Nasdaq and Dow Jones Declined

UFXBank Research from UFX Bank at 01/18/10

Daily Review 18/01/2010

USD Dollar (USD) – The Dollar gained versus most majors as stocks declined following investor's doubts about the economic recovery. Consumer Price Index came out worse with 0.1% versus 0.2% expected but had no effect. Michigan's Consumer Sentiment came out weaker as well with 72.8. NASDAQ and Dow Jones declined by -1.24% and -0.94% respectively led by drops in the financial sector. Crude dropped by -1.75% closing at 78$ a barrel and Gold (XAU) declined by -1.09% closing at 1130.10$ an ounce. Today is Martin Luther King Day and banks will be closed. Low liquidity and high volatility should be expected.

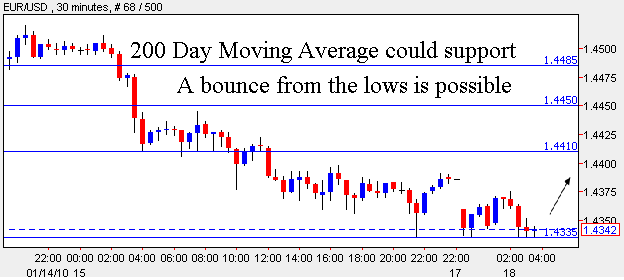

EURO (EUR) –The Euro fell versus the Dollar as Greece's debt concerns continued to lower investor's confidence in the Euro. CPI came out as expected with 0.9% and Core CPI came out better with 1.1% versus 1.0% forecast. Overall, EUR/USD traded with a low of 1.4336 and a high of 1.4503. EUR/USD fell after not being able to remain above the 1.45 level. The pair is near its 200 moving day average that will act as a support level. No major economic data expected today.

EUR/USD - Last: 1.4365

Resistance 1.441 1.445 1.4485

Support 1.4335 1.43 1.4265

British Pound (GBP) – The Pound weakened versus the Dollar after 5 consecutive days of gains as a result of declines in world stocks. Rightmove HPI came out positive with 0.4% versus -2.2% prior. Overall, GBP/USD traded with a low of 1.6212 and a high of 1.6355. GBP/USD has hit resistance level at 1.6350 along with 200 day moving average and a downside move is expected. No economic data expected today.

GBP/USD - Last: 1.6275

Resistance 1.63 1.6355 1.642

Support 1.6195 1.615 1.6115

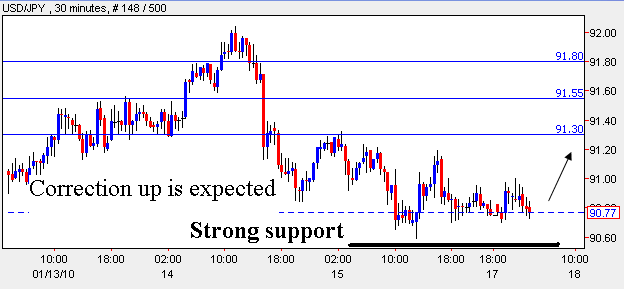

Japanese Yen (JPY) –The Yen gained versus the Dollar as declines in stocks lowered risk appetite and increased the appeal of the Yen as safety. Overall, USD/JPY traded with a low of 90.59 and a high of 91.32. USD/JPY has moved down and reached the 50% Fibonacci retracement from the upside movement it made in December. Along with the Fibonacci support level daily moving averages 50 and 100 are near and all these will support the pair near 90.50. Today, Household Confidence is expected stronger with 40.3 versus 39.5.

USD/JPY-Last: 90.85

Resistance 91.30 91.55 91.80

Support 90.40 90 89.80

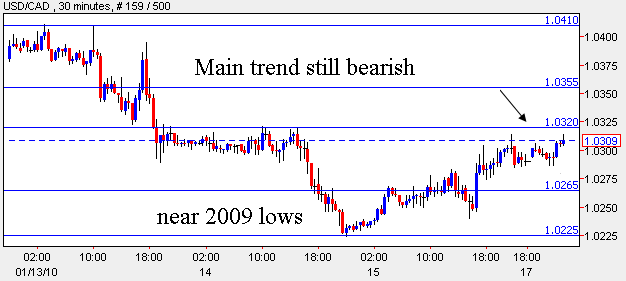

Canadian Dollar (CAD) – The Canadian Dollar weakened versus the Dollar as stocks and commodities dropped and demand for high yielding assets dropped. Overall, USD/CAD traded with a low of 1.0235 and a high of 1.0314. USD/CAD trend is still downwards but it is trading near its 2009 lows at 1.0205. A rebound back up is possible but it will be against the main trend. Today, Foreign Securities Purchases are expected lower with 5.23B versus 5.81B.

USD/CAD - Last: 1.0295

Resistance 1.032 1.0355 1.041

Support 1.0265 1.0225 1.0205