EUR Weakens Versus USD and GBP

UFXBank Research from UFX Bank at 11/18/09

Daily Review 18/11/2009

USD Dollar (USD) – The Dollar gained versus most majors as Industrial Production came out weaker, lowering risk appetite. Industrial Production came out 0.1% versus 0.4% expected. PPI came out weaker with 0.3% versus 0.6% forecast. TIC Long-Term Purchases came out better with 40.7B versus 27.3B expected. NASDAQ and Dow Jones rose slightly by 0.27% and 0.29%. Crude gained by 0.68% closing at 79.44$ a barrel and Gold (XAU) remained almost unchanged with 0.16% change closing at 1140.5$ an ounce. Today, Building Permits are expected higher with 0.59M versus 0.57M prior and Core CPI is expected with 0.1% versus 0.2% prior. Housing Starts are expected higher with 0.61M versus 0.59M and Crude Inventories are expected with 1.2M versus 1.8M prior.

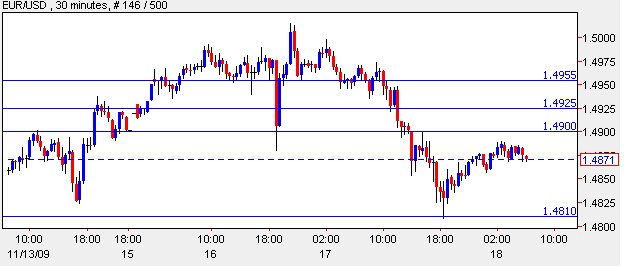

EURO (EUR) –The Euro weakened versus the Dollar and the Pound as risk appetite weakened and ECB's president Trichet said a strong Dollar is important for the world economy. European Trade Balance came out better than expected with 6.8B versus -0.9B expected. EUR/USD traded with a low of 1.4806 and with a high of 1.4998. Today, European Current Account is expected with 0.6B versus -1.3B prior. ECB President Trichet will speak in Frankfurt.

EUR/USD - Last: 1.4870

Resistance 1.49 1.4925 1.4955

Support 1.481 1.474 1.4703

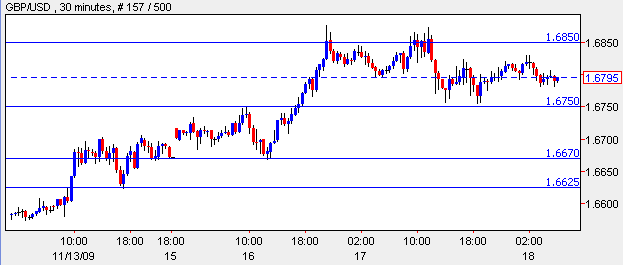

British Pound (GBP) – The Pound remained almost unchanged versus the Dollar as CPI figures came out better than expected but Industrial Production in the U.S lowered investors Risk Appetite. CPI came out 1.5% versus 1.4% expected and RPI came out -0.8% versus -0.9% expected. Overall, GBP/USD traded with a low of 1.6755 and a high of 1.6872. Today, MPC Meeting Minutes will be released. CBI Industrial Order Expectations are expected with -47 versus -51 prior.

GBP/USD - Last: 1.68

Resistance 1.685 1.69 1.6955

Support 1.675 1.667 1.6625

Japanese Yen (JPY) –The Yen gained versus the Euro and weakened versus the Dollar as risk appetite lowered after Industrial Production in the U.S came out weaker than expected. Overall, USD/JPY traded with a low of 88.73 and a high of 89.53 and EUR/JPY traded with a low of 132.44 and a high of 133.58. Today, All Industries Activity is expected with -0.1% versus 0.9% prior.

USD/JPY-Last: 89.17

Resistance 89.65 90 90.18

Support 88.8 88.6 88.25

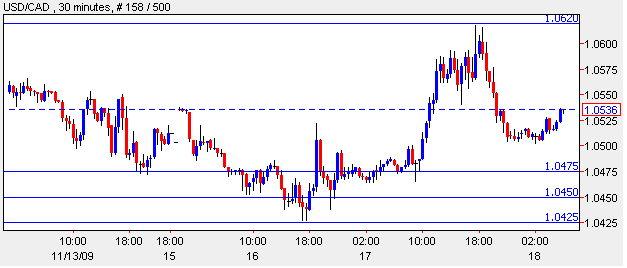

Canadian dollar (CAD) – The Canadian Dollar dropped as Risk Appetite weakened following U.S production data. Overall, USD/CAD traded with a low of 1.0464 and a high of 1.0617. Today, Canadian CPI is expected with 0.2% versus 0% prior and Core CPI is expected with 0% versus 0.3% prior.

CAD/USD - Last: 1.0535

Resistance 1.062 1.068 1.0735

Support 1.0475 1.045 1.0425