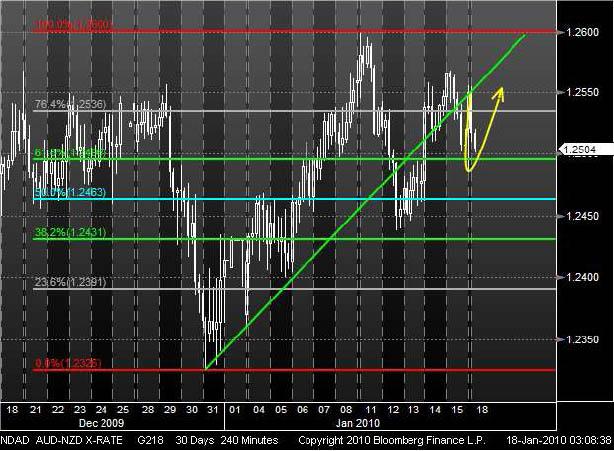

With the beginning of 2010, the AUD has been trading in a bullish trend against the NZD

Varengold Bank Research Team from Varengold Wertpapierhandelsbank AG at 01/18/10

Good morning from icy Hamburg and welcome to our Daily FX report. A new week begins and we start with analysis about the NZD. Furthermore we report EUR and it’s four week decline against the JPY. However, we wish you a good start today.

The EUR declined to a one week low against the USD, hitting 1.4361, on speculation that the Greece will extend its budget deficit. This will deter investors from buying the region`s assets. Finance misters from the 16 nations will discuss Greece`s public finance today. The JPY reached a four week high against the EUR quoting 130.45. The NZD weakened against 15 of its 16 most traded counterparts after a report showed that the house prices fell for the first time in six month in December 2009. The NZD slipped to 0.7350 versus the USD. The USD could extend its gain versus the JPY and reached 90.83.

Asian currencies weakened as regional stocks slid on concern that earnings at U.S. banks may miss analysts’ estimates. The Nikkei 225 Stock Average dropped 1.8% and the MSCI Asia Pacific Index of regional shares fell 0.8%. In Germany said the Chancellor Angela Merkel that Greece`s financial crisis will be a very difficult phase for the EUR. Last week, Greece presented the European Commission a budget plan about 10 billion EUR to reduce budget deficit.

With the beginning of 2010, the AUD has been trading in a bullish trend against the NZD. Recently, the currency pair weakened and touched its Fibonacci Retracement line at 61.8% (1.2496) and the prices could recover. It seems that the support was strong enough to stop the last downward trend and the AUD is ready to continue its bullish trend. But it remains to be seen if the AUD could break its next Fibonacci level at 76.4% (1.2536).

Since the beginning of January, the NZD is trading in a bullish trend channel versus the USD. Last Friday, the currency pair has left its trend channel with a breakthrough of the bottom line. Now, the prices have reached its pivot point at 0.7346. Also the RSI may indicate an increasing trend. These could be signs for a further upward trend and a pull back for the NZD in the trend channel.