Comprehensive FX and Futures Daily Research

FastBrokers Research Team from FastBrokersFX at 10/28/09

Daily Market Commentary

EUR/USD Consolidates above 10/13 Lows

The EUR/USD has undergone encouraging consolidation along what is now our 3rd tier uptrend line. Present consolidation comes with a sigh of relief considering the extent of the selloff in the EUR/USD thus far this week. Investors are encouraged by the better than expected Core DGO data even though the headline figure printed shallow by two basis points. Since the EU’s economy relies heavily upon manufacturing, the solid Core DGO number signals that export demand from the U.S. may be stable. However, investors are still cautious since equity markets have been behaving unfavorably lately. The S&P futures have drifted below our important 1st tier uptrend line, and are presently testing the patience of the psychological 1050 level. Any extended weakness in the S&P would likely drag the EUR/USD lower due to their positive correlation. Therefore, investors should keep a close eye on U.S. equities over the next 24-48 hours and monitor their interaction with our technicals in reaction to key economic data. The U.S. will release its Advance GDP tomorrow, and this data will likely be a market mover. A disappointing GDP number would likely send U.S. equities lower and investors towards the Dollar for safety, and vice versa.

In addition to tomorrow’s U.S. Advance GDP number, the EU will release German Unemployment Change data. Analysts are expecting an increase to 17k, likely due to the negatively mixed German PMI data as of late. The ECB has been quite these days, and the central bank is probably waiting to see how the next set of important econ data fares. Furthermore, the ECB should be happy that the EUR/USD has lost roughly 250 basis points from October highs. The pullback in the EUR/USD gives the ECB a little breathing room since the rapid appreciation of the Euro was beginning to squeeze EU exporters. Meanwhile, focus should remain on the U.S. since EU data will be relatively light until Friday’s Unemployment Rate and CPI Flash Estimate releases.

Technically speaking, the sharp movement below the psychological 1.50 level is a discouraging sign for bulls. However, there remain several uptrend lines we can form, meaning the EUR/USD has a few technical cushions to rely upon before investors can safely cry bear. Our new 1st tier uptrend line should gauge whether the EUR/USD is bound to retreat towards previous October lows and the psychological 1.45 level. As for the topside, the EUR/USD now has multiple uptrend lines bearing down on price and the psychological 1.50 level becomes a technical barrier once again. Overall, although the uptrend remains intact, investors should tread carefully since U.S. equities are facing headwinds.

Present Price: 1.4797

Resistances: 1.4819, 1.4844, 1.4863, 1.4890, 1.4925

Supports: 1.4783, 1.4764, 1.4727, 1.4700, 1.4671, 1.4638

Psychological: 1.50, 1.45

GBP/USD Treks Higher with our 2nd tier Uptrend Line

The Cable has managed to hold up well above our 2nd tier uptrend line despite recent strength in the Dollar. Investors were encouraged by yesterday’s positive CBI Realized Sales data considering the damage brought upon the Cable by Friday’s disappointing Prelim GDP data. The CBI release has allowed the Cable to consolidate with a slight upward bias and the currency pair has managed to salvage its near-term uptrend in the process. Additionally, today’s U.S. Core DGO data is helping buoy stocks about. However, the positive DGO showing is being negated by yesterday’s CB Consumer Confidence number along with the discouraging New Home Sales data that just printed. Therefore, U.S. data continues to be negatively mixed. The reason we’re speaking of the U.S. today is because this week is mostly about tomorrow’s Advance GDP data. The S&P futures have drifted below our key 1st tier uptrend line and are presently testing their psychological 1050 level. Therefore, tomorrow’s GDP data could determine whether the S&P is on a path to test 1000, or on a path towards stabilization. The reason the S&P is so important right now is due to the Dollar’s negative correlation with U.S. equities. Any extensive losses in U.S. equities coupled with rising investor uncertainty usually leads investors towards the Dollar for safety. Therefore, investors should keep a sharp eye on the S&P’s interaction with our technical levels and reaction to econ data over the next 24-48 hours.

