FOMC Meeting Minutes Shows Increase in Mortgage−Backed Securities

UFXBank Research from UFX Bank at 10/15/09

Daily Review 15/10/2009

USD Dollar (USD) – The Dollar was down versus most majors after FOMC's Meeting Minutes showed some members of the committee support increasing the mortgage-backed securities purchase program. Retail Sales came out -1.5% better than -2% expected. NASDAQ and Dow Jones gained by 1.51% and 1.47% respectively, Crude advanced by 0.63% closing at 75.65$ a barrel as demand rises. Gold (XAU) finished almost flat with -0.08% change, closing at 1063.0$ an ounce. Today, CORE CPI is expected unchanged at 0.1% and Unemployment Claims are expected mildly higher with 524K versus 521K prior. Crude Inventories will be released and Crude prices volatility is expected.

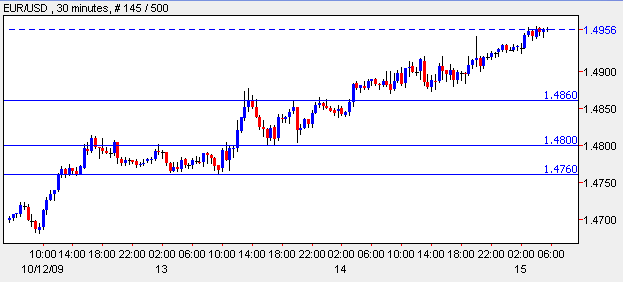

EURO (EUR) –The Euro rally toward 1.50 versus the Dollar continued as Industrial Production gained for the 4th consecutive month. Industrial Production came out at 0.9% as expected. EUR/USD traded with a low of 1.4838 and with a high of 1.4946. Today, ECB Monthly Bulletin will be released and will provide detailed analysis of current and future economic conditions. European Core CPI is expected slightly weaker with 1.2% versus 1.3% prior.

EUR/USD - Last: 1.4950

Resistance 1.499 1.501

Support 1.486 1.48 1.476

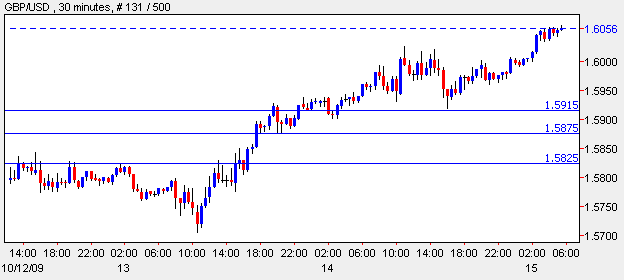

British Pound (GBP) – The Pound gained versus the Dollar and remained steady versus the Euro after better than expected employment data was released. Claimant Count Change came out better with only 20.8K versus 25.1K expected and 24.4K change prior. Average Earnings Index gained by 1.6% better than 1.4% forecast and Britain's Unemployment Rate came out surprisingly lower at 7.9% versus 8% forecast and 7.9% prior. Overall, GBP/USD traded with a low of 1.5901 and with a high of 1.6024. No major economic data expected today.

GBP/USD - Last: 1.6060

Resistance 1.612 1.62

Support 1.5915 1.5875 1.5825

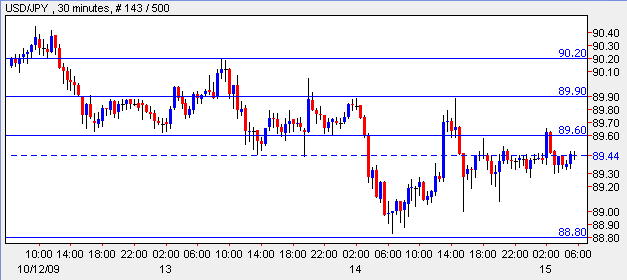

Japanese Yen (JPY) –The Yen gained versus the Dollar and weakened versus the Euro as Bank of Japan kept the Interest Rate at 0.1% as expected. BOJ's Governor Shirakawa said that due to improving economic conditions the liquidity programs might be halted sooner than previously expected. Overall, USD/JPY traded with a low of 88.83 and with a high of 89.89 and EUR/JPY traded with a low of 132.25 and a high of 133.76. BOJ's Governor Shirakawa will speak tonight at the Annual Meeting of Credit Cooperatives in Tokyo.

USD/JPY-Last: 89.45

Resistance 89.6 89.9 90.2

Support 88.8 88.5 88.15

Canadian dollar (CAD) – The Canadian Dollar continued gaining as Crude advanced and demand for higher yielding assets remained strong. Overall, USD/CAD traded with a low of 1.0233 and with a high of 1.0324. Today, Manufacturing Sales are expected lower with -1% versus 5.5% increase prior.

CAD/USD - Last: 1.0210

Resistance 1.032 1.037 1.0425

Support 1.018 1.0165 1.0125