious metal after it dipped below our 3rd tier uptrend line. Meanwhile, it seems that a retest of our 1st tier uptrend line and the highly psychological $1100/oz level could be in order. Attention will now turn to China with the release of GDP and Industrial Production coming during tomorrow’s Asia trading session. Furthermore, investors will receive EU PMI data along with U.S. weekly Unemployment Claims and the Philly Manufacturing Index. Hence, volatility could remain at a heightened state for the next 24 hours. That being said, investors should keep a close eye on the interaction between gold and its highly $1100/oz level should it be tested. Furthermore, investors should take note of signs of stability in the major Dollar crosses, particularly the EUR/USD. Once the EUR/USD does create a base this should yield stability in gold as well.

Present Price: $1113.30/oz

Resistances: $1114.45, $1118.16/oz, $1121.93/oz, $1125.93/oz, $1128.42/oz, $1134.33/oz

Supports: $1111.01/oz, $1109.15/oz, $1106.04/oz, $1100.44/oz, $1096.40/oz, $11093.29/oz

Psychological: $1100/oz

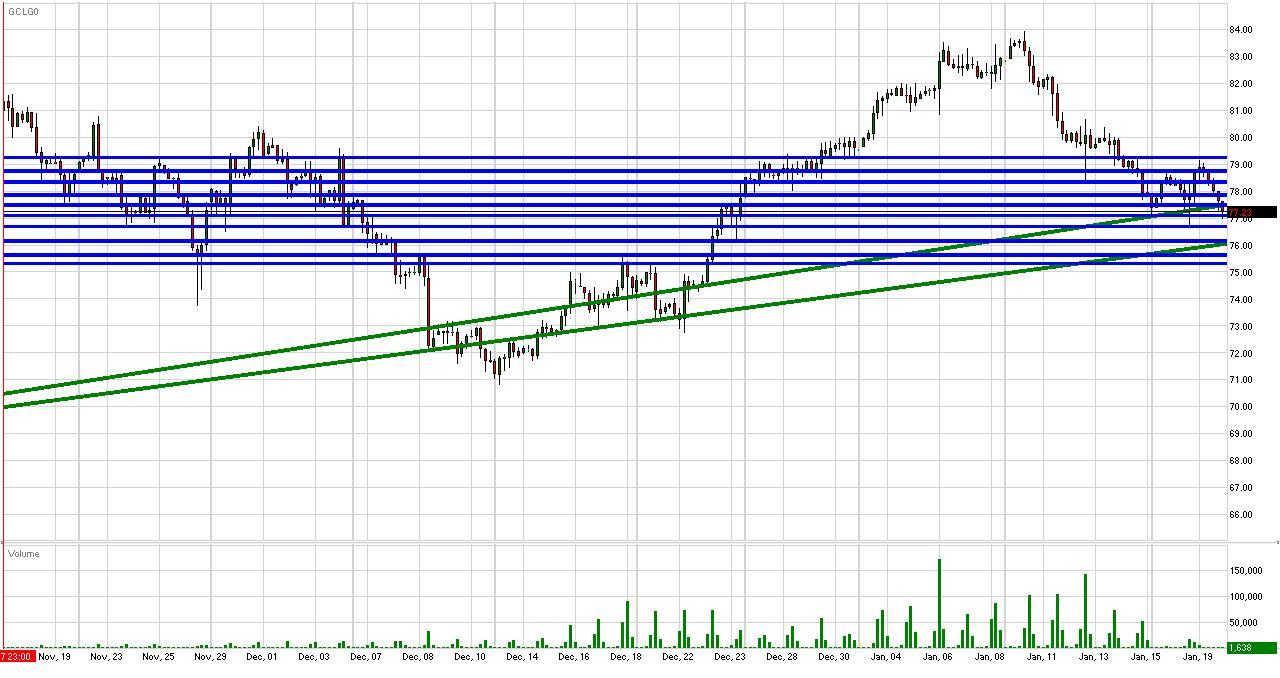

Crude Futures Head South as Dollar Advances

Crude futures are trading lower today after a failed attempt to retest the highly psychological $80/bbl level. Crude is being dragged lower despite encouraging U.S. Building Permits data. The Dollar is strengthening across the board, particularly against the Euro after the director of the IMF delivered a discouraging statement in regards to the status of Greece’s economy. Therefore, it seems crude is exercising its negative correlation with the Greenback today. However, losses in crude are only moderate considering the gains we’re witness in the Dollar. Meanwhile, China’s central bank continues to send signals that it is serious about tightening liquidity. China has been a driver of demand for crude. Hence, a cool down in China could have a negative impact on the price of crude over the medium-term. Speaking of China, investors will receive important GDP and Industrial Production data tomorrow, which could be a market mover as far as crude and equities are concerned. Additionally, the U.S. will release weekly Unemployment Claims along with the Philly Manufacturing Index. An improvement in unemployment and manufacturing could boost the outlook for domestic demand.

Technically speaking, crude futures are still trading below their highly psychological $80/bbl level, a negative development. The futures currently have our 1st and 2nd tier uptrend lines serving as technical cushions along with 1/19 and 12/23 lows. Furthermore, the psychological $75/bbl level could serve as a solid support should it be tested. As for the topside, crude faces technical obstacles in the form of 1/19 and 1/13 highs and the highly psychological $80/bbl level.

Price: $77.23/bbl

Resistances: $77.48. $77.87/bbl, $78.33/bbl, $78.76/bbl, $79.25/bbl

Supports: $77.10/bbl, $76.69/bbl, $76.15/bbl, $75.63/bbl, $75.32/bbl

Psychological: $80/bbl, $75/bbl, January highs and lows

S&P Futures Drop on Disappointing Earnings and China News

The S&P futures are being dragged lower today after earnings from both IBM and Bank of America disappointed analysts. Meanwhile, the Dollar is strengthening across the board with heavy losses in the EUR/USD after the director of the IMF made a discouraging statement in regards to the state of Greece’s economy. The combination of negative earnings releases and uncertainty in the EU has trumped stronger than expected Building Permits number from the U.S. Also dragging on the S&P futures is further monetary tightening from China. China’s central bank is sending a clear message that the government plans to cool down economic growth. That being said, China will release GDP and Industrial Production during tomorrow’s Asia trading session. Should tomorrow’s economic data eclipse analyst expectations the FX markets could experience speculation in regards to more hawkish monetary measures from China. Tighter liquidity in China could have as noticeable impact on global growth since China’s economy has been the engine driving the recovery from the nadir of the Great Recession. The U.S. will also release weekly Unemployment Claims tomorrow along with the Philly Fed Manufacturing Index. Hence, the markets could be in for another volatile 24 hours. Meanwhile, investors should keep an eye on the FX markets, particularly the Cable. The GBP/USD has held up relatively well in the midst of today’s broad-based strength in the Dollar. If the Cable decides to join the downturn and slips below our uptrend lines this could be a sign of another leg of up for the Dollar, a negative development for the S&P futures considering the negative correlation they’re exhibiting.

Technically speaking, the S&P futures are currently fighting to stay above our key 1st tier uptrend line. Our 1st tier runs through December 17 lows. Hence, a collapse of our 1st tier could yield a more extensive pullback towards the psychological 1100 level. As for the topside, the S&P futures face technical obstacles in the form of 1/18 and 1/19 highs along with the psychological 1150 level should it be tested.

Price: 1128.50

Resistances: 1131, 1134, 1138.75, 1141.75, 1145.5

Supports: 1127.25, 1124.5, 1120, 1116.5, 1113.25

Psychological: 1150, 1100, 2010 Highs and January Lows

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.