Technically speaking, is facing multiple downtrend lines while the psychological 1.65 level hangs overhead. Meanwhile, our trend lines are approaching multiple inflection points, supporting our expectation of higher volatility. The GBP/USD’s last run topped out beneath 9/11 highs, meaning the currency pair has its work cut out for it to the topside since a reversal into a longer downtrend isn’t out of the question. As for the downside, the Cable has managed to avoid a retest of 9/21 lows thus far. Our 2nd tier uptrend line should play an important role in preventing such an occurrence. Meanwhile, though far away, the Cable still has our 1st tier uptrend line to fall back on along with the psychological 1.60 level and previous October lows should the situation deteriorate further. Therefore, the Cable’s uptrend is salvageable as long as near-term technical cushions hold up.

Present Price: 1.6350

Resistances: 1.6352, 1.6371, 1.6395, 1.6431, 1.6454, 1.6491

Supports: 1.6304, 1.6285, 1.6265, 1.6247, 1.6233, 1.6205

Psychological: 1.65, 1.60

USD/JPY Reverses and Dips Back Towards 91

The USD/JPY topped out yesterday and has been hit by a wave of downward pressure in reaction to the selloff in U.S. equities. Investors are taking profits in some of their riskier investment vehicles, including the USD/JPY. Additionally, the more negatively mixed U.S. econ data we receive, the less likely the Fed will tighten liquidity in the near future. Speaking of which, although today’s Core DGO outperformed analyst expectations by three basis points, both the headline DGO number and New Home Sales data came in negatively. Furthermore, yesterday’s CB Consumer Confidence reading was nothing to cheer about. Therefore, the U.S. economy is still in a funk and the recovery seems to be anemic. This is bad news for the Japanese economy since the export-reliant nation has been hit heavily by the large downturn in U.S. consumption. As a result, Japan is becoming increasingly reliant upon demand from China. If China’s impressive economic growth cools off as its stimulus wanes, this could put even further downward pressure on Japan’s economy. Although such events would likely favor a stronger Yen, we shouldn’t get ahead of ourselves. The USD/JPY has still created some breathing room above its highly psychological 90 level and a BoJ monetary policy decision is on the way.

The BoJ will announce its monetary policy decision late Thursday/early Friday EST. Barring any large selloff in the USD/JPY between now and then, the BoJ will likely feel comfortable sticking to its newly conservative monetary stance since the USD/JPY is back above its important 90 threshold. Meanwhile, Japan will release its Prelim Industrial Production data late tonight EST. Investors are expecting a slight pullback in the reading to 1.1%.

Technically speaking, the USD/JPY is trading back below our 1st tier downtrend line, meaning the currency pair has multiple uptrend lines to overcome now. Additionally, the currency pair will have to deal with 9/24 highs along with intraday highs. As for the downside, the psychological 90 area continues to work in the USD/JPY’s favor along with our 1st and 2nd tier uptrend lines. Despite today’s setback, the USD/JPY still has an opportunity to right itself and salves its technicals supporting a near-term uptrend. However, investors should keep in mind there is still a debilitating, long-term downtrend force at work.

Present Price: 91.09

Resistances: 91.19, 91.30, 91.43, 91.57, 91.70, 91.85

Supports: 90.89, 90.78, 90.66, 90.47, 90.34, 90.14

Psychological: 90

Gold Stabilizes Following Monday’s Technical Setback

Gold is presently consolidating around our 2nd tier uptrend line after experiencing a solid down-bar backed by a pop in volume on Monday. Gold’s recent weakness came in reaction to a stronger Dollar, particularly against the EUR/USD. We notice the AUD/USD is drifting lower as well, and this is a negative sign for gold considering it has exhibited a stronger positive correlation with these two major crosses. Meanwhile, the S&P futures have dropped below our important 1st tier uptrend line and are presently testing their psychological 1050 level after New Home Sales printed negatively. The S&P’s decline beneath our 1st tier could indicate a retracement towards previous October lows and the psychological 1000 area. Any extended weakness in U.S. equities of this sort would likely yield a stronger Dollar due their positive correlation, and consequently weaker gold. All eyes will be on tomorrow U.S. Advance GDP data. Therefore, investors should keep a close eye in the S&P’s interaction with our aforementioned technicals and their reaction to econ data.

