NASDAQ and Dow Jones Reach 13 Month Highs

UFXBank Research from UFX Bank at 11/17/09

Daily Review 17/11/2009

USD Dollar (USD) – The Dollar dropped versus the other after Fed Chairman Bernanke said interest rates would remain low to spur growth. Retail Sales came out at 1.4% better than 1% forecast but Core Retail Sales came out 0.2% worse than 0.4% forecast. NASDAQ and Dow Jones reached new 13 month highs with 1.38% and 1.45% gains respectively after Bernanke's speech. Crude gained by 3.3% closing at 78.87$ a barrel and Gold (XAU) jumped by 2.02% closing at 1140.4$ an ounce. Today, PPI is expected stronger with 0.6% versus -0.6% prior. TIC Long-Term Purchases are expected with 27.3B versus 28.6B prior. Industrial Production is expected with 0.4% versus 0.7% prior. FOMC Member Lacker will speak about his economic outlook at the State House Appropriation Committee in Richmond.

EURO (EUR) –The Euro gained versus the Dollar after Fed Chairman Bernanke commented the interest rates will remain low, spurring Risk Appetite. European CPI and Core CPI came out as expected with -0.1% and 1.2% respectively. EUR/USD traded with a low of 1.4880 and with a high of 1.5014. Today, European Trade Balance is expected with -0.9B versus 1B.

EUR/USD - Last: 1.4970

Resistance 1.5020 1.505 1.5115

Support 1.488 1.4825 1.474

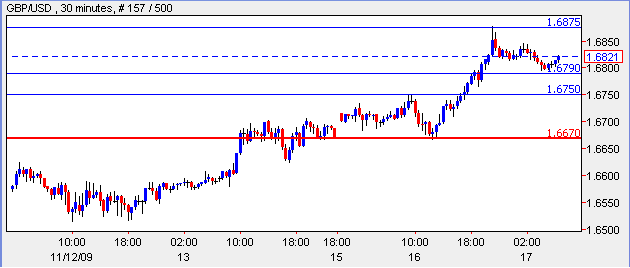

British Pound (GBP) – The Pound reached new 3 month highs versus the Dollar after Bernanke's speech spurred risk appetite. Overall, GBP/USD traded with a low of 1.6657 and a high of 1.6876. Today, CPI is expected stronger with 1.4% versus 1.1% prior. RPI is expected with -0.9% versus -1.4% prior.

GBP/USD - Last: 1.6825

Resistance 1.6875 1.69 1.6955

Support 1.679 1.675 1.667

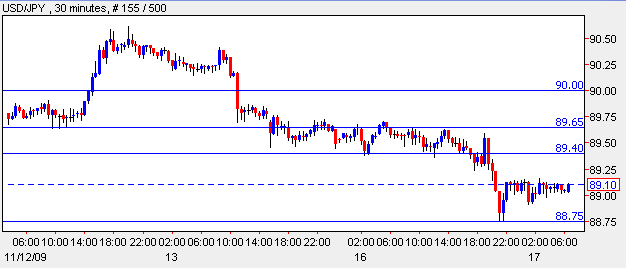

Japanese Yen (JPY) –The Yen gained versus the Dollar, Euro and the Pound as it Japan's economy showed the fastest growth pace in more than 2 years pulling Japan out of the recession. Tertiary Industry Activity came out weaker with -0.5% versus 0.1% expected and 0.3% prior. Overall, USD/JPY traded with a low of 88.74 and a high of 89.72 and EUR/JPY traded with a low of 133.18 and a high of 134.32. No major economic data is expected today.

USD/JPY-Last: 89.10

Resistance 89.4 89.65 90

Support 88.75 88.6 88.25

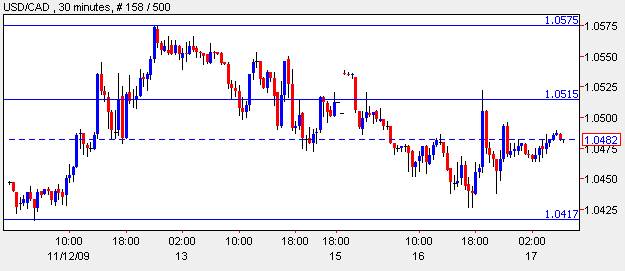

Canadian dollar (CAD) – The Canadian Dollar gained versus the Dollar as stocks and commodities gained. Manufacturing Sales came out 1.4% better than 1% expected and -1.8% prior. Overall, USD/CAD traded with a low of 1.0425 and a high of 1.0540. No major economic data is expected today.

CAD/USD - Last: 1.048

Resistance 1.0515 1.0575 1.061

Support 1.0417 1.038 1.0315