EUR Gains Versus the USD

UFXBank Research from UFX Bank at 01/05/10

Daily Review 05/01/2010

USD Dollar (USD) – The Dollar weakened versus the Euro and the Yen and gained versus the Pound as more signs of recovery raise demand for higher yielding currencies. ISM Manufacturing PMI came out stronger than expected with 55.9. NASDAQ and Dow Jones jumped by 1.73% and 1.50% respectively on the first trading day of 2010. Crude gained by 2.73% closing at 81.53$ a barrel and Gold (XAU) strengthened by 2.26% closing at 1120$ an ounce on weaker Dollar and higher demand for commodities. Today, Pending Home Sales are expected with -2.3% versus 3.7% prior. Factory Orders are expected with 0.5% versus 0.6% prior.

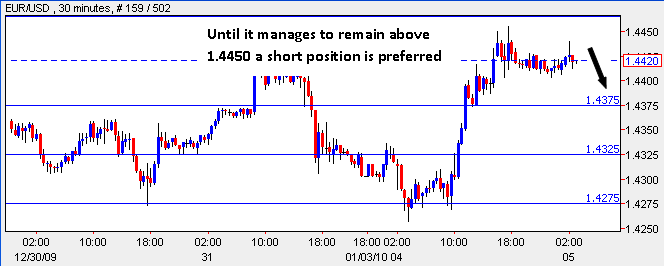

EURO (EUR) –The Euro gained versus the Dollar after Final Manufacturing PMI came out as expected with 51.6 and Italian Prelim CPI came out better than expected with 0.2%. Stocks rallied as more economic recovery signs lifted risk appetite for higher yielding assets again. Overall, EUR/USD traded with a low of 1.4257 and a high of 1.4455. EUR/USD is trapped between 1.4250 and 1.4450 and no clear trend is available. Today, German Unemployment Change is expected with 6K versus -7K prior. CPI Flash Estimate is expected with 0.9% versus 0.5% prior.

EUR/USD - Last: 1.4410

Resistance 1.4465 1.45 1.4525

Support 1.4375 1.4325 1.4275

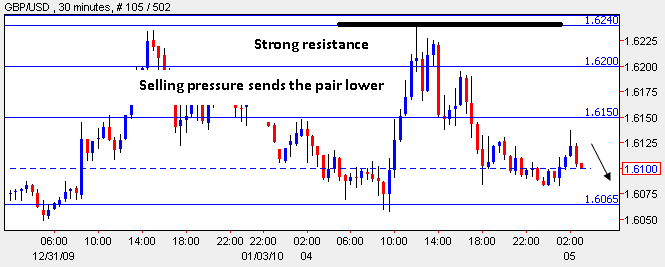

British Pound (GBP) – The Pound weakened versus the Dollar after earlier reaching its highest rate in 2 weeks. Manufacturing PMI came out stronger with 54.1 and Net Lending to Individuals came out stronger with 1.1B leading the Pound toward 1.6235 resistance level, but selling pressure along with U.S economic data drove the pound lower to 1.61 again. Until GBP/USD is able to remain above 1.62 a short position is preferred. Overall, GBP/USD traded with a low of 1.6058 and a high of 1.6240. Today, Construction PMI is expected 47.6 versus 47 prior.

GBP/USD - Last: 1.6090

Resistance 1.615 1.62 1.624

Support 1.6065 1.602 1.599

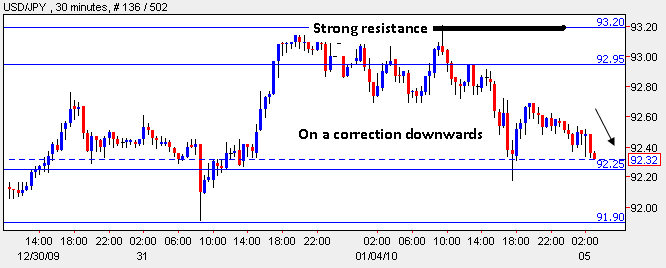

Japanese Yen (JPY) –The Yen gained versus the Dollar after overbought conditions and the Dollar's weakness versus the other majors led the Dollar lower. Monetary Base came out stronger with 5.2% versus 3.5% expected. Overall, USD/JPY traded with a low of 92.18 and a high of 93.21. USD/JPY is facing strong resistance at 93.30 and until it breaks above this level it is more likely to continue its correction downwards. No major economic data expected today.

USD/JPY-Last: 92.45

Resistance 92.95 93.2 93.5

Support 92.25 91.9 91.6

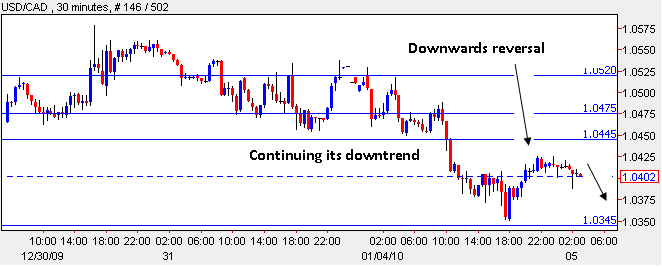

Canadian Dollar (CAD) – The Canadian Dollar gained versus the Dollar as more economic recovery signs pushed commodities and higher yielding assets higher. Overall, USD/CAD traded with a low of 1.0351 and a high of 1.0517. USD/CAD is pushing lower toward the continuance of its long term downtrend. Today, RMPI is expected with 1.2% versus 2.5% prior.

USD/CAD - Last: 1.0420

Resistance 1.0445 1.0475 1.052

Support 1.0345 1.0315 1.0265