Technically speaking, gold has our 1st tier uptrend line and 10/6 lows to fall back on along with the highly psychological $1000/oz area should the markets take a turn for the worst. As for the topside, gold is creating some new topside barriers as the precious metal heads south, beginning with 10/6 and 10/7 highs as well as the psychological $1050/oz level.

Present Price: $1036.05/oz

Resistances: $1043.60/oz, $1046.91/oz, $1049.98/oz, $1053.76/oz, $1058.26/oz

Supports: $1036.03/oz, $1032.01/oz, $1029.41/oz, $1024.44/oz, $1018.53/oz

Psychological: $1050/oz, $1000/oz.

The S&P Futures Test 1050 After Dipping Below our 1st Tier Uptrend Line

The S&P futures are testing their psychological 1050 level after drifting below our important 1st tier uptrend line. Our 1st tier runs through October lows, meaning we could potentially be in for a near-term retracement towards 1010 and the highly psychological 1000 zone. U.S. equities are reacting negatively to more disappointing economic data. Although Core DGO data beat expectations, the headline DGO number and New Home Sales both printed negatively. Therefore, New Home Sales continue to trail behind the recovery in Existing Home Sales data. This trend indicates buyers are likely snapping up homes in short sale or foreclosure instead of buying a new home. Regardless, the excess supply of housing is declining, albeit at a snail’s pace. In addition to today’s negatively mixed econ releases, yesterday’s CB Consumer Confidence number also came in well below analyst expectations, reflecting recent negative results from UoM data.

However, despite today’s pullback in the S&P futures, all eyes will be in tomorrow’s Advance GDP data. If Advance GDP can manage to top analyst expectations, this would likely provide a boost to U.S. equities and help the S&P stabilize. On the other hand, a negative showing from Advance GDP could just place further downward pressure on the S&P futures and actualize a retest of previous October lows. Meanwhile, the EUR/USD and AUD/USD are experiencing a sizable pullback as well, indicating an investor retreat from riskier investment vehicles.

Technically speaking, it will be interesting to see how much gravitational pull 1050 will have on the futures. Beneath present levels, the S&P futures have 9/28 and October lows serving as technical cushions along with the highly psychological 1000 level.

