Daily volatility is increasing in all markets including Forex

Pierre Charlebois from Trading Metro at 11/02/09

The markets are definitely moving towards a break-out or reversal as daily volatility has returned. As the long-term trend has been quite one-sided it stands to reason that this could signal a larger reverse.

I will caution that there is always a chance the trend will end with a bang and a further push to new highs and lows on some currencies pairs is possible. The other consideration of course is that a strong pull back in wave 2 on the Index is also a possibility. However I think the bottom line is to look for further USD strength in the bigger picture.

USD Index - Looks impulsive - A three wave pull back and continuation would bolster the Bullish USD view

EUR/USD - The long term trend-line is at risk - A bounce or new high is possible but I believe the upside is limited

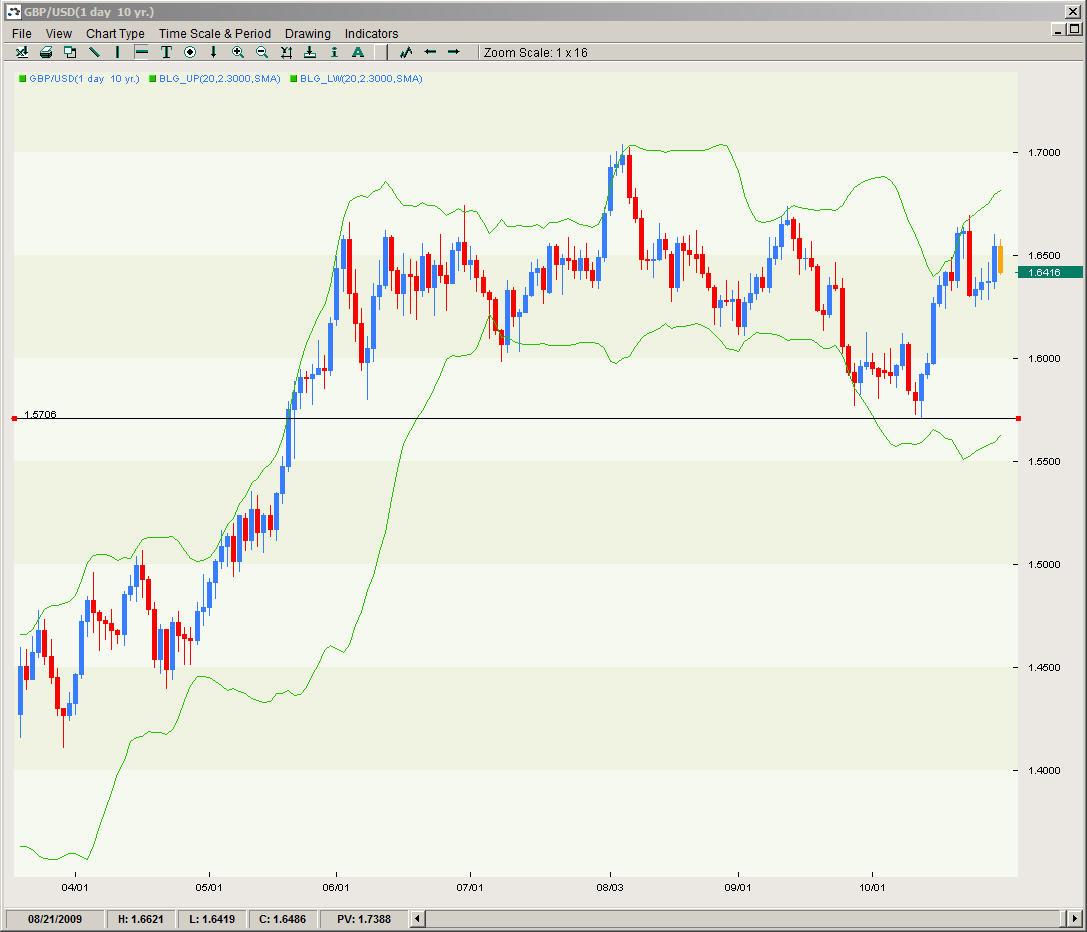

GBP/USD - A new high or drop have about equal weight possibility on this pair. Of course the downside level to watch is 1.5706

USD/JPY - Yen strength and Dollar strength correlate when risk aversion is the theme. The move up looks corrective so downside is possible mid-term

USD/CHF - I'm not sure what the sort-term EW count is, However 1.0287 could be the key level

USD/CAD - Friday's closing price of 1.0818, is a key pivot point the this pair

AUD/USD - Like the EUR/USD, a top is not guaranteed but a new top should signal a new drop

NZD/USD - This pair should bounce but further drops would be expected

EUR/JPY - Key levels are 1.40 and 1.30