Since the middle of January, the AUD trades in a bearish trend channel against the CHF

Varengold Bank Research Team from Varengold Wertpapierhandelsbank AG at 02/10/10

Good morning from Hamburg and welcome to a new Daily FX Report. Yesterday, the new cruise ship AIDAblu was christened in the port of Hamburg with a big firework and more than 25,000 visitors. However, the USD gained versus 13 of its 16 major counterparts and the GBP fell to a three week low against the EUR.

The EUR dropped against the USD before the release of the Federal Reserve Chairmen Ben S. Bernanke`s testimony on the central bank’s strategy for ending its policy of low interest rates. The USD rose to 1.3767 versus the EUR. Furthermore the USD could climb against 13 of its 16 most traded counterparts before reports will forecast this week that the U.S. will reduce its trade deficit and retail sales rebounded. This increases the demand of the nation’s assets. The JPY lost versus the USD and traded at 89.76. The EUR traded near a three week high against the GBP on speculations that the Bank of England will cut its economic growth today. This was expected in its quarterly report. The EUR fetched to 0.8778 versus the GBP. The GBP fell against 11 of its 16 major counterparts.

In the U.S. reports showed that the trade gap shrank to 35.8 billion USD in December from 36.4 billion in the prior month. Sales at retailers rose 0.3 % in January, after a 0.3 % decline in December. Today, the Commerce Department will release the trade balance report.

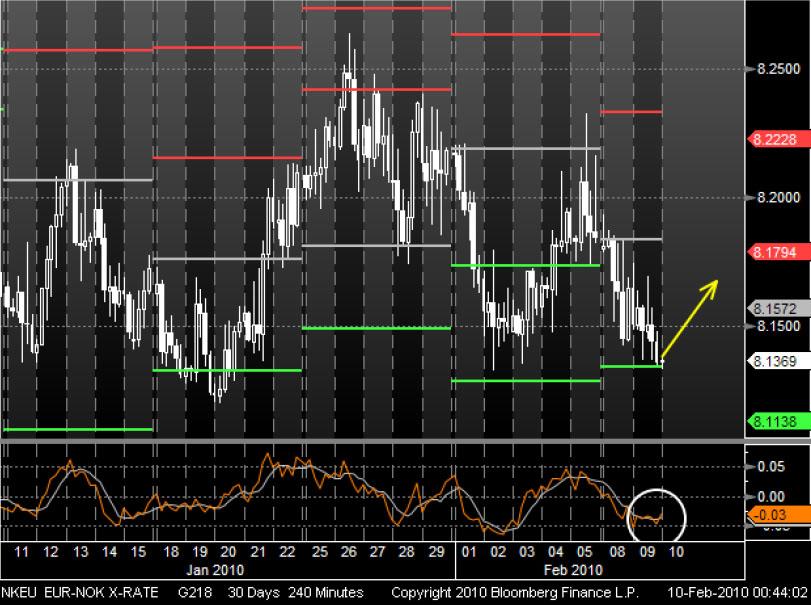

With the beginning of February, the EUR started an upward trend against the NOK. Recently, the currency pair rebounded and fell to its Pivot Point at 8.1138. It seems that this support could be strong enough to stop the current trend. Furthermore a crossing Momentum through the signal line from below may indicate a pull back for the EUR to its old level around 8.1572.

Since the middle of January, the AUD trades in a bearish trend channel against the CHF. At the moment, the price of the currency pair touches the upper line from the trend channel. Two times before, whenever this happened in the last two weeks, the price rebounded. Also the RSI indicator may support a further bearish trend channel with a continuing sideways trend.