Price: 1048.75

Resistances: 1070.5, 1076, 1082.25, 1088.75, 1094.5

Supports: 1048, 1040.75, 1030.5, 1025.75, 1014.25

Psychological: 1050, 1075, 1000

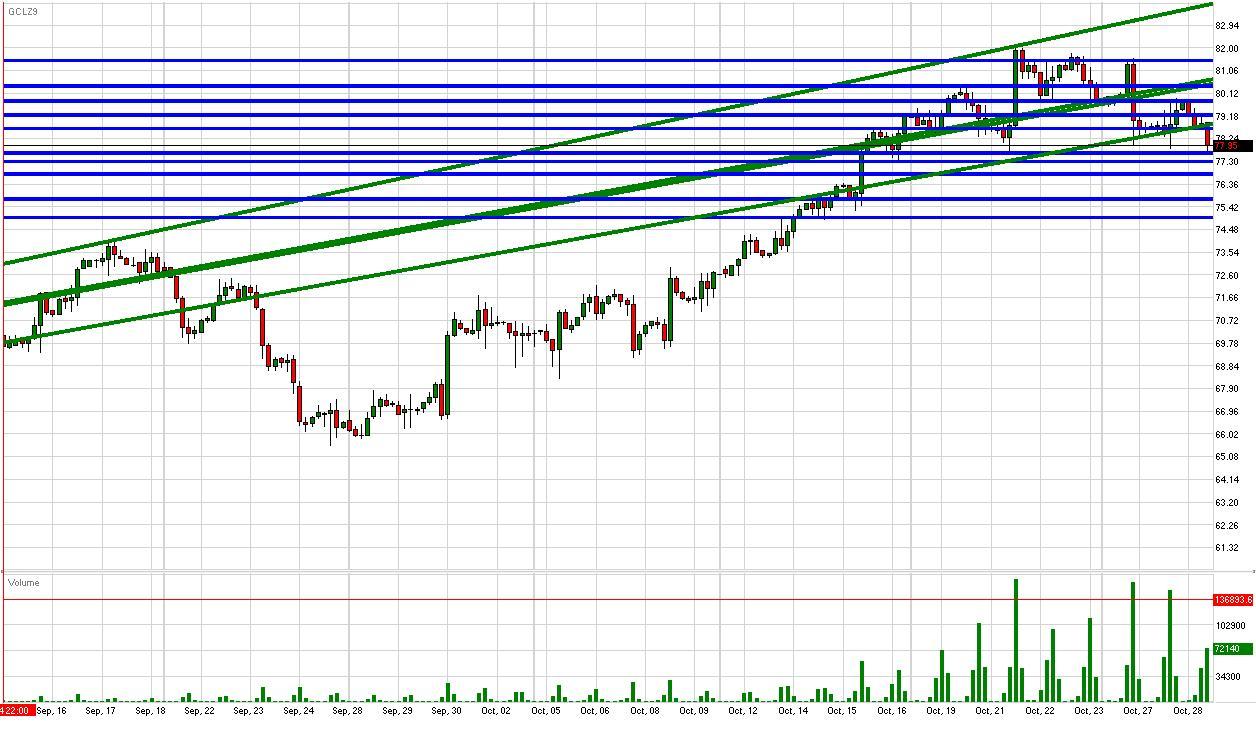

Crude Heads South of $80/bbl Towards 10/16 Lows

Crude futures are heading south of their highly psychological $80/bbl level after failing to close back above yesterday. There’s not much new news concerning crude besides Monday’s MEND ceasefire and OPEC announcing a potential ceiling of $100/bbl before increasing production. Therefore, it seems crude is opting to follow the S&P futures lower and the Greenback higher. Investors have received a stream of negatively mixed U.S. econ data over the past 24 hours. Yesterday’s negative CB Consumer Confidence reading further supports the belief that U.S. consumption is still in a funk, a negative sign regarding the outlook for aggregate demand for crude. Additionally, today’s DGO data paints a mixed picture since the headline number came in two basis points below expectations. The low headline DGO reading implies auto purchases still have a hangover from the buying spree resulting from the U.S. government’s ‘cash-for-clunkers’ program. Less autos on the road implies less consumption of crude, thereby serving as a negative catalyst for the price of crude.

Meanwhile, the Greenback has logged sizable gains against Euro, and gold is stumbling with broad-based strength in the Dollar. A stronger Dollar makes U.S. crude a less attractive important, thereby decreasing the outlook for aggregate demand while driving price lower. Therefore, investors should keep a close eye on the Dollar should the pullback in U.S. equities accelerate further since the two are negatively correlated.

Technically speaking, crude is presently fighting to stay above 10/21 and 10/16 lows. Beneath levels, the next foreseeable technical cushions are 10/15 lows and the psychological $75/bbl level. As for the topside, the $80/bbl should serve as a technical barrier along with 10/20 and previous October highs.

Price: $77.95/bbl

Resistances: $78.67/bbl, $79.24/bbl, $79.82/bbl, $80.44/bbl, $81.48/bbl

Supports: $77.66/bbl, $77.30/bbl, $76.80/bbl, $75.74/bbl, $74.99/bbl

Psychological: $80/bbl, $75/bbl

Disclaimer: FastBrokers' market commentary is provided for information purposes only and under no circumstances should be regarded neither as investment advice or as a solicitation or an offer to sell/buy any financial product. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. All materials are property of Fast Trading services, LLC and unless otherwise indicated, any unauthorized reproduction is prohibited.

Risk Disclosure: There is a substantial risk of loss in trading futures and foreign exchange. Please carefully review all risk disclosure documents before opening an account as these financial instruments are not appropriate for all investors.