Majors Gain Against the USD

UFXBank Research from UFX Bank at 10/14/09

Daily Review 14/10/2009

USD Dollar (USD) – The Dollar was down versus most majors as global reserves shifting away from the Dollar and demand for higher yielding assets kept dragging it lower. NASDAQ closed almost flat with 0.04% and Dow Jones declined by 0.15% , Crude rose by 1.2% to a 7 week high closing at 74.89$ a barrel as global demand is expected to rise. Gold (XAU) gained by 0.71% closing at 1063.9$ an ounce on weaker Dollar. Today, Retail Sales are expected weaker with -2% versus 2.7% prior. FOMC's Meeting Minutes will be released, providing insights into the economic conditions. Federal Budget Balance will be released and is expected better with -77.3B versus -111.4B prior.

EURO (EUR) –The Euro gained versus the Dollar reaching price levels that existed before Lehman Brothers Bank collapsed in September 2008 as economy recovers and demand for higher yielding assets increases. German Zew Economic Sentiment came out weaker with 56 versus 58.6 expected. EUR/USD traded with a low of 1.4762 and with a high of 1.4875. Today, Industrial Production is expected stronger with 0.9% versus -0.3% prior.

EUR/USD - Last: 1.4880

Resistance 1.49 1.4955

Support 1.479 1.476 1.4735

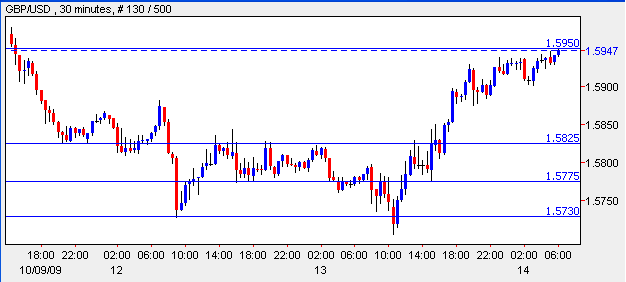

British Pound (GBP) – The Pound gained versus the Dollar after bouncing from the first Fibonacci retracement at 1.57 drawn from January lows to August highs. CPI was weaker with 1.1% versus 1.3% expected and 1.6% prior. Overall, GBP/USD traded with a low of 1.5706 and with a high of 1.5928. Today, Claimant Count Change is expected worse with 25.1K versus 24.4K as more people file for unemployment benefits in England. Average Earnings Index is expected worse with 1.4% versus 1.7%. Britain's Unemployment Rate is expected worse with 8% versus 7.9% prior.

GBP/USD - Last: 1.5940

Resistance 1.595 1.6005 1.605

Support 1.5825 1.5775 1.573

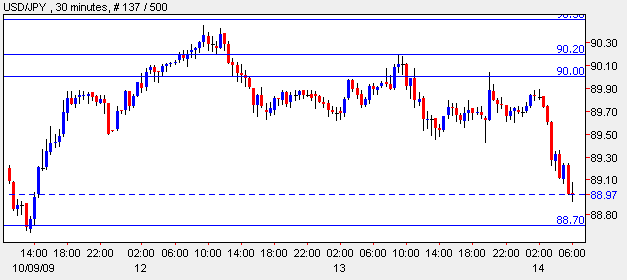

Japanese Yen (JPY) –The Yen gained versus the Dollar on Dollar's global weakness and dropped versus the Euro as demand for higher yielding assets remains strong. Overall, USD/JPY traded with a low of 89.43 and with a high of 90.18 and EUR/JPY traded with a low of 132.53 and a high of 133.51. No economic data expected today.

USD/JPY-Last: 89.00

Resistance 90 90.2 90.5

Support 88.7 88.5

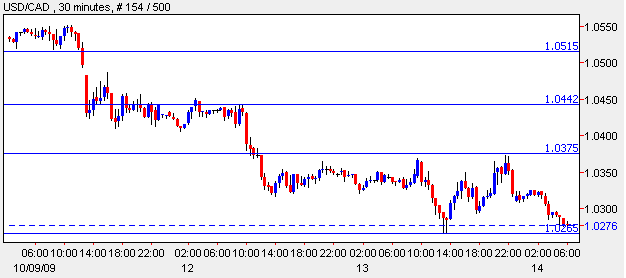

Canadian dollar (CAD) – The Canadian Dollar continued gaining as Crude advanced and demand for higher yielding assets remained strong. New Homes Price Index came out 0.1% worse than 0.2% expected and 0.3% prior. Overall, USD/CAD traded with a low of 1.0264 and with a high of 1.0373. No major economic data expect today.

CAD/USD - Last: 1.0280

Resistance 1.0375 1.0442 1.0515

Support 1.0265 1.02 1.018