The U.S. retail sales climbed an estimated 3.6 percent this holiday season

Varengold Bank Research Team from Varengold Wertpapierhandelsbank AG at 12/29/09

Good morning from Hamburg and welcome to Varengold’s Daily FX Report. The year draws to a close but we’re waiting for some interesting consumer data from the world’s biggest economy today. However, we wish you a prosperous trading day.

The USD extended its gains versus the JPY for the second day and traded near a two-month high at 91.78 on speculation that the Federal Reserve may reduce emergency stimulus measures as the U.S. economy recovers. Economists expect a U.S. report for today which may show that the consumer confidence rose this month. The U.S. retail sales climbed an estimated 3.6 percent this holiday season. Therefore the USD also strengthened against the EUR and traded during the Asia session around 1.4350. The JPY declined for the second day against most of its 16 major counterparts on concern the Bank of Japan will be the last major central bank which begins raising interest rates. “The BoJ may have to add more monetary ease or introduce more aggressive measures to arrest deflation”, a FX-Broker said in Tokyo.

The AUD/USD traded nearly unchanged in the early Tokyo trading hours as traders pared bets that the Reserve Bank of Australia will continue hiking interest rates. Also the NZD/USD was little changed at 64.87 after the currency pair rose 0.34 percent from 64.28 to 64.96 at its highest level yesterday.

During December the currency pair has been trading close to a bearish trend line and fell below the 1.4430 level. This level points a new resistance-line which repulsed the EUR now for the third time. Now it seems that the bears take control again and pulls the EUR/USD down, close to the second Fibonacci Fan. Also the declining MA Oscillator indicates a continuing downward-trend.

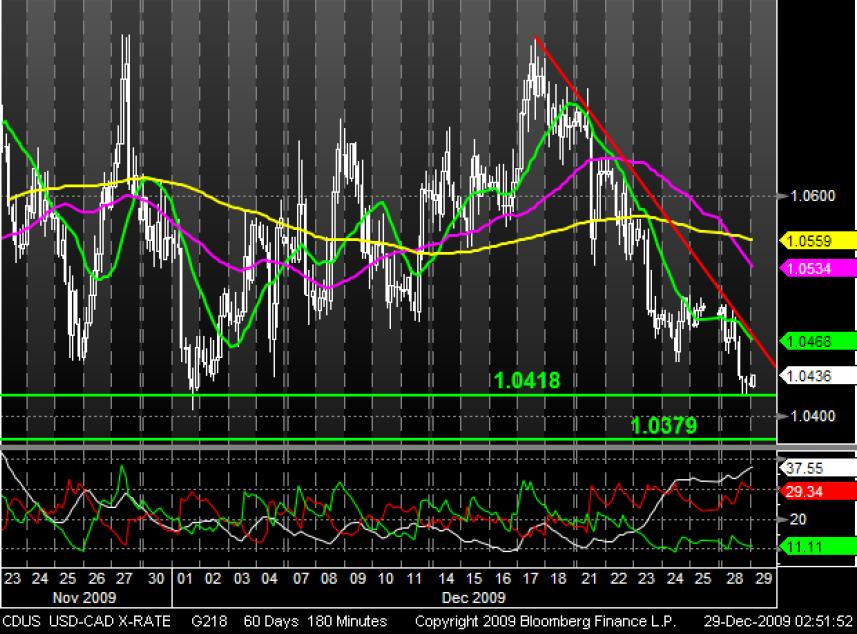

After the USD/CAD traded trend-less during December, the bears accelerated the downward movement at last. Today it seems that the currency pair tests its support at 1.0418. The DMI shows still a strong bearish trend and in considering of the crossed 200 day-line we may have to allow further losses for the USD. If the support at 1.0418 would break it may boost the downward movement straight to the next support at 1.